Question: X Cut Copy Calibri (Body) 14 A- A- Wrap Text General AutoSum Fill - 49 H Paste B I U A Merge & Center $

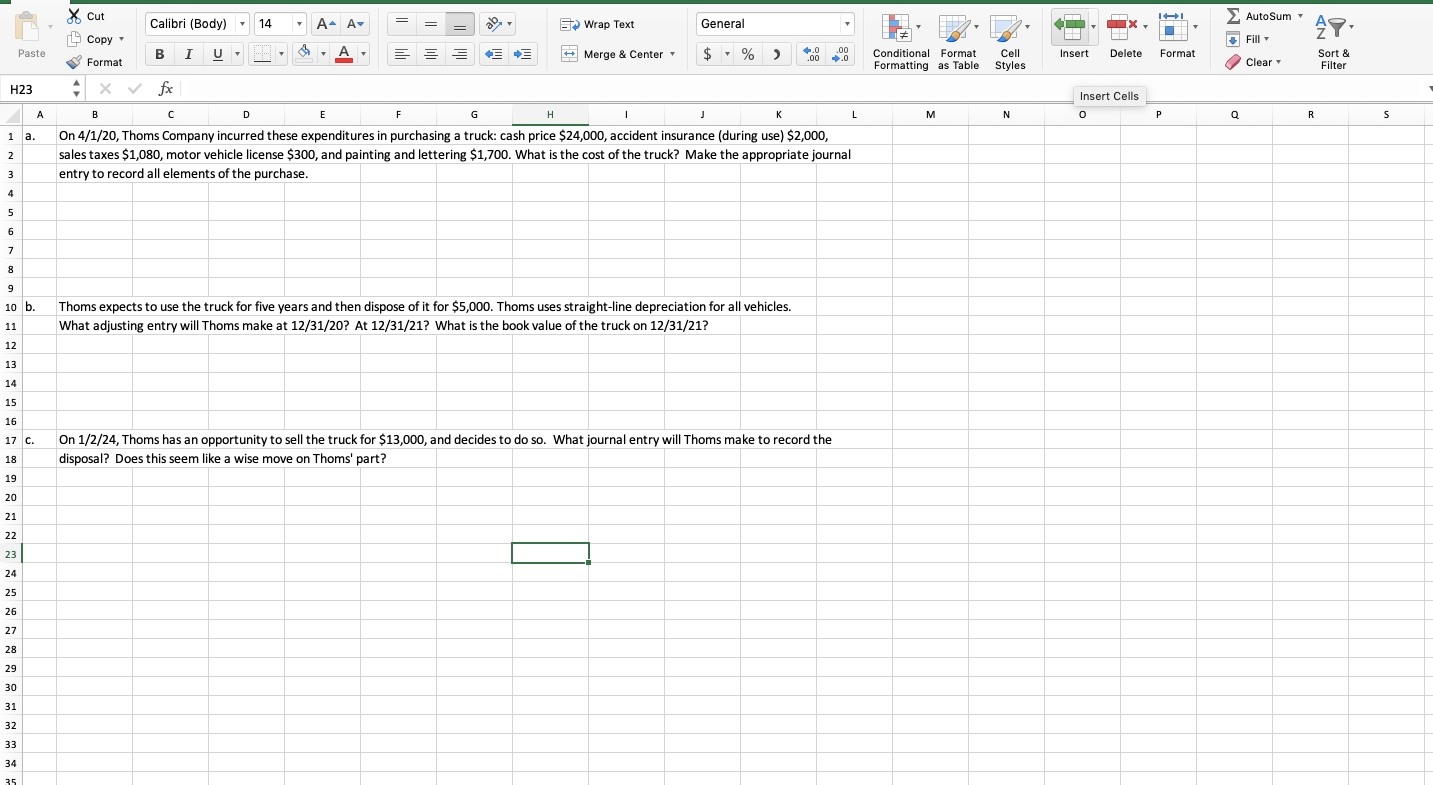

X Cut Copy Calibri (Body) 14 A- A- Wrap Text General AutoSum Fill - 49 H Paste B I U A Merge & Center $ - % ) 4.0 .00 .00 0 Insert Delete Format Format Conditional Format Formatting as Table Cell Styles Clear Sort & Filter H23 4 fx Insert Cells A B D E F G 1 J L M N 0 Q R S 1 a. . On 4/1/20, Thoms Company incurred these expenditures in purchasing a truck: cash price $24,000, accident insurance (during use) $2,000, sales taxes $1,080, motor vehicle license $300, and painting and lettering $1,700. What is the cost of the truck? Make the appropriate journal entry to record all elements of the purchase. 2 3 4 4 5 6 7 8 9 10 b. Thoms expects to use the truck for five years and then dispose of it for $5,000. Thoms uses straight-line depreciation for all vehicles. What adjusting entry will Thoms make at 12/31/20? At 12/31/21? What is the book value of the truck on 12/31/21? 11 12 13 14 15 16 17 c. On 1/2/24, Thoms has an opportunity to sell the truck for $13,000, and decides to do so. What journal entry will Thoms make to record the disposal? Does this seem like a wise move on Thoms' part? 18 19 20 21 22 23 24 25 26 27 28 29 30 31 32 33 34 35

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts