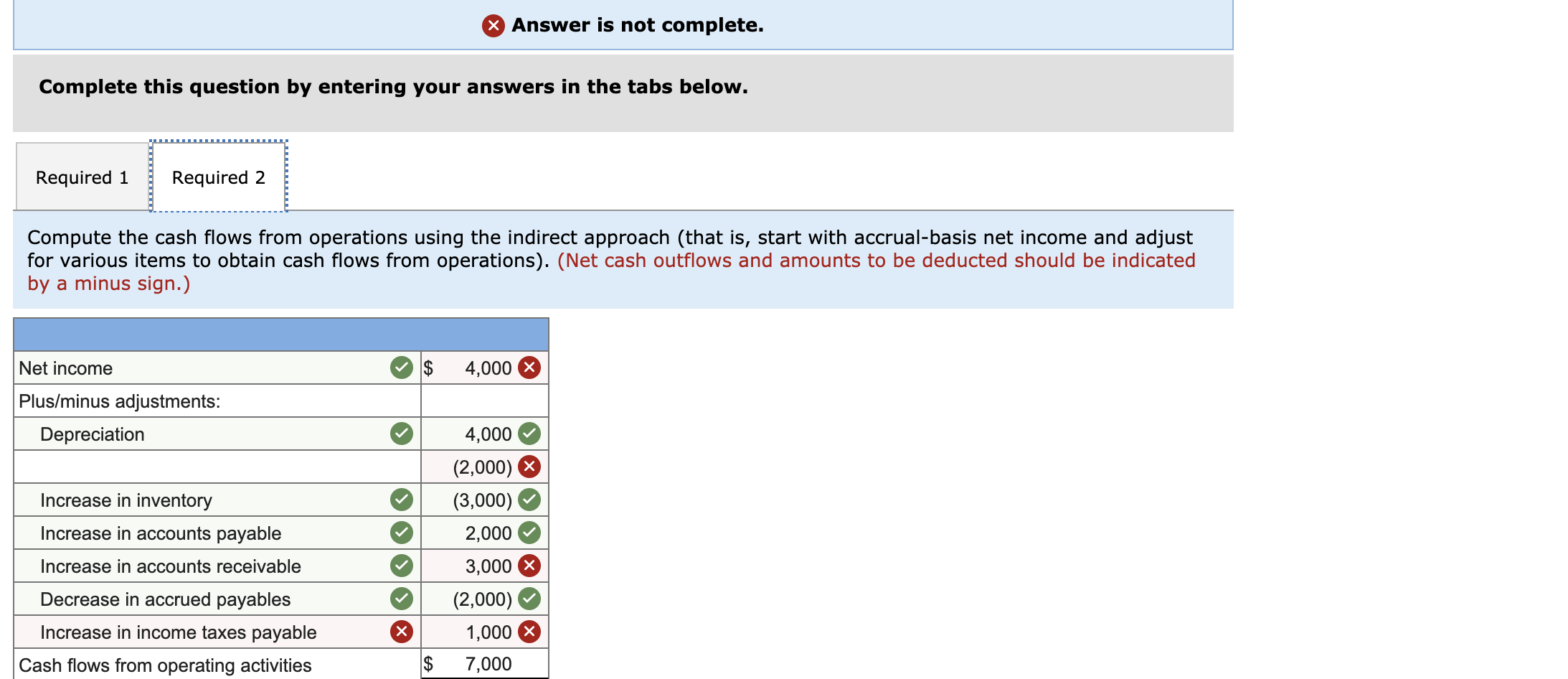

Question: X Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the cash flows from

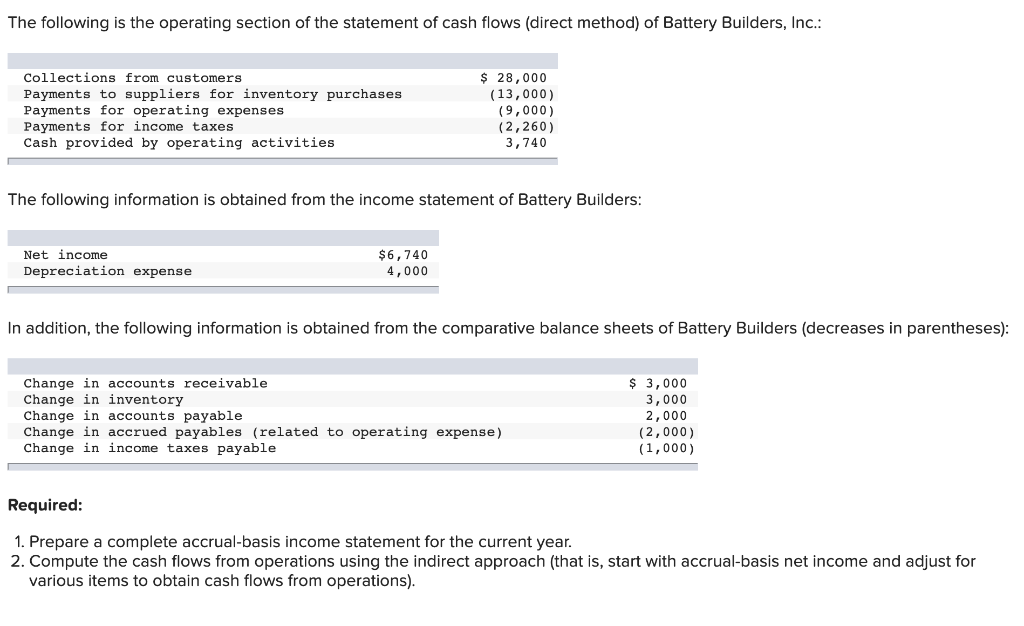

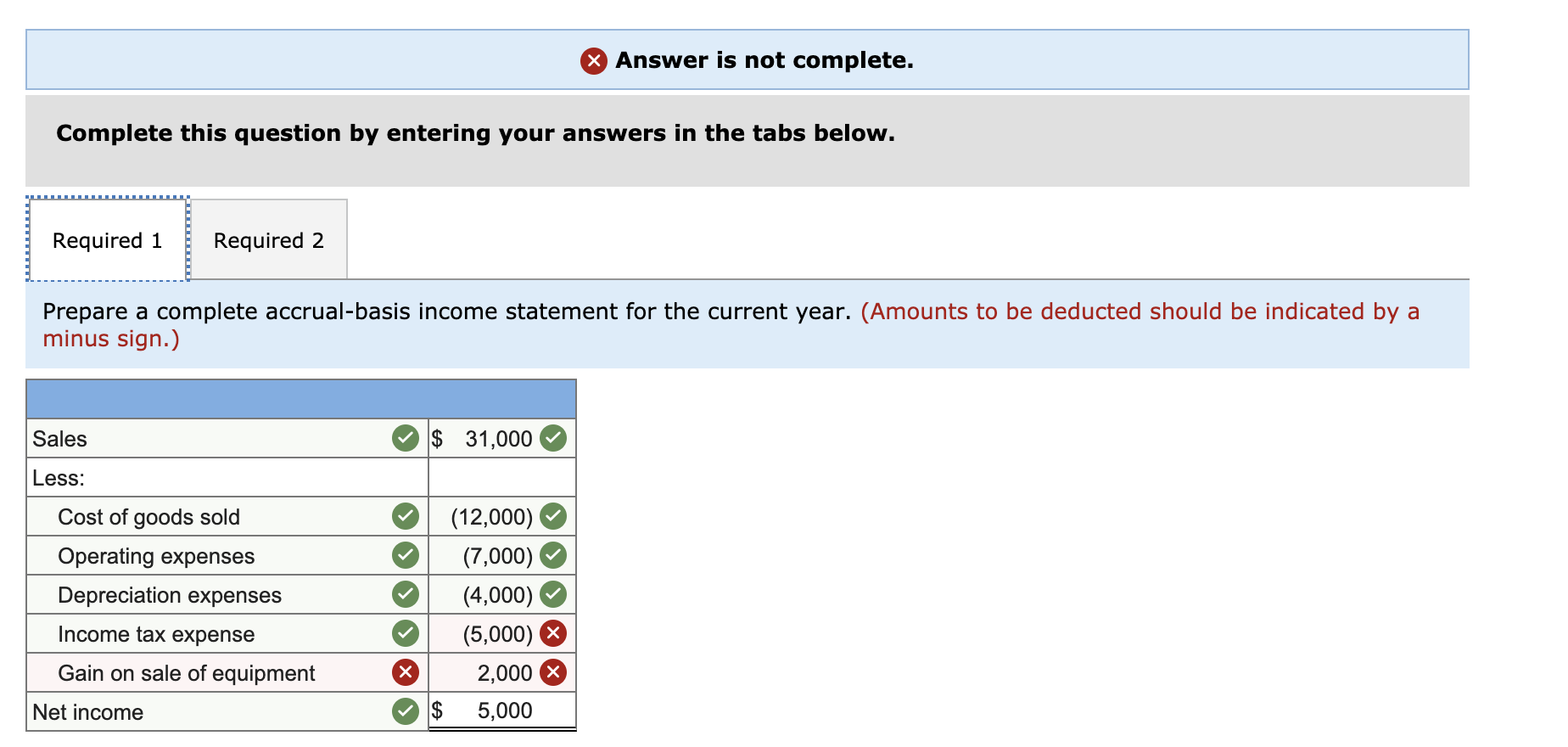

X Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the cash flows from operations using the indirect approach (that is, start with accrual-basis net income and adjust for various items to obtain cash flows from operations). (Net cash outflows and amounts to be deducted should be indicated by a minus sign.) Net income 4,000 Plus/minus adjustments: Depreciation 4,000 (2,000) X (3,000) 2,000 Increase in inventory Increase in accounts payable Increase in accounts receivable Decrease in accrued payables Increase in income taxes payable Cash flows from operating activities 3,000 (2,000) 1,000 7,000 $ The following is the operating section of the statement of cash flows (direct method) of Battery Builders, Inc.: Collections from customers Payments to suppliers for inventory purchases Payments for operating expenses Payments for income taxes Cash provided by operating activities $ 28,000 (13,000) (9,000) (2,260) 3,740 The following information is obtained from the income statement of Battery Builders: Net income Depreciation expense $6,740 4,000 In addition, the following information is obtained from the comparative balance sheets of Battery Builders (decreases in parentheses): Change in accounts receivable Change in inventory Change in accounts payable Change in accrued payables (related to operating expense) Change in income taxes payable $ 3,000 3,000 2,000 (2,000) (1,000) Required: 1. Prepare a complete accrual-basis income statement for the current year. 2. Compute the cash flows from operations using the indirect approach (that is, start with accrual-basis net income and adjust for various items to obtain cash flows from operations). X Answer is not complete. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare a complete accrual-basis income statement for the current year. (Amounts to be deducted should be indicated by a minus sign.) Sales $ 31,000 Less: Cost of goods sold Operating expenses Depreciation expenses (12,000) (7,000) (4,000) (5,000) X 2,000 X 5,000 Income tax expense Gain on sale of equipment Net income

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts