Question: Writing off accounts receivable E6-6 Quantum Technologies, a computer consulting firm, has decided to write off the $13,000 balance of an account owed by a

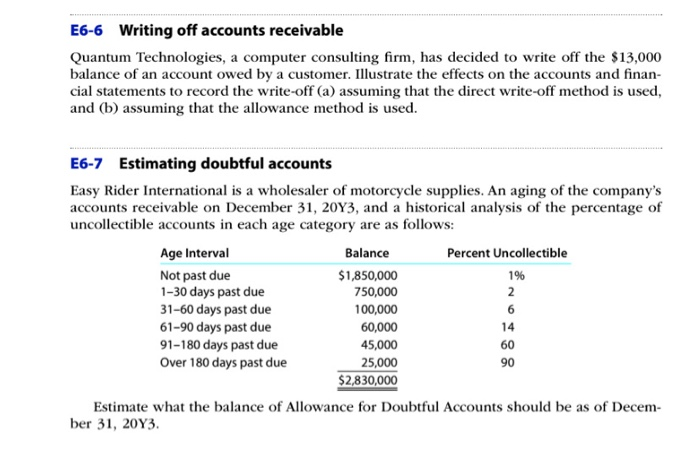

Writing off accounts receivable E6-6 Quantum Technologies, a computer consulting firm, has decided to write off the $13,000 balance of an account owed by a customer. Illustrate the effects on the accounts and finan- cial statements to record the write-off (a) assuming that the direct write-off method is used, and (b) assuming that the allowance method is used. Estimating doubtful accounts E6-7 Easy Rider International is a wholesaler of motorcycle supplies. An aging of the company's accounts receivable on December 31, 20Y3, and a historical analysis of the percentage of uncollectible accounts in each age category are as follows: Age Interval Balance Percent Uncollectible Not past due 1-30 days past due 31-60 days past due 61-90 days past due 91-180 days past due Over 180 days past due $1,850,000 1% 750,000 2 100,000 6 60,000 14 45,000 60 25,000 $2,830,000 Estimate what the balance of Allowance for Doubtful Accounts should be as of Decem 90 ber 31, 20Y3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts