Question: Written accounting question Question 2. Share and dividend transactions (5 marks) On January 1, 2011, Hinkin Corporation had an unlimited number of common shares authorized,

Written accounting question

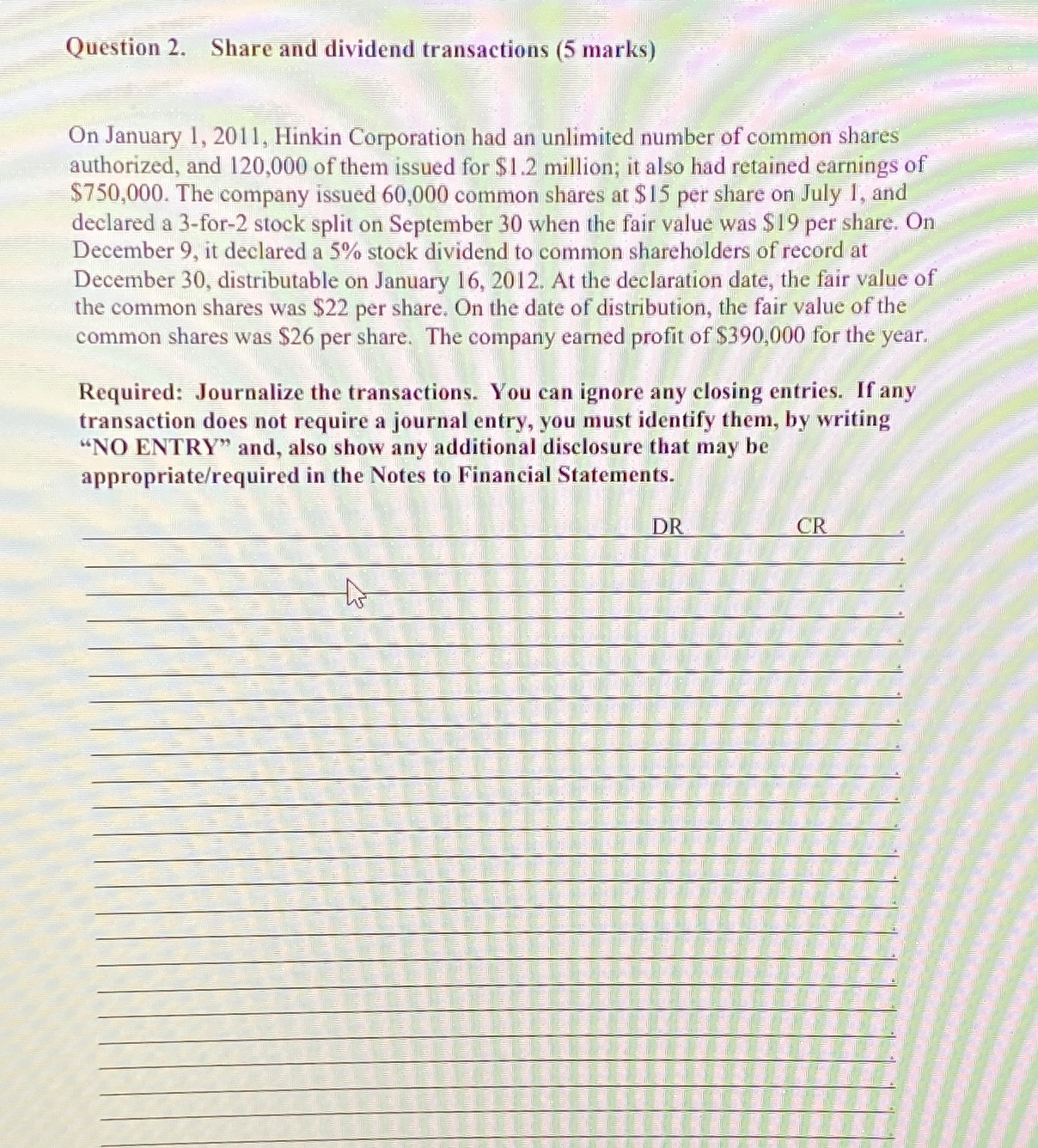

Question 2. Share and dividend transactions (5 marks) On January 1, 2011, Hinkin Corporation had an unlimited number of common shares authorized, and 120,000 of them issued for $1.2 million; it also had retained earnings of $750,000. The company issued 60,000 common shares at $15 per share on July 1, and declared a 3-for-2 stock split on September 30 when the fair value was $19 per share. On December 9, it declared a 5% stock dividend to common shareholders of record at December 30, distributable on January 16, 2012. At the declaration date, the fair value of the common shares was $22 per share. On the date of distribution, the fair value of the common shares was $26 per share. The company earned profit of $390,000 for the year. Required: Journalize the transactions. You can ignore any closing entries. If any transaction does not require a journal entry, you must identify them, by writing "NO ENTRY" and, also show any additional disclosure that may be appropriate/required in the Notes to Financial Statements. DR CR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts