Question: x Borrowed $550,000 by signing a note payable with a local bank 21 Issued 25,000 shares of $22 par value Common Stock for $1,500,000 31

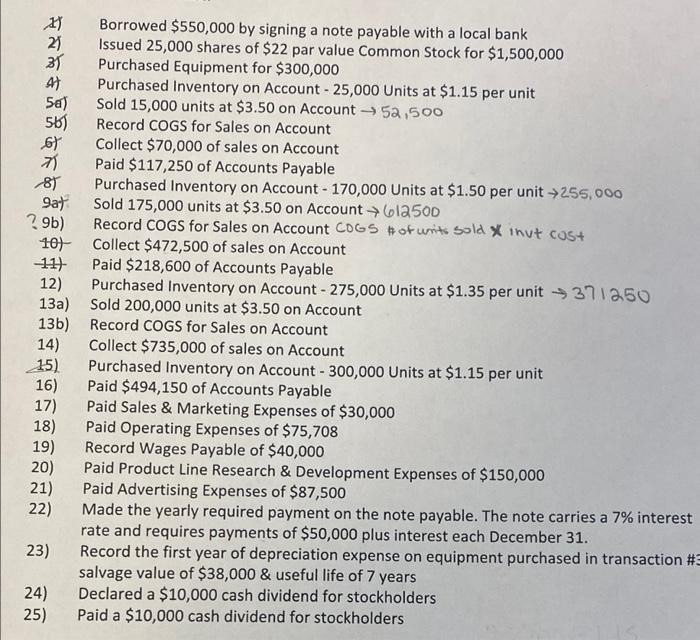

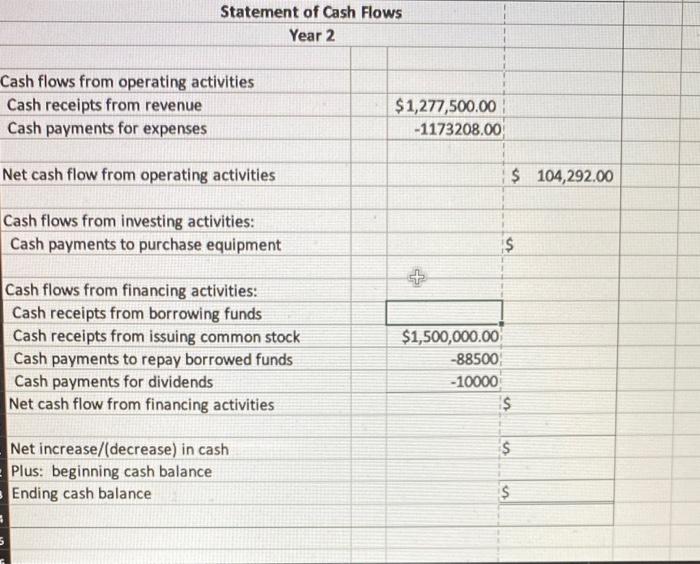

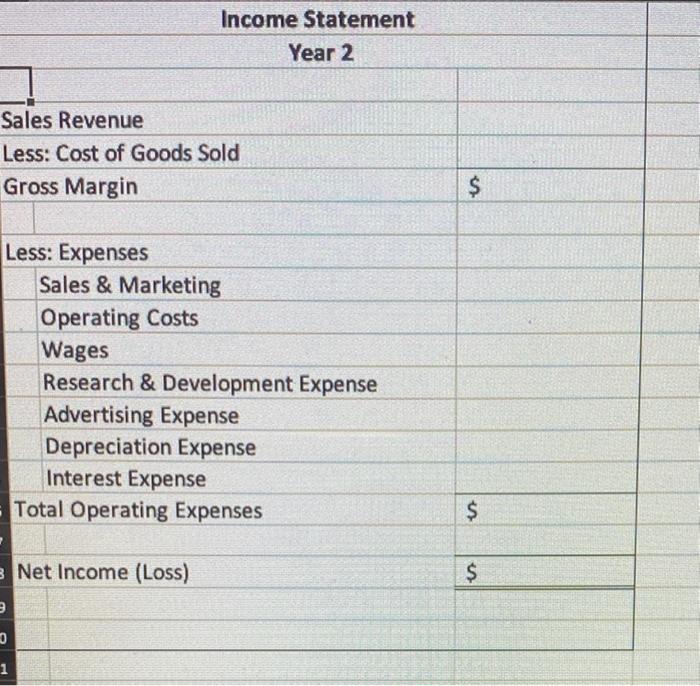

x Borrowed $550,000 by signing a note payable with a local bank 21 Issued 25,000 shares of $22 par value Common Stock for $1,500,000 31 Purchased Equipment for $300,000 41 Purchased Inventory on Account - 25,000 Units at $1.15 per unit 5a) Sold 15,000 units at $3.50 on Account -> 52,500 56) Record COGS for Sales on Account 6) Collect $70,000 of sales on Account Paid $117,250 of Accounts Payable 81 Purchased Inventory on Account - 170,000 Units at $1.50 per unit +255,000 9at Sold 175,000 units at $3.50 on Account 61250D 29b) Record COGS for Sales on Account COGS # of writs sold x tnut cost 107 Collect $472,500 of sales on Account 11) Paid $218,600 of Accounts Payable 12) Purchased Inventory on Account - 275,000 Units at $1.35 per unit 371250 13a) Sold 200,000 units at $3.50 on Account 13b) Record COGS for Sales on Account 14) Collect $735,000 of sales on Account 15) Purchased Inventory on Account - 300,000 Units at $1.15 per unit 16) Paid $494,150 of Accounts Payable 17) Paid Sales & Marketing Expenses of $30,000 18) Paid Operating Expenses of $75,708 19) Record Wages Payable of $40,000 20) Paid Product Line Research & Development Expenses of $150,000 21) Paid Advertising Expenses of $87,500 22) Made the yearly required payment on the note payable. The note carries a 7% interest rate and requires payments of $50,000 plus interest each December 31. 23) Record the first year of depreciation expense on equipment purchased in transaction #3 salvage value of $38,000 & useful life of 7 years 24) Declared a $10,000 cash dividend for stockholders 25) Paid a $10,000 cash dividend for stockholders Statement of Cash Flows Year 2 Cash flows from operating activities Cash receipts from revenue Cash payments for expenses $1,277,500.00 -1173208.00 Net cash flow from operating activities $ 104,292.00 Cash flows from investing activities: Cash payments to purchase equipment $ Cash flows from financing activities: Cash receipts from borrowing funds Cash receipts from issuing common stock Cash payments to repay borrowed funds Cash payments for dividends Net cash flow from financing activities $1,500,000.00 -88500 -10000 $ $ Net increase/(decrease) in cash Plus: beginning cash balance Ending cash balance $ Income Statement Year 2 Sales Revenue Less: Cost of Goods Sold Gross Margin $ Less: Expenses Sales & Marketing Operating costs Wages Research & Development Expense Advertising Expense Depreciation Expense Interest Expense Total Operating Expenses $ Net Income (Loss) $ 2 3 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts