Question: WURDE Attempts: Do No Harm: /20 3. Problem 16.03 (AFN Equation) eBook Carlsbad Corporation's sales are expected to increase from $5 million in 2019 to

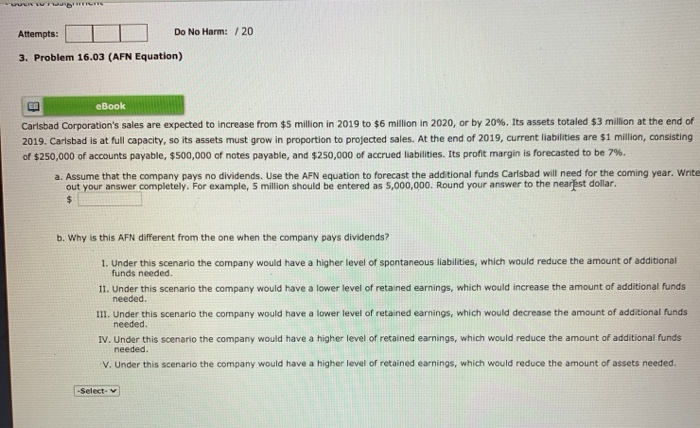

WURDE Attempts: Do No Harm: /20 3. Problem 16.03 (AFN Equation) eBook Carlsbad Corporation's sales are expected to increase from $5 million in 2019 to $6 million in 2020, or by 20%. Its assets totaled $3 million at the end of 2019. Carlsbad is at full capacity, so its assets must grow in proportion to projected sales. At the end of 2019, current liabilities are $1 million, consisting of $250,000 of accounts payable, $500,000 of notes payable, and $250,000 of accrued liabilities. Its profit margin is forecasted to be 7%. a. Assume that the company pays no dividends. Use the AFN equation to forecast the additional funds Carlsbad will need for the coming year. Write out your answer completely. For example, 5 million should be entered as 5,000,000. Round your answer to the nearest dollar. $ b. Why is this AFN different from the one when the company pays dividends? 1. Under this scenario the company would have a higher level of spontaneous liabilities, which would reduce the amount of additional funds needed. 11. Under this scenario the company would have a lower level of retained earnings, which would increase the amount of additional funds needed. III. Under this scenario the company would have a lower level of retained earnings, which would decrease the amount of additional funds needed. IV. Under this scenario the company would have a higher level of retained earnings, which would reduce the amount of additional funds needed. V. Under this scenario the company would have a higher level of retained earnings, which would reduce the amount of assets needed. -Select

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts