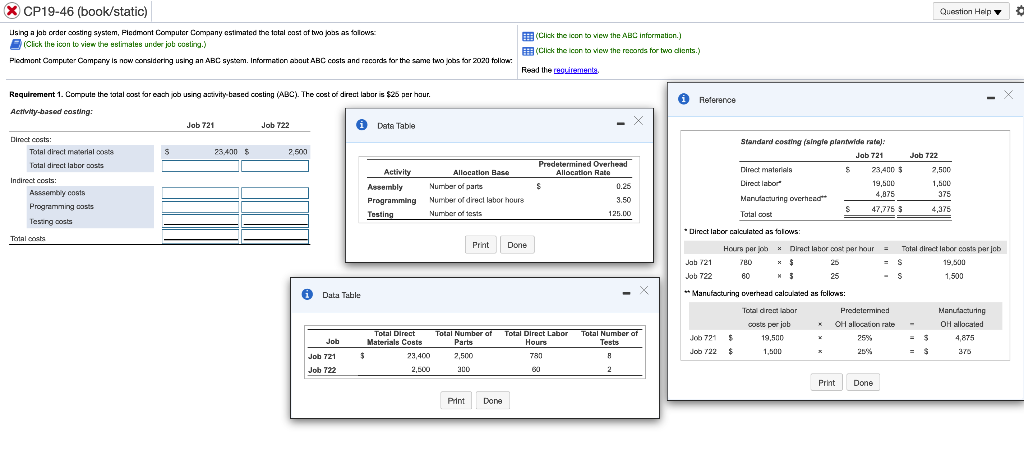

Question: X CP19-46 (book/static) Question Help o Using a job order coating system, Piedmont Computer Comaany estimated the total cost of twojas as follows: Click the

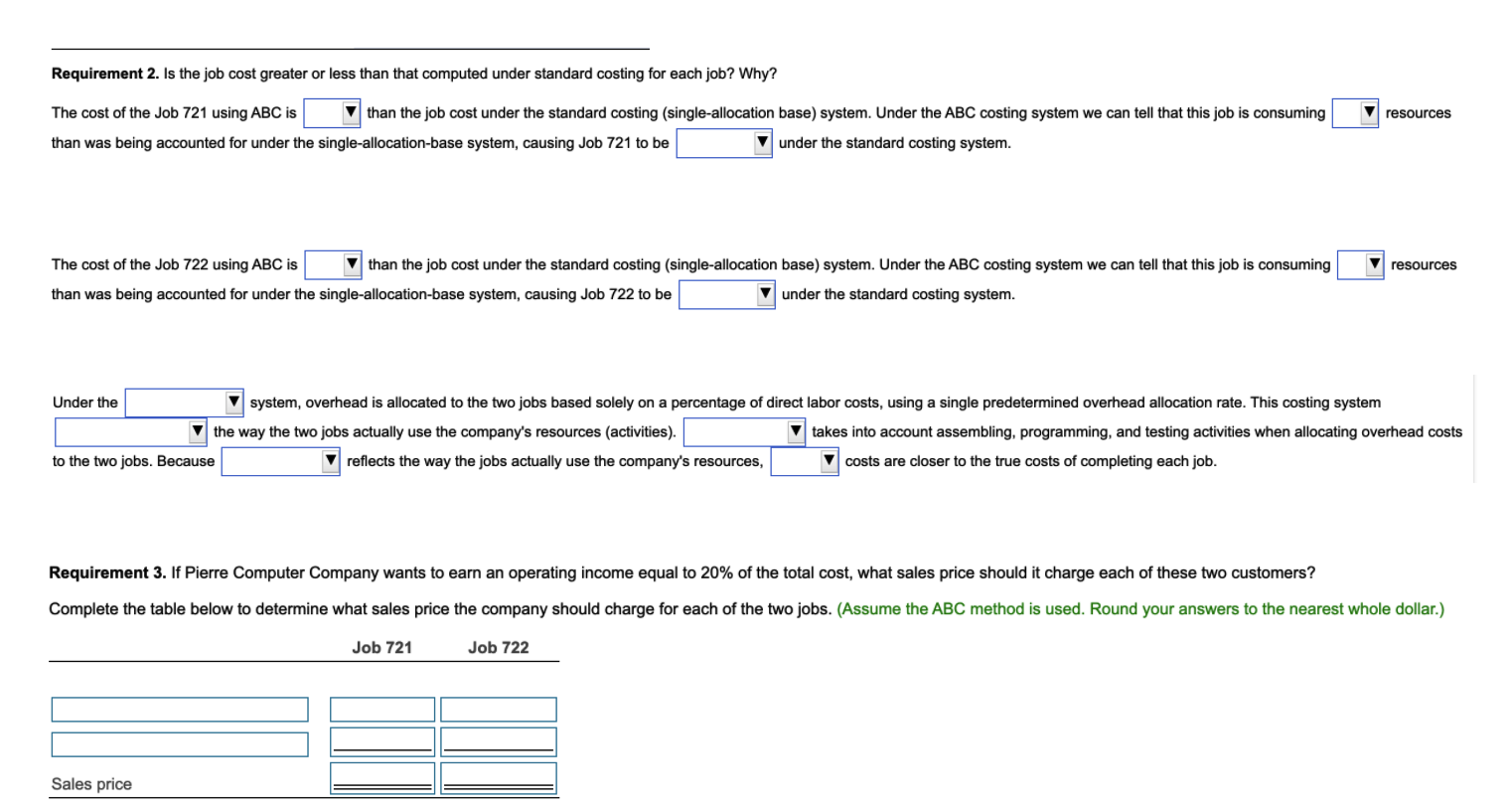

X CP19-46 (book/static) Question Help o Using a job order coating system, Piedmont Computer Comaany estimated the total cost of twojas as follows: Click the icon to view the uslimale under job cusling.) Podmont Computer Company is now considering using an ABC system. Information about ABC costs and records for the same two pastor 2020 follow: (Click the icon to view the ABC information.) (Click the icon to view the records for two clients.) Reed the requirements Requirement 1. Compute the total cost for each ob using asuvity based costing (ABC). The cost of direct laboris $25 per hour. Reference Activity-based costing: Job 721 Job 722 i Data Table Direct costs: Total direct material S 23.400$ $ 2.500 Total direct labor post Allocation Base Activity Assembly Indirect costs: Assembly CORTA Programming costs Tasang costs Predetermined Overhead Allocation Rate $ 0.25 3.50 125.00 Number of parts Number of direct labor hours Number of tests Programming Testing 47,7753 Totalants Print Done Standard costing (single planiwide rata) Jab 721 Job T22 Direct materials $ 23.400 $ 2,500 Direct labore 19,500 1,500 Marutamuning overhead 4,875 375 S 4,375 Total cost Direct labor calculated as falows: Hours par jo * Direct laboronet per hour Total direct labor conta par job Jab 721 7LD 20 S 19.500 Job 722 60 N3 25 S 1,500 ** Manufacturing overhead calculated as follows: Total direct labar Predetermined Manufacturing costs Derib OH allocation rate OH allocated Job 724 $ 19,500 2593 4,875 Job 722 $ 1,500 20% 375 Data Table Job Total Number of Parts 2,500 Total Direct Labor Hours Total Number of Tests Total Direct Materials Costs $ 23,400 2,600 781 Job 721 Job 722 A 200 2 Print Done Print Done Requirement 2. Is the job cost greater or less than that computed under standard costing for each job? Why? resources The cost of the Job 721 using ABC is than the job cost under the standard costing (single-allocation base) system. Under the ABC costing system we can tell that this job is consuming than was being accounted for under the single-allocation-base system, causing Job 721 to be under the standard costing system. resources The cost of the Job 722 using ABC is than the job cost under the standard costing (single-allocation base) system. Under the ABC costing system we can tell that this job is consuming than was being accounted for under the single-allocation-base system, causing Job 722 to be v under the standard costing system. Under the system, overhead is allocated to the two jobs based solely on a percentage of direct labor costs, using a single predetermined overhead allocation rate. This costing system the way the two jobs actually use the company's resources (activities). takes into account assembling, programming, and testing activities when allocating overhead costs to the two jobs. Because reflects the way the jobs actually use the company's resources, costs are closer to the true costs of completing each job. Requirement 3. If Pierre Computer Company wants to earn an operating income equal to 20% of the total cost, what sales price should it charge each of these two customers? Complete the table below to determine what sales price the company should charge for each of the two jobs. (Assume the ABC method is used. Round your answers to the nearest whole dollar.) Job 721 Job 722 Sales price

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts