Question: X 2 A Show your work. submit file Alaser cutting machine bought at a cost of $300,000 for a customer that had given a 5-year

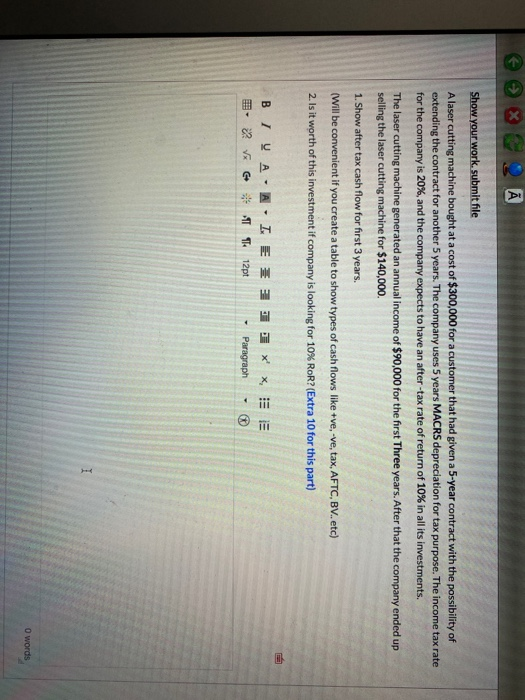

X 2 A Show your work. submit file Alaser cutting machine bought at a cost of $300,000 for a customer that had given a 5-year contract with the possibility of extending the contract for another 5 years. The company uses 5 years MACRS depreciation for tax purpose. The income tax rate for the company is 20%, and the company expects to have an after-tax rate of return of 10% in all its investments. The laser cutting machine generated an annual income of $90,000 for the first Three years. After that the company ended up selling the laser cutting machine for $140,000 1. Show after tax cash flow for first 3 years. (Will be convenient if you create a table to show types of cash flows like +ve, -ve, tax, AFTC, BV. etc) 2. Is it worth of this investment if company is looking for 10% RoR? (Extra 10 for this part) BI VAAI EE 3 1 1 **, BEE 3. 2 V 6 * 1 T 12pt - Paragraph - O words

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts