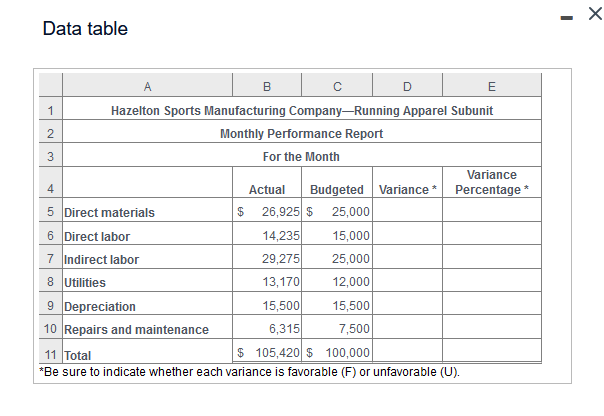

Question: X Data table A B C D E 1 Hazelton Sports Manufacturing Company-Running Apparel Subunit 2 Monthly Performance Report 3 For the Month Variance 4

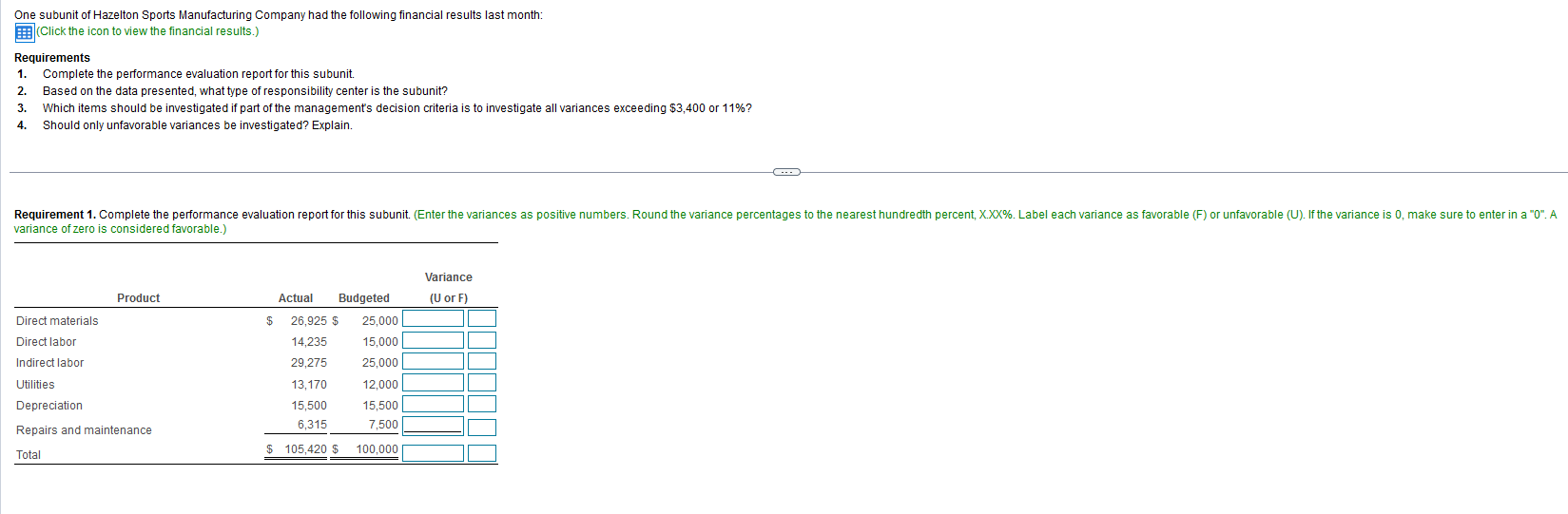

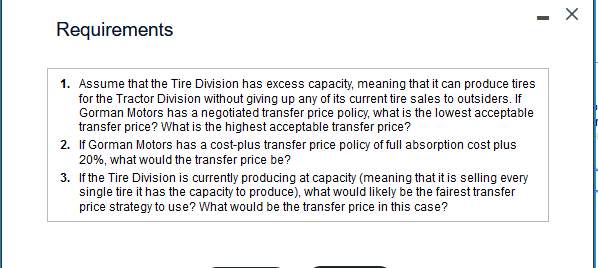

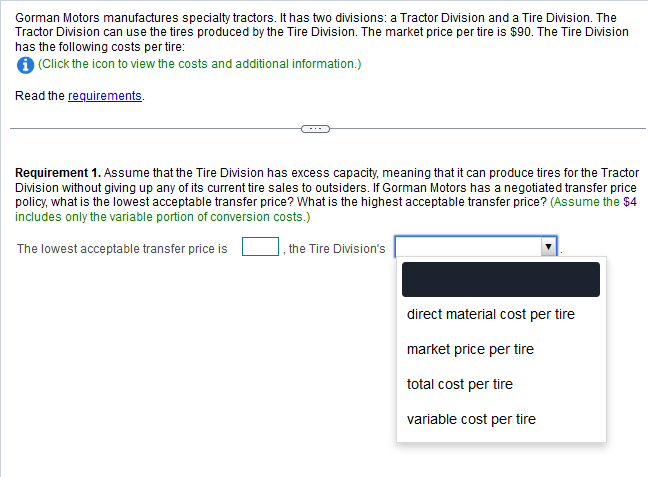

X Data table A B C D E 1 Hazelton Sports Manufacturing Company-Running Apparel Subunit 2 Monthly Performance Report 3 For the Month Variance 4 Actual Budgeted Variance * Percentage * 5 Direct materials 26,925 25,000 6 Direct labor 14,235 15,000 7 Indirect labor 29,275 25,000 8 Utilities 13,170 12,000 9 Depreciation 15,500 15,500 10 Repairs and maintenance 6,315 7,500 11 Total $ 105,420 $ 100,000 *Be sure to indicate whether each variance is favorable (F) or unfavorable (U).One subunit of Hazelton Sports Manufacturing Company had the following financial results last month: (Click the icon to view the financial results.) Requirements 1. Complete the performance evaluation report for this subunit. 2. Based on the data presented, what type of responsibility center is the subunit? 3. Which items should be investigated if part of the management's decision criteria is to investigate all variances exceeding $3,400 or 11%? 4. Should only unfavorable variances be investigated? Explain. Requirement 1. Complete the performance evaluation report for this subunit. (Enter the variances as positive numbers. Round the variance percentages to the nearest hundredth percent, XXX%. Label each variance as favorable (F) or unfavorable (U). If the variance is 0, make sure to enter in a "0". A variance of zero is considered favorable. Variance Product Actual Budgeted (U or F) Direct materials $ 26,925 $ 25,000 Direct labor 14,235 15,000 Indirect labor 29,275 25,000 Utilities 13,170 12,000 Depreciation 15,500 15,500 Repairs and maintenance 5.315 7,500 Total $ 105,420 $ 100,000X Requirements 1. Assume that the Tire Division has excess capacity, meaning that it can produce tires for the Tractor Division without giving up any of its current tire sales to outsiders. If Gorman Motors has a negotiated transfer price policy, what is the lowest acceptable transfer price? What is the highest acceptable transfer price? 2. If Gorman Motors has a cost-plus transfer price policy of full absorption cost plus 20%, what would the transfer price be? 3. If the Tire Division is currently producing at capacity (meaning that it is selling every single tire it has the capacity to produce), what would likely be the fairest transfer price strategy to use? What would be the transfer price in this case?Gorman Motors manufactures specialty tractors. It has two divisions: a Tractor Division and a Tire Division. The Tractor Division can use the tires produced by the Tire Division. The market price per tire is $90. The Tire Division has the following costs per tire: i (Click the icon to view the costs and additional information.) Read the requirements. - . - Requirement 1. Assume that the Tire Division has excess capacity, meaning that it can produce tires for the Tractor Division without giving up any of its current tire sales to outsiders. If Gorman Motors has a negotiated transfer price policy, what is the lowest acceptable transfer price? What is the highest acceptable transfer price? (Assume the $4 includes only the variable portion of conversion costs.) The lowest acceptable transfer price is the Tire Division's direct material cost per tire market price per tire total cost per tire variable cost per tire

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts