Question: Wxcel with calculations. Thank you Return statistics for AT&T, General motors, the S&P 500 and the risk-free asset, Treasury bills, are given below: 1 YearAT&T

Wxcel with calculations. Thank you

Wxcel with calculations. Thank you

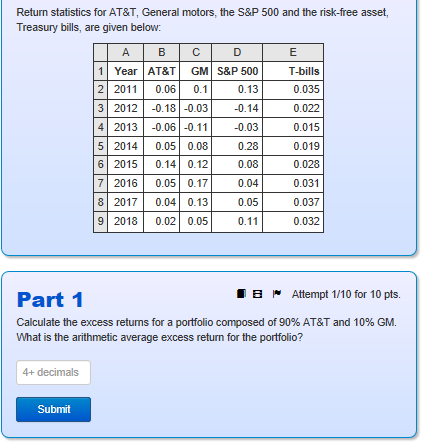

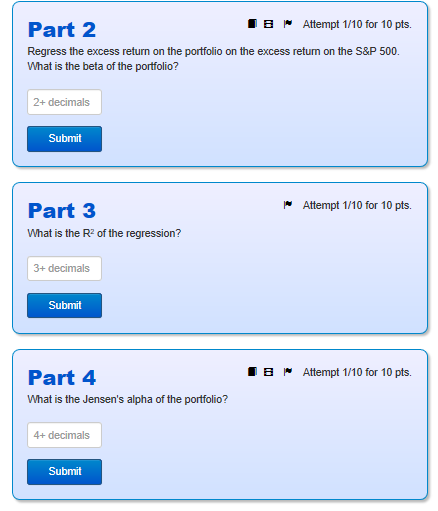

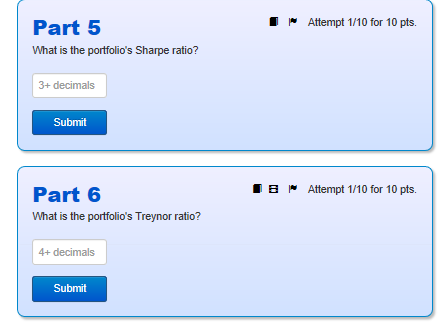

Return statistics for AT&T, General motors, the S&P 500 and the risk-free asset, Treasury bills, are given below: 1 YearAT&T GM S&P 500T-bills 2 20110.06 0.0.13 3 20120.18 -0.03 -0.14 4 20130.06-0.11-0.03 5 2014 0.05 0.08 6 2015 0.14 0.120.08 7 2016 0.05 0.170.04 8 20170.04 0.130.00.037 9 2018 0.02 0.050.11 0.035 0.022 0.015 0.019 0.028 0.031 5 2014 0.05 008028 0.032 E Attempt 1/10 for 10 pts. Part 1 Calculate the excess retums for a portfolio composed of 90% AT&T and 10% GM. What is the arithmetic average excess return for the portfolio? Submit Part 2 E Attempt 1/10 for 10 pts. Regress the excess return on the portfolio on the excess return on the S&P 500. What is the beta of the portfolio? Submit Attempt 1/10 for 10 pts. Part 3 What is the R2 of the regression? Submit E Attempt 1/10 for 10 pts. Part 4 What is the Jensen's alpha of the portfolio? Submit ~ Attempt 1/10 for 10 pts. Part 5 What is the portfolio's Sharpe ratio? Submit Part 6 E Attempt 1/10 for 10 pts. Submit Return statistics for AT&T, General motors, the S&P 500 and the risk-free asset, Treasury bills, are given below: 1 YearAT&T GM S&P 500T-bills 2 20110.06 0.0.13 3 20120.18 -0.03 -0.14 4 20130.06-0.11-0.03 5 2014 0.05 0.08 6 2015 0.14 0.120.08 7 2016 0.05 0.170.04 8 20170.04 0.130.00.037 9 2018 0.02 0.050.11 0.035 0.022 0.015 0.019 0.028 0.031 5 2014 0.05 008028 0.032 E Attempt 1/10 for 10 pts. Part 1 Calculate the excess retums for a portfolio composed of 90% AT&T and 10% GM. What is the arithmetic average excess return for the portfolio? Submit Part 2 E Attempt 1/10 for 10 pts. Regress the excess return on the portfolio on the excess return on the S&P 500. What is the beta of the portfolio? Submit Attempt 1/10 for 10 pts. Part 3 What is the R2 of the regression? Submit E Attempt 1/10 for 10 pts. Part 4 What is the Jensen's alpha of the portfolio? Submit ~ Attempt 1/10 for 10 pts. Part 5 What is the portfolio's Sharpe ratio? Submit Part 6 E Attempt 1/10 for 10 pts. Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts