Question: X CengageNOW210X Cengage Learning X CeAssignment/takeAssignment Main.do?invokeretakeAssignmentSessionLocatorw&inprogress=false Connect-Class: Bus X M MHE Reader X Mystic Magic issued X Book Calculator Print Item Paus Blake: S

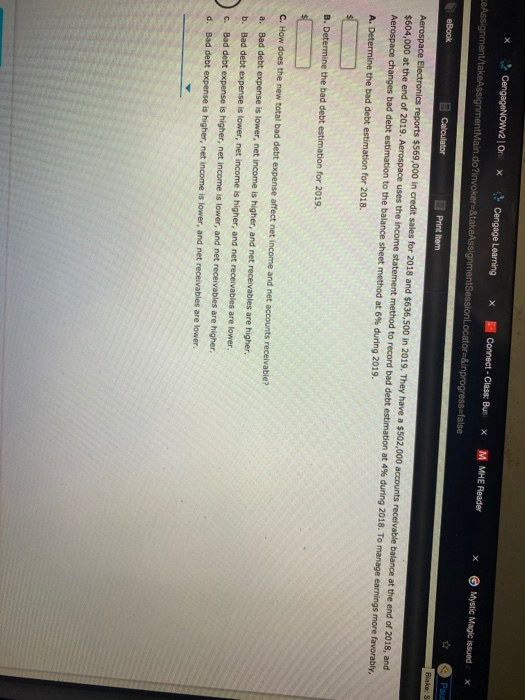

X CengageNOW210X Cengage Learning X CeAssignment/takeAssignment Main.do?invokeretakeAssignmentSessionLocatorw&inprogress=false Connect-Class: Bus X M MHE Reader X Mystic Magic issued X Book Calculator Print Item Paus Blake: S Aerospace Electronics reports $569,000 in credit sales for 2018 and $636,500 in 2019. They have a $502,000 accounts receivable balance at the end of 2018, and $604,000 at the end of 2019. Aerospace uses the income statement method to record bad debt estimation at 4% during 2018. To manage earnings more favorably Aerospace changes bad debt estimation to the balance sheet method at 6% during 2019. A. Determine the bad debt estimation for 2018. B. Determine the bad debt estimation for 2019. C. How does the new total bad debt expense affect net income and net accounts receivable? a. Bad debt expense is lower, net income is higher, and net receivables are higher. b. Bad debt expense is lower, net income is higher, and net receivables are lower C. Bad debt expense is higher, net income is lower, and net receivables are higher. d. Bad debt expense is higher, net income is lower, and net receivables are lower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts