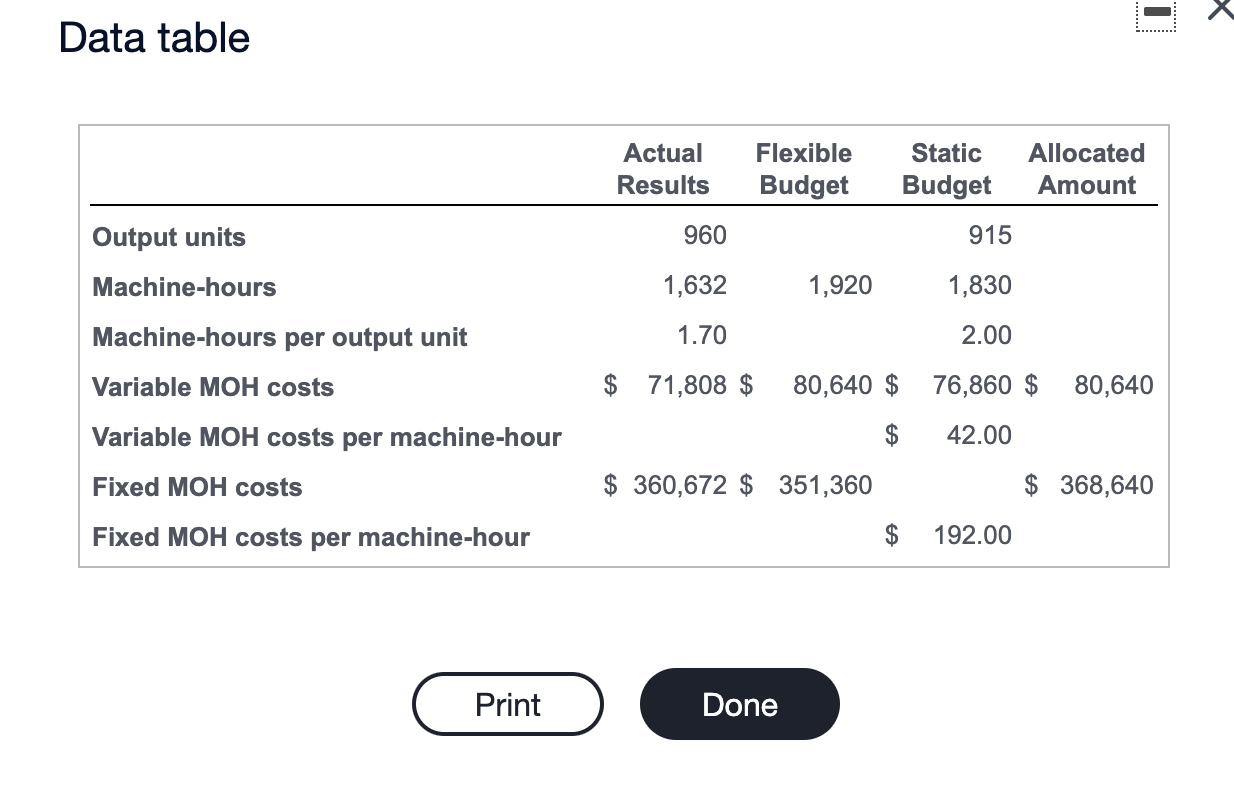

Question: - X Data table Actual Results Flexible Budget Static Budget Allocated Amount 960 915 Output units Machine-hours Machine-hours per output unit 1,632 1,920 1,830 1.70

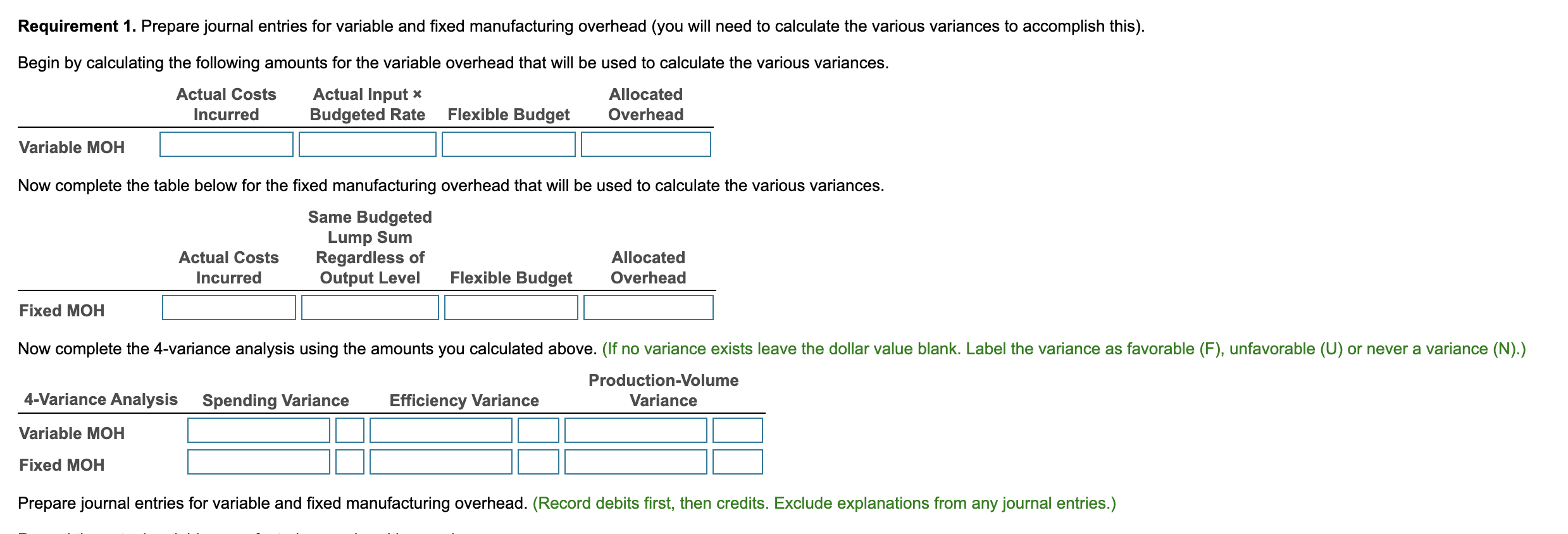

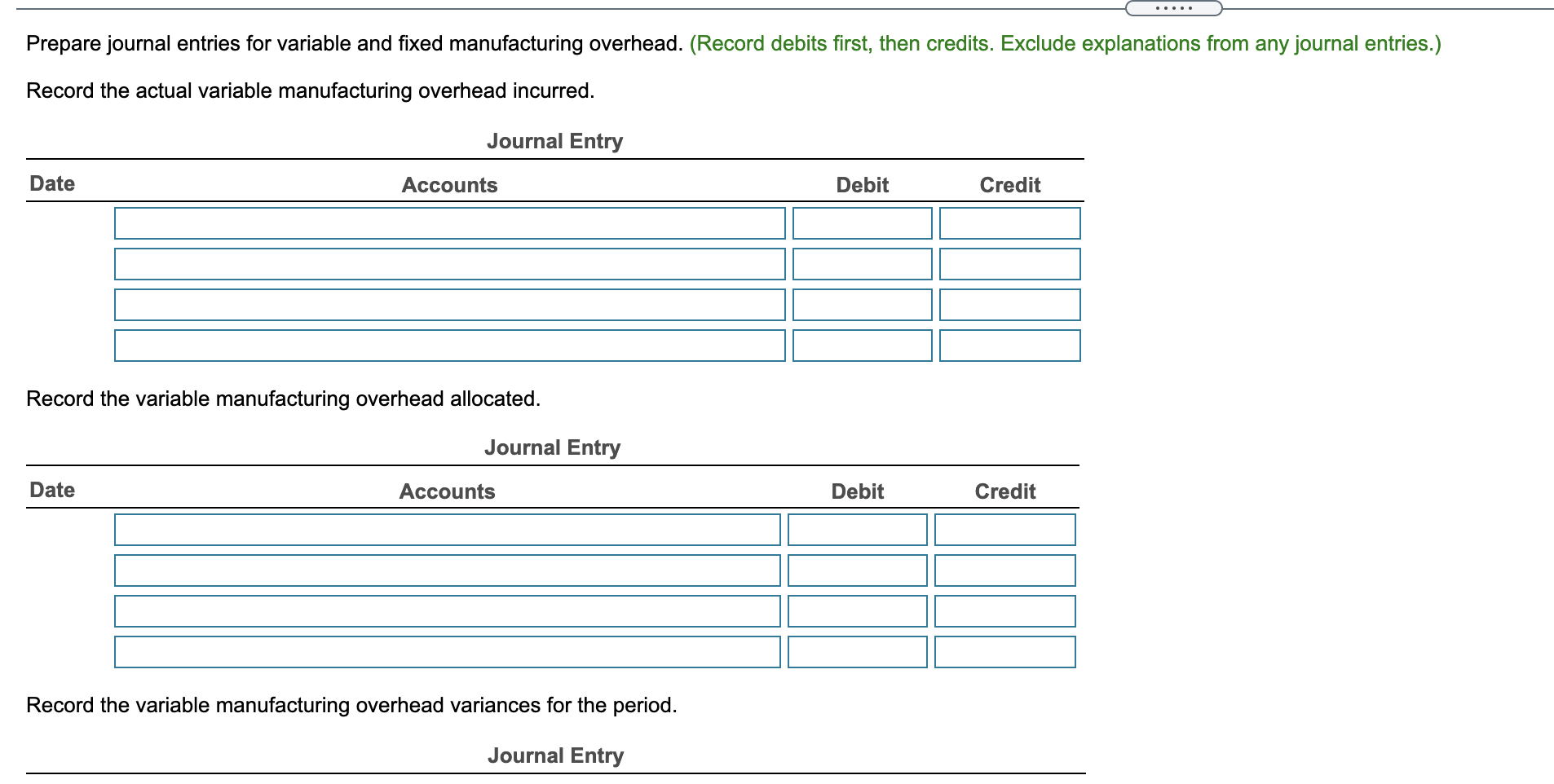

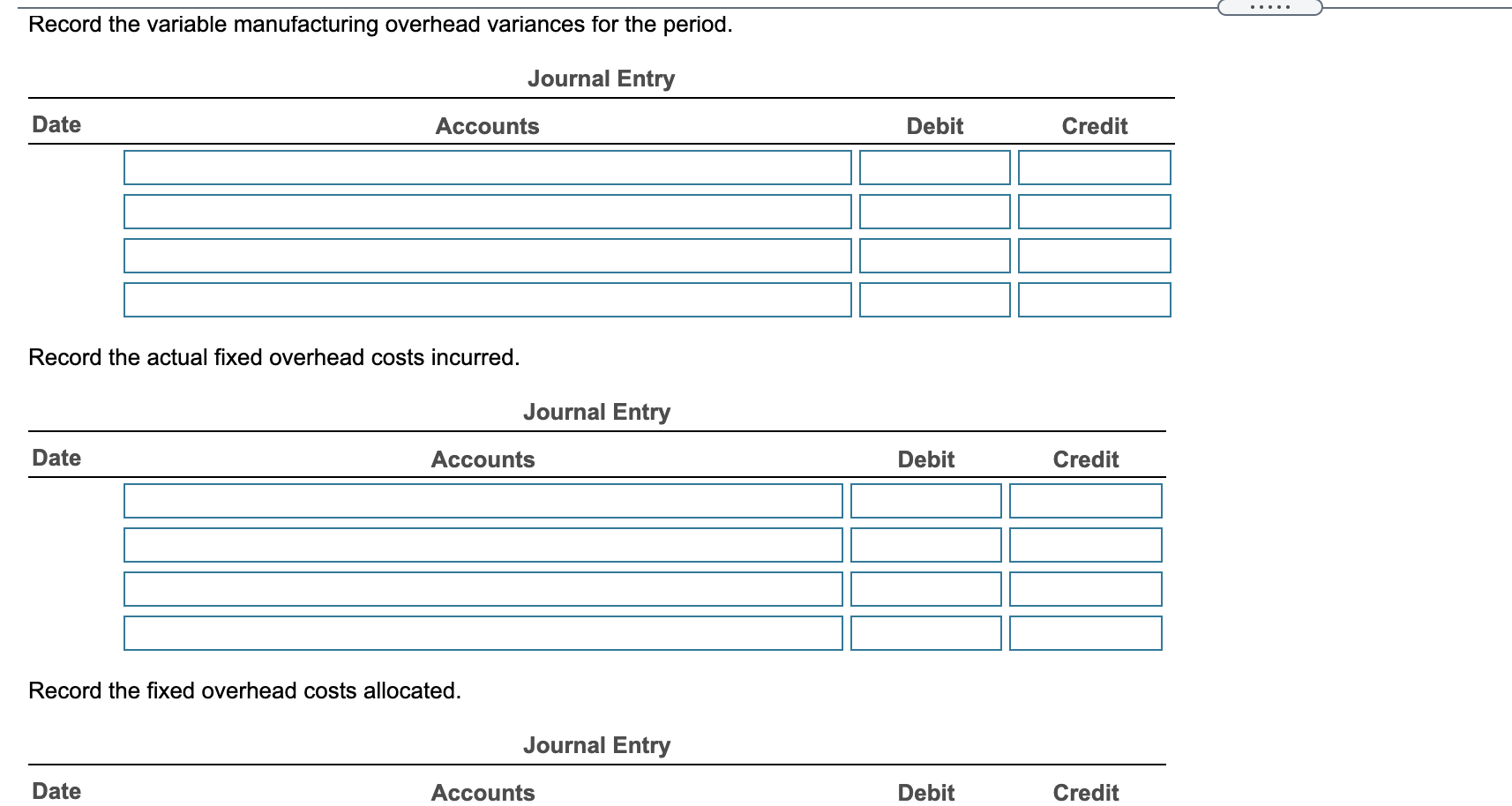

- X Data table Actual Results Flexible Budget Static Budget Allocated Amount 960 915 Output units Machine-hours Machine-hours per output unit 1,632 1,920 1,830 1.70 2.00 Variable MOH costs $ 71,808 $ 80,640 $ 76,860 $ 80,640 $ 42.00 Variable MOH costs per machine-hour Fixed MOH costs Fixed MOH costs per machine-hour $ 360,672 $ 351,360 $ 358,640 192.00 Print Done Requirement 1. Prepare journal entries for variable and fixed manufacturing overhead (you will need to calculate the various variances to accomplish this). Begin by calculating the following amounts for the variable overhead that will be used to calculate the various variances. Actual Costs Actual Input * Allocated Incurred Budgeted Rate Flexible Budget Overhead Variable MOH Now complete the table below for the fixed manufacturing overhead that will be used to calculate the various variances. Same Budgeted Lump Sum Actual Costs Regardless of Allocated Incurred Output Level Flexible Budget Overhead Fixed MOH Now complete the 4-variance analysis using the amounts you calculated above. (If no variance exists leave the dollar value blank. Label the variance as favorable (F), unfavorable (U) or never a variance (N).) Production-Volume 4-Variance Analysis Spending Variance Efficiency Variance Variance Variable MOH Fixed MOH Prepare journal entries for variable and fixed manufacturing overhead. (Record debits first, then credits. Exclude explanations from any journal entries.) Prepare journal entries for variable and fixed manufacturing overhead. (Record debits first, then credits. Exclude explanations from any journal entries.) Record the actual variable manufacturing overhead incurred. Journal Entry Date Accounts Debit Credit Record the variable manufacturing overhead allocated. Journal Entry Date Accounts Debit Credit Record the variable manufacturing overhead variances for the period. Journal Entry Record the variable manufacturing overhead variances for the period. Journal Entry Date Accounts Debit Credit Record the actual fixed overhead costs incurred. Journal Entry Date Accounts Debit Credit Record the fixed overhead costs allocated. Journal Entry Date Accounts Debit Credit Record the fixed overhead variances for the period. Journal Entry Date Accounts Debit Credit Requirement 2. Overhead variances are written off to the Cost of Goods Sold (COGS) account at the end of the fiscal year. Show how COGS is adjusted through journal entries. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Date Accounts Debit Credit - X Data table Actual Results Flexible Budget Static Budget Allocated Amount 960 915 Output units Machine-hours Machine-hours per output unit 1,632 1,920 1,830 1.70 2.00 Variable MOH costs $ 71,808 $ 80,640 $ 76,860 $ 80,640 $ 42.00 Variable MOH costs per machine-hour Fixed MOH costs Fixed MOH costs per machine-hour $ 360,672 $ 351,360 $ 358,640 192.00 Print Done Requirement 1. Prepare journal entries for variable and fixed manufacturing overhead (you will need to calculate the various variances to accomplish this). Begin by calculating the following amounts for the variable overhead that will be used to calculate the various variances. Actual Costs Actual Input * Allocated Incurred Budgeted Rate Flexible Budget Overhead Variable MOH Now complete the table below for the fixed manufacturing overhead that will be used to calculate the various variances. Same Budgeted Lump Sum Actual Costs Regardless of Allocated Incurred Output Level Flexible Budget Overhead Fixed MOH Now complete the 4-variance analysis using the amounts you calculated above. (If no variance exists leave the dollar value blank. Label the variance as favorable (F), unfavorable (U) or never a variance (N).) Production-Volume 4-Variance Analysis Spending Variance Efficiency Variance Variance Variable MOH Fixed MOH Prepare journal entries for variable and fixed manufacturing overhead. (Record debits first, then credits. Exclude explanations from any journal entries.) Prepare journal entries for variable and fixed manufacturing overhead. (Record debits first, then credits. Exclude explanations from any journal entries.) Record the actual variable manufacturing overhead incurred. Journal Entry Date Accounts Debit Credit Record the variable manufacturing overhead allocated. Journal Entry Date Accounts Debit Credit Record the variable manufacturing overhead variances for the period. Journal Entry Record the variable manufacturing overhead variances for the period. Journal Entry Date Accounts Debit Credit Record the actual fixed overhead costs incurred. Journal Entry Date Accounts Debit Credit Record the fixed overhead costs allocated. Journal Entry Date Accounts Debit Credit Record the fixed overhead variances for the period. Journal Entry Date Accounts Debit Credit Requirement 2. Overhead variances are written off to the Cost of Goods Sold (COGS) account at the end of the fiscal year. Show how COGS is adjusted through journal entries. (Record debits first, then credits. Exclude explanations from journal entries.) Journal Entry Date Accounts Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts