Question: WRONG ANSWER IS NOT ALLOWED. NO MISSING DATA. IN SERIOUS PRRPARATION FOR EXAMS, SO NO WRONG ANSWERS On 1 April 2019, entity A contracted for

WRONG ANSWER IS NOT ALLOWED. NO MISSING DATA.

IN SERIOUS PRRPARATION FOR EXAMS, SO NO WRONG ANSWERS

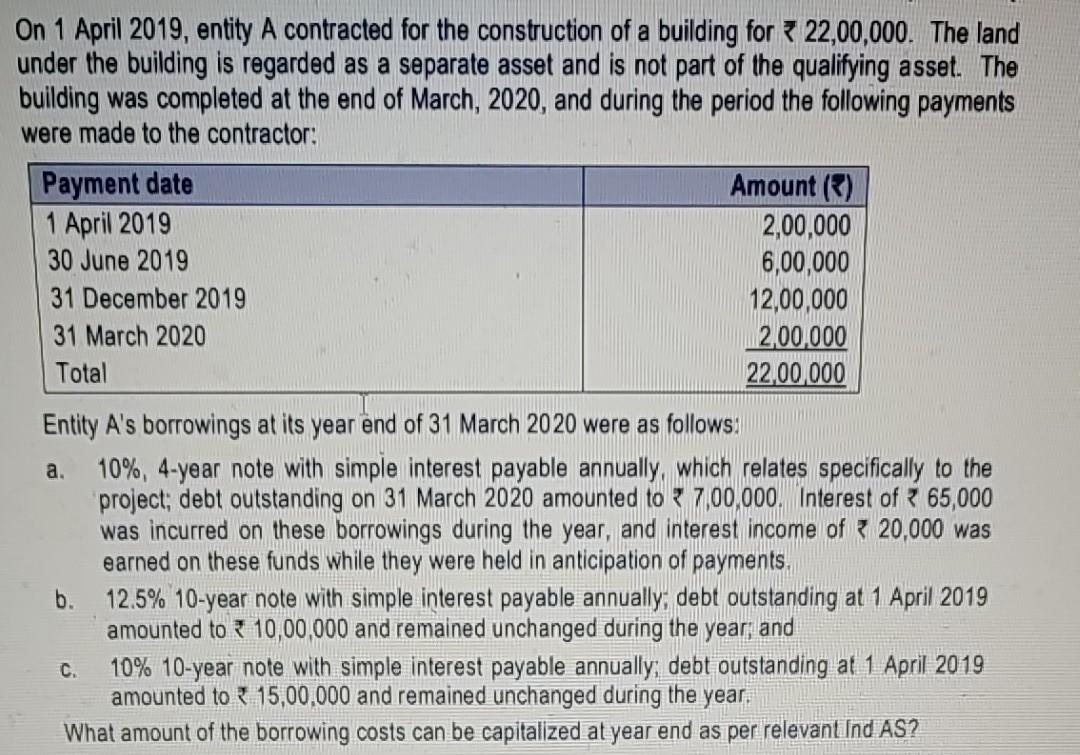

On 1 April 2019, entity A contracted for the construction of a building for 322,00,000. The land under the building is regarded as a separate asset and is not part of the qualifying asset. The building was completed at the end of March, 2020, and during the period the following payments were made to the contractor: Payment date Amount(*) 1 April 2019 2,00,000 30 June 2019 6,00,000 31 December 2019 12,00,000 31 March 2020 200,000 Total 22,00.000 a. Entity A's borrowings at its year end of 31 March 2020 were as follows: 10%, 4-year note with simple interest payable annually, which relates specifically to the project; debt outstanding on 31 March 2020 amounted to 7,00,000. Interest of 265,000 was incurred on these borrowings during the year, and interest income of 20,000 was earned on these funds while they were held in anticipation of payments. b. 12.5% 10-year note with simple interest payable annually, debt outstanding at 1 April 2019 amounted to R10,00,000 and remained unchanged during the year, and 10% 10-year note with simple interest payable annually, debt outstanding at 1 April 2019 amounted to 15,00,000 and remained unchanged during the year. What amount of the borrowing costs can be capitalized at year end as per relevant Ind AS? C

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts