Question: X Cut Copy Calibri (Body) 11 A A Paste B I U A Format Office Update To keep up-to-date with security updates, fixes, and

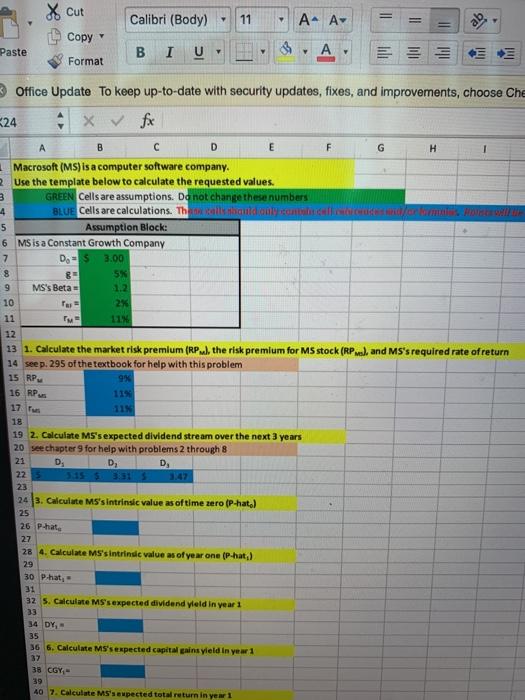

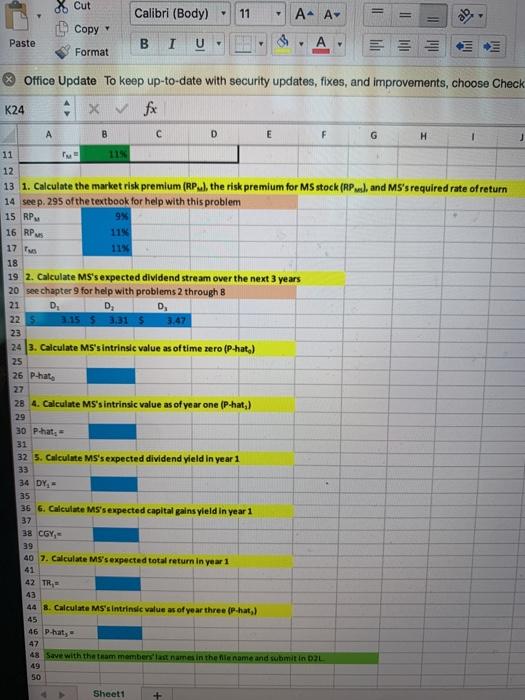

X Cut Copy " Calibri (Body) 11 A A Paste B I U A Format Office Update To keep up-to-date with security updates, fixes, and improvements, choose Che 24 B D E F 1 Macrosoft (MS) is a computer software company. Use the template below to calculate the requested values. 3 GREEN Cells are assumptions. Do not change these numbers 4 BLUE Cells are calculations. The all build any contenido 5 Assumption Block: 6 MS is a Constant Growth Company 7 D3 3.00 8 5 MS's Beta = 1.2 10 2x 11 IM 11 12 16 RP 13 1. Calculate the market risk premium (RP), the risk premium for MS stock (RPM), and MS's required rate of return 14 seep. 295 of the textbook for help with this problem 15 RP 9x 1154 113 18 19 2. Calculate MS's expected dividend stream over the next 3 years 20 see chapter 9 for help with problems 2 through 8 21 D D D 22 5315 53:31 23 243. Calculate MS's intrinsic value as of time zero (Phato) 25 26 P-hat 27 28 4. Calculate MS's intrinsic value as of year one (Phat.) 29 30 Phat 31 32 5. Calculate MS's expected dividend yleld in year 1 33 34 DY, 35 36 6. Calculate MS's expected capital gains yield in year 1 37 38 CGY,- 39 40 7. Calculate MS's expected total return in year 1 Cut Copy - Calibri (Body) 11 A- A+ Paste B U Ini hul Format Office Update To keep up-to-date with security updates, fixes, and improvements, choose Check K24 X fx A B D E F G H 11 115 12 115 17 13 1. Calculate the market risk premium (RP), the risk premium for MS stock (RP), and MS's required rate of return 14 see p. 295 of the textbook for help with this problem 15 RP 9% 16 RPUS 11% 18 19 2. Calculate MS's expected dividend stream over the next 3 years 20 see chapter 9 for help with problems 2 through 8 21 D. D. D. 22 3.15 33.315 3.47 23 243. Calculate MS's intrinsic value as of time rero (P-hat.) 25 26 P-hat 27 28 4. Calculate MS's intrinsic value as of year one (P-hat) 29 30 Pha = 31 32 5. Calculate MS's expected dividend yield in year 1 33 34 DY, 35 36 6. Calculate MS's expected capital gains yield in year 1 37 38 CGY, 40 7. Calculate MS's expected total return in year 1 41 42 TR = 43 44 8. Calculate MS's Intrinsie value as of year three (Phat) 45 46 Phat, 47 48 Save with the team members' last names in the file name and submit in D2L 49 50 Sheet1 +

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts