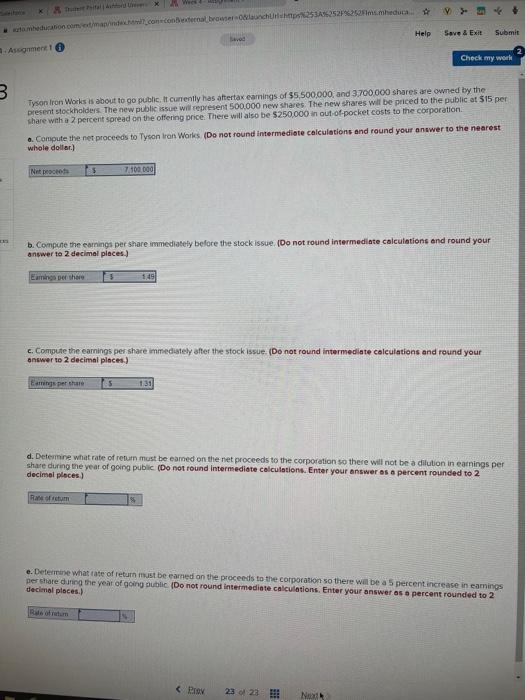

Question: ws V 3- education commande.concoexternal browser och 253A%252F%252Fimmhieduca Help Save & Exit Submit Assignment Check my work 3. Tyson Iron Works is about to go

ws V 3- education commande.concoexternal browser och 253A%252F%252Fimmhieduca Help Save & Exit Submit Assignment Check my work 3. Tyson Iron Works is about to go public. It currently has attertak earnings of $5,500,000, and 3.700.000 shares are owned by the present stockholders. The new public issue will represent 500,000 new shares The new shares will be priced to the public at 515 per share with a 2 percent spread on the offering price. There will also be $250,000 in out-of-pocket costs to the corporation a. Compute the net proceeds to Tyson Iron Works (Do not round intermediate calculations and round your answer to the nearest whole dollar) Nettet es 7.100.000 b. Compute the earnings per share immediately before the stock issue (Do not round intermediate calculations and round your answer to 2 decimal places.) Eines per the 149 c. Compute the earnings per share immediately after the stock issue (Do not round intermediate calculations and round your answer to 2 decimal places) Barring Pera 131 d. Determine what rate of retum must be earned on the net proceeds to the corporation so there will not be a dilution in earnings per share during the year of going public (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places) Raum e. Determine what rate of return must be earned on the proceeds to the corporation so there will be a 5 percent increase in eamings per share during the year of going oublic (Do not round Intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts