Question: WV2 Online teachi Cengage Learning * C nstructionsDuring The First M x + keAssignment/takeAssignment Main.do?invokerStakeAssignmentSessionLocatorkinprogress-false eBook Show Me How Calculator Analyzing Income under Absorption and

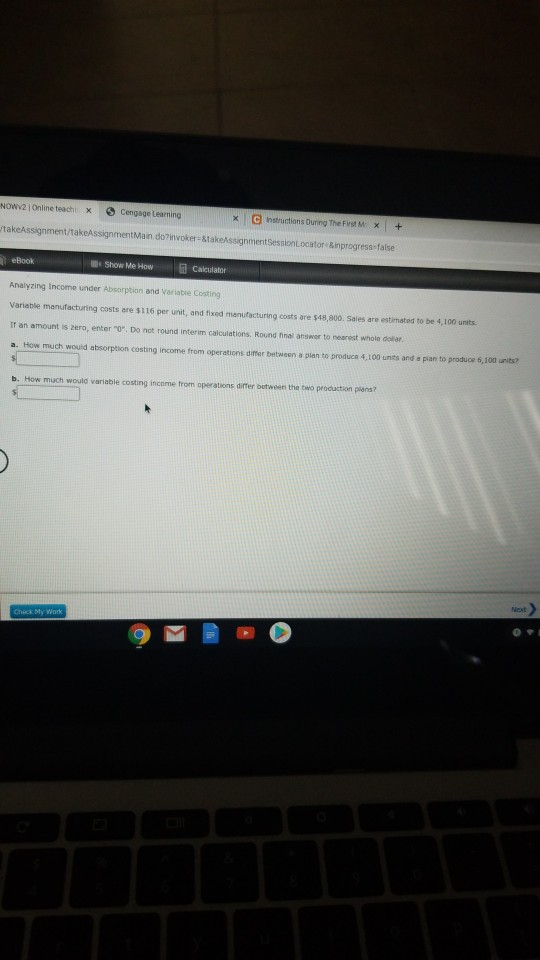

WV2 Online teachi Cengage Learning * C nstructionsDuring The First M x + keAssignment/takeAssignment Main.do?invokerStakeAssignmentSessionLocatorkinprogress-false eBook Show Me How Calculator Analyzing Income under Absorption and Varate Costing Variable manufacturing costs are $116 per unit, and fixed manufacturing costs are $48.800. Sales are estimated to be 4,100 units If an amount is zero, enter . Do not round interim calculations. Round in answer to n ot whole dollar a. How much would absorption costing income from operations differ between a plan to produce 4.100 units and a plan to produce 6,100 units? b. How much would variable costing income from operations differ between the two production plans? WV2 Online teachi Cengage Learning * C nstructionsDuring The First M x + keAssignment/takeAssignment Main.do?invokerStakeAssignmentSessionLocatorkinprogress-false eBook Show Me How Calculator Analyzing Income under Absorption and Varate Costing Variable manufacturing costs are $116 per unit, and fixed manufacturing costs are $48.800. Sales are estimated to be 4,100 units If an amount is zero, enter . Do not round interim calculations. Round in answer to n ot whole dollar a. How much would absorption costing income from operations differ between a plan to produce 4.100 units and a plan to produce 6,100 units? b. How much would variable costing income from operations differ between the two production plans

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts