Question: WUPHF.com, a Scranton-based technology firm, is considering a project that will overhaul its IT infrastructure: - The project requires an initial capital expenditure of $15

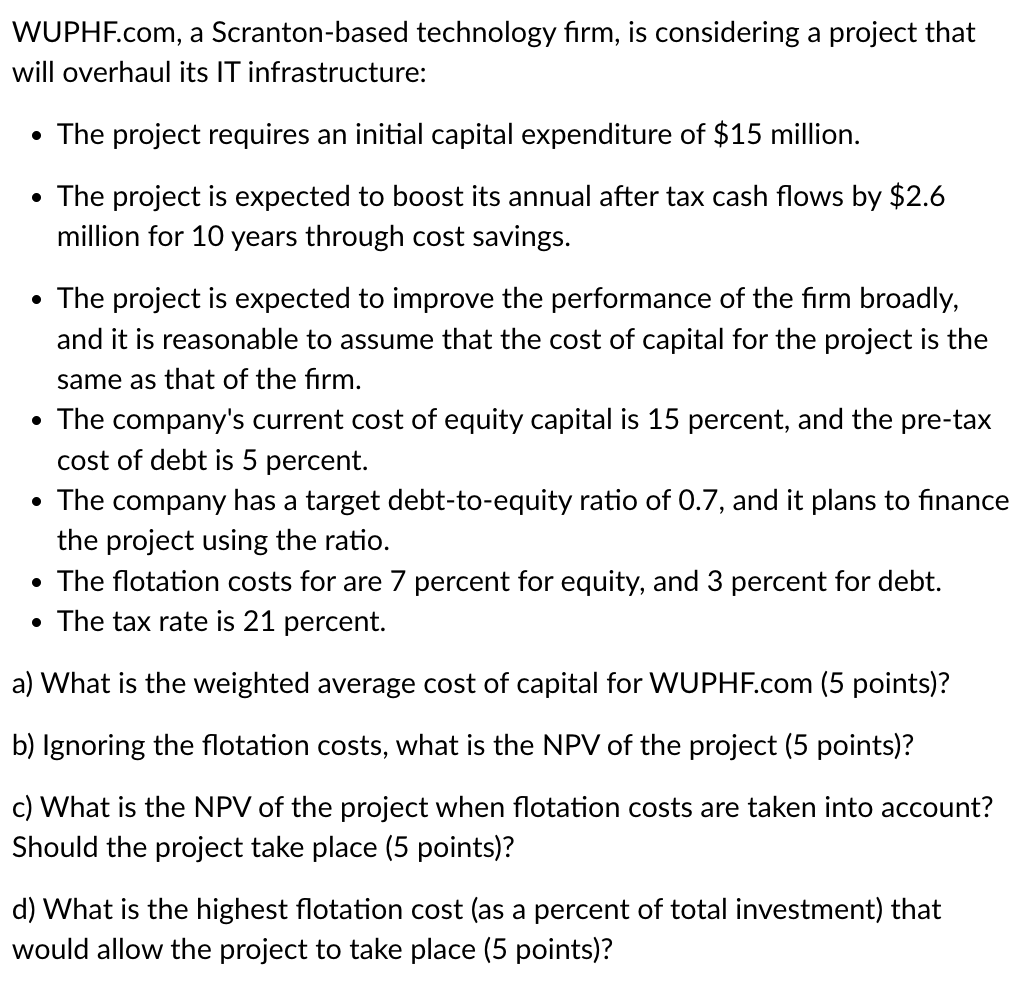

WUPHF.com, a Scranton-based technology firm, is considering a project that will overhaul its IT infrastructure: - The project requires an initial capital expenditure of $15 million. - The project is expected to boost its annual after tax cash flows by $2.6 million for 10 years through cost savings. - The project is expected to improve the performance of the firm broadly, and it is reasonable to assume that the cost of capital for the project is the same as that of the firm. - The company's current cost of equity capital is 15 percent, and the pre-tax cost of debt is 5 percent. - The company has a target debt-to-equity ratio of 0.7 , and it plans to finance the project using the ratio. - The flotation costs for are 7 percent for equity, and 3 percent for debt. - The tax rate is 21 percent. a) What is the weighted average cost of capital for WUPHF.com (5 points)? b) Ignoring the flotation costs, what is the NPV of the project (5 points)? c) What is the NPV of the project when flotation costs are taken into account? Should the project take place (5 points)? d) What is the highest flotation cost (as a percent of total investment) that would allow the project to take place (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts