Question: WRITING SHOULD BE CLEAR TO READ!! Valuation Using the PE Multiple The following table provides summary data for Applied Materials Inc. and its competitors, KLA

WRITING SHOULD BE CLEAR TO READ!!

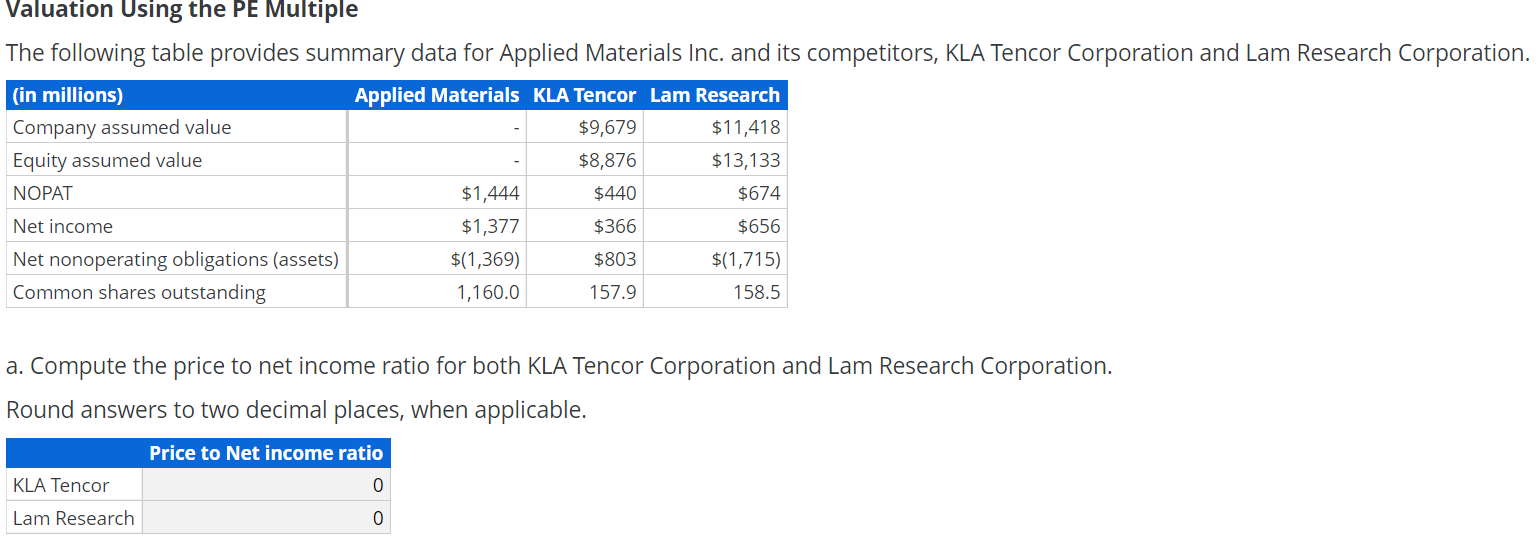

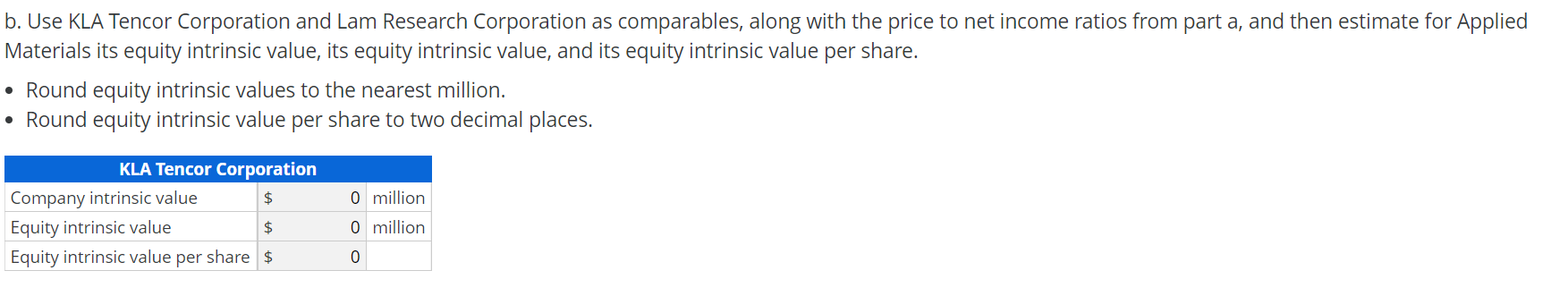

Valuation Using the PE Multiple The following table provides summary data for Applied Materials Inc. and its competitors, KLA Tencor Corporation and Lam Research Corporation. (in millions) Applied Materials KLA Tencor Lam Research Company assumed value $9,679 $11,418 Equity assumed value $8,876 $13,133 NOPAT $1,444 $440 $674 Net income $1,377 $366 $656 Net nonoperating obligations (assets) $(1,369) $803 $(1,715) Common shares outstanding 1,160.0 157.9 158.5 a. Compute the price to net income ratio for both KLA Tencor Corporation and Lam Research Corporation. Round answers to two decimal places, when applicable. Price to Net income ratio 0 KLA Tencor Lam Research 0 b. Use KLA Tencor Corporation and Lam Research Corporation as comparables, along with the price to net income ratios from part a, and then estimate for Applied Materials its equity intrinsic value, its equity intrinsic value, and its equity intrinsic value per share. Round equity intrinsic values to the nearest million. Round equity intrinsic value per share to two decimal places. 0 million KLA Tencor Corporation Company intrinsic value $ Equity intrinsic value $ Equity intrinsic value per share $ 0 million 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts