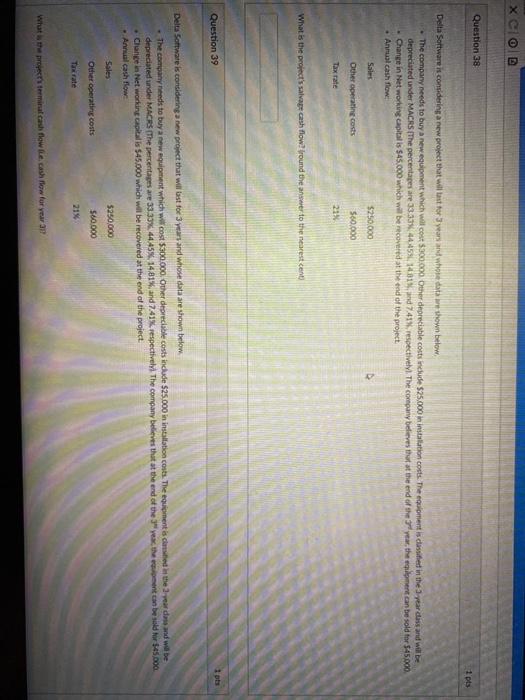

Question: X COD Question 38 1 pts Delta Software is considering a new project that will last for 3 years and where do we shown below

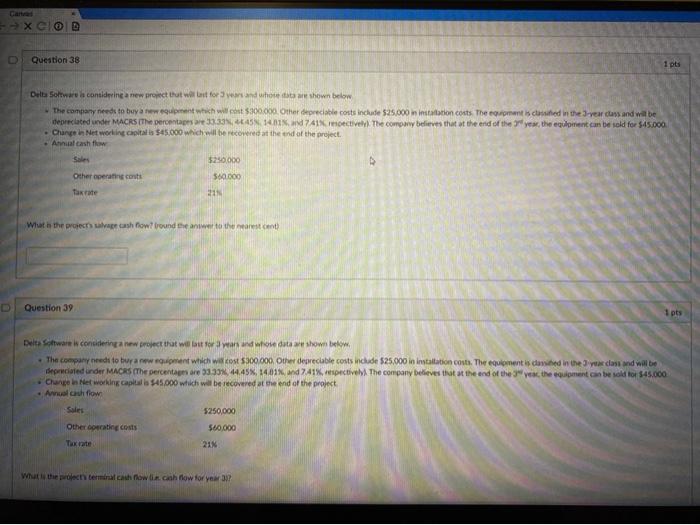

X COD Question 38 1 pts Delta Software is considering a new project that will last for 3 years and where do we shown below The company needs to buy a new equipment which will cost $300.000. Other deoreciable costs include $25.000 in installation costs. The equipment is classified in the year dess and will be depreciated under MACRS |The percentages are 33333 444514013, d741% respectively. The company believes that at the end of the year, the moment can be sold for $45.000 Change in Networking capital is $45.000 which will be recovered at the end of the project Annual cash flow Sales $250.000 Other operating costs 560.000 Tax rate 21% What is the project's salvar cash flow round the answer to the nearest cent Question 39 1 pts Delta Software is considering a new project that will last for 3 years and whose data are shown below. - The company needs to buy a new equipment which will cost $300.000. Other depreciable costs include $25.000 in installation costs. The equipment is closed the year dose and will be depreciated under MACRS (The percentages are 33.33%. 44A5% 1481% and 741% respectively. The company believes that at the end of the year, then can be sold for $45.000 Change in Networking capitalis 545.000 which will be recovered at the end of the project. Annual cash flow Sales Other operating costs $250,000 560.000 21% What is the proper terminal cash flow fie cash flow for year - XGIO Question 38 1 pts Delta Software la considering a new protect that went for years and whose are shown below The company needs to buy a new equipment which will cost $300.000. Other preoble costs include 525.000 in installation costs. The price in the years and will be deprecated under MACRS (The percentages are 133345. 14.1 741 oectively. The company believes that at the end of the year, the gulment can be sold for $45.000 Change in Networking capital is $45.000 which will be recovered at the end of the project. Annual cash flow Sales $250,000 Other operating costs 560.000 taxe 211 What is the projects are how? bound the answer to the nearest cent Question 39 1 pts Delta Stware is considering new project that will last for a year and whose data shown below The company needs to buy a new equipment which will cost $300.000. Other depreciable costs include 525.000 in installation costs. The equipment is dared in the class and walbe depreciated under MACRS The percentar 330, 44.45, 14.01% and 2.41%, spectively. The company believes that the end of the year, the equipment can be sold for $45.000 Change Networking capital is $45.000 which will be covered at the end of the project Anul fio Sales 5250,000 Other operating costs $60,000 21 What the permalcah pow. cash flow for year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts