Question: X 5. Bonds payable - SAT Notes v.1 X + X File | C:/Users/ASUS/Downloads/PPT%20AND%20PDF/FM561/5.%20Bonds%20payable%20-%20SAT%20... ... 3 of 9 (D Page view AN Read aloud Draw

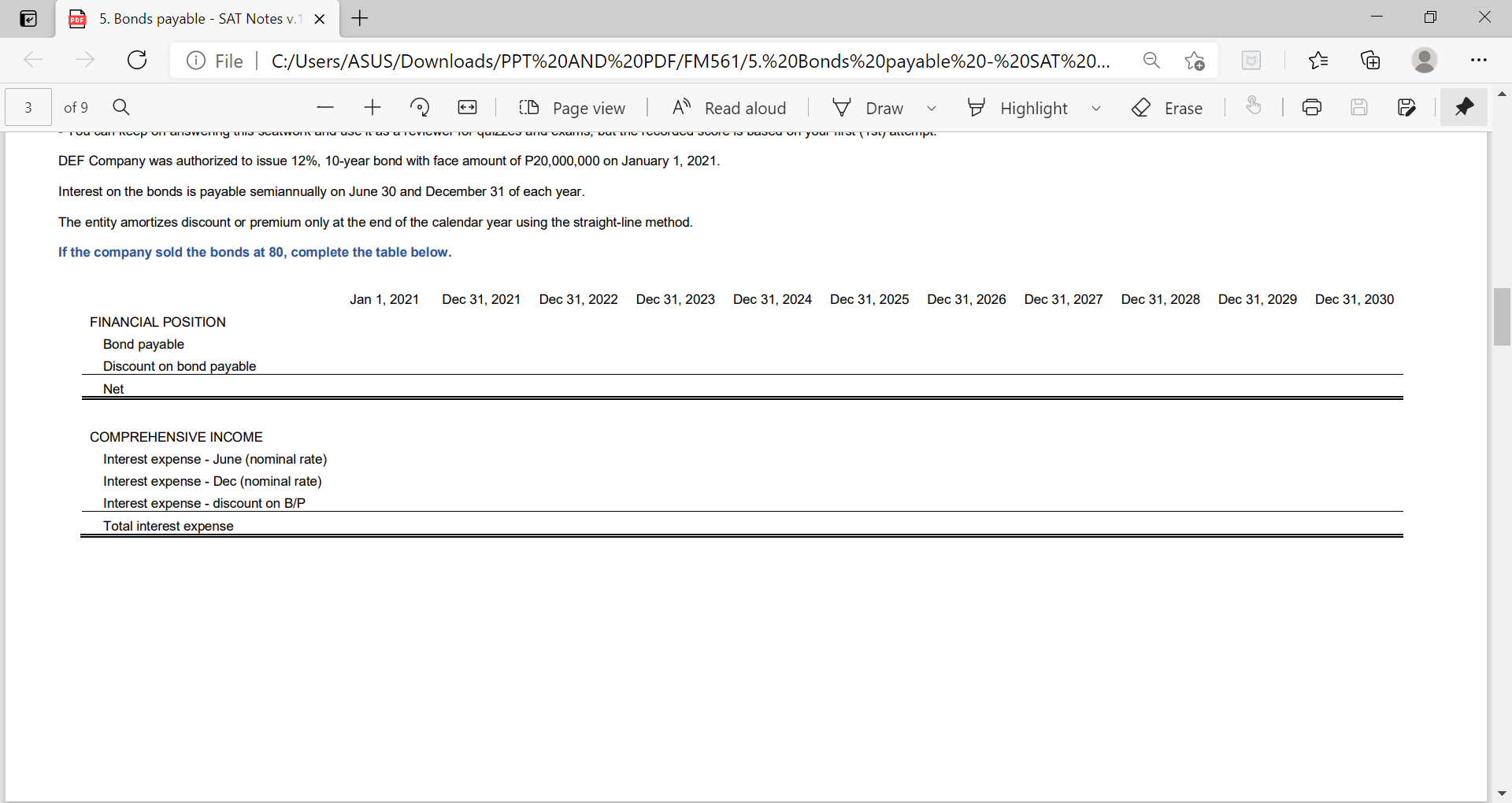

X 5. Bonds payable - SAT Notes v.1 X + X File | C:/Users/ASUS/Downloads/PPT%20AND%20PDF/FM561/5.%20Bonds%20payable%20-%20SAT%20... ... 3 of 9 (D Page view AN Read aloud Draw Highlight Erase re 19 Tou van kopum Twing u uwornumu UuT VINCI Tor quiccu unu CAUTIO, vurm Torucu vor vucu on your moup. DEF Company was authorized to issue 12%, 10-year bond with face amount of P20,000,000 on January 1, 2021. Interest on the bonds is payable semiannually on June 30 and December 31 of each year. The entity amortizes discount or premium only at the end of the calendar year using the straight-line method. If the company sold the bonds at 80, complete the table below. Jan 1, 2021 Dec 31, 2021 Dec 31, 2022 Dec 31, 2023 Dec 31, 2024 Dec 31, 2025 Dec 31, 2026 Dec 31, 2027 Dec 31, 2028 Dec 31, 2029 Dec 31, 2030 FINANCIAL POSITION Bond payable Discount on bond payable Net COMPREHENSIVE INCOME Interest expense - June (nominal rate) Interest expense - Dec (nominal rate) Interest expense - discount on B/P Total interest expense X 5. Bonds payable - SAT Notes v.1 X + X File | C:/Users/ASUS/Downloads/PPT%20AND%20PDF/FM561/5.%20Bonds%20payable%20-%20SAT%20... ... 3 of 9 (D Page view AN Read aloud Draw Highlight Erase re 19 Tou van kopum Twing u uwornumu UuT VINCI Tor quiccu unu CAUTIO, vurm Torucu vor vucu on your moup. DEF Company was authorized to issue 12%, 10-year bond with face amount of P20,000,000 on January 1, 2021. Interest on the bonds is payable semiannually on June 30 and December 31 of each year. The entity amortizes discount or premium only at the end of the calendar year using the straight-line method. If the company sold the bonds at 80, complete the table below. Jan 1, 2021 Dec 31, 2021 Dec 31, 2022 Dec 31, 2023 Dec 31, 2024 Dec 31, 2025 Dec 31, 2026 Dec 31, 2027 Dec 31, 2028 Dec 31, 2029 Dec 31, 2030 FINANCIAL POSITION Bond payable Discount on bond payable Net COMPREHENSIVE INCOME Interest expense - June (nominal rate) Interest expense - Dec (nominal rate) Interest expense - discount on B/P Total interest expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts