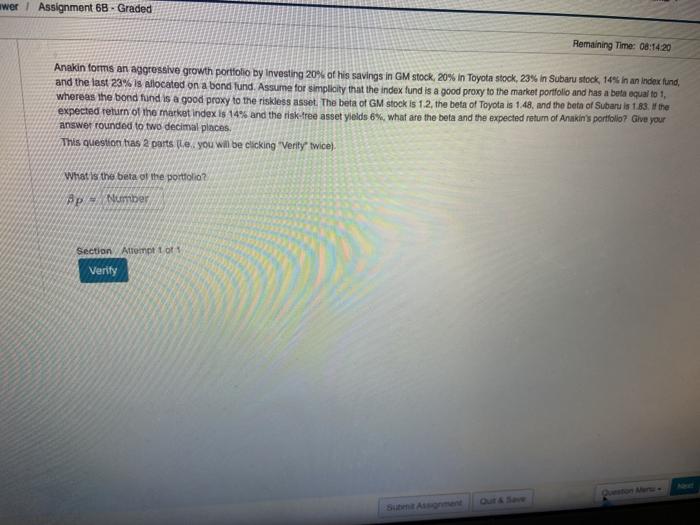

Question: wwer Assignment 68 - Graded Remaining Time: 08:14 20 Anakin forms an aggressive growth portfolio by Investing 20% of his savings in GM stock, 20%

wwer Assignment 68 - Graded Remaining Time: 08:14 20 Anakin forms an aggressive growth portfolio by Investing 20% of his savings in GM stock, 20% in Toyota stock, 23% in Subaru stock 14% in an index fund, and the last 23% is allocated on a bond fund. Assume for simplicity that the index fund is a good proxy to the market portfolio and has a beta equal to 1, whereas the bond fund is a good proxy to the riskless asset. The beta of GM stock is 1.2, the beta of Toyota is 1.48. and the beta of Subaru is 1.83 the expected return of the market index is 14% and the risk-free asset yields 6%, what are the beta and the expected return of Anakinis portfolio? Give your answer rounded to two decimal places This question has 2 parts ple, you will be clicking "Verity twice) What is the beta of the portfolio? p Number Section Atomt 1 of 1 Verity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts