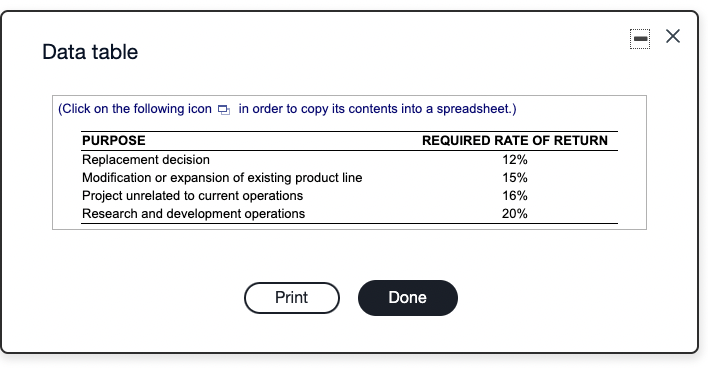

Question: X Data table (Click on the following icon in order to copy its contents into a spreadsheet.) PURPOSE REQUIRED RATE OF RETURN Replacement decision 12%

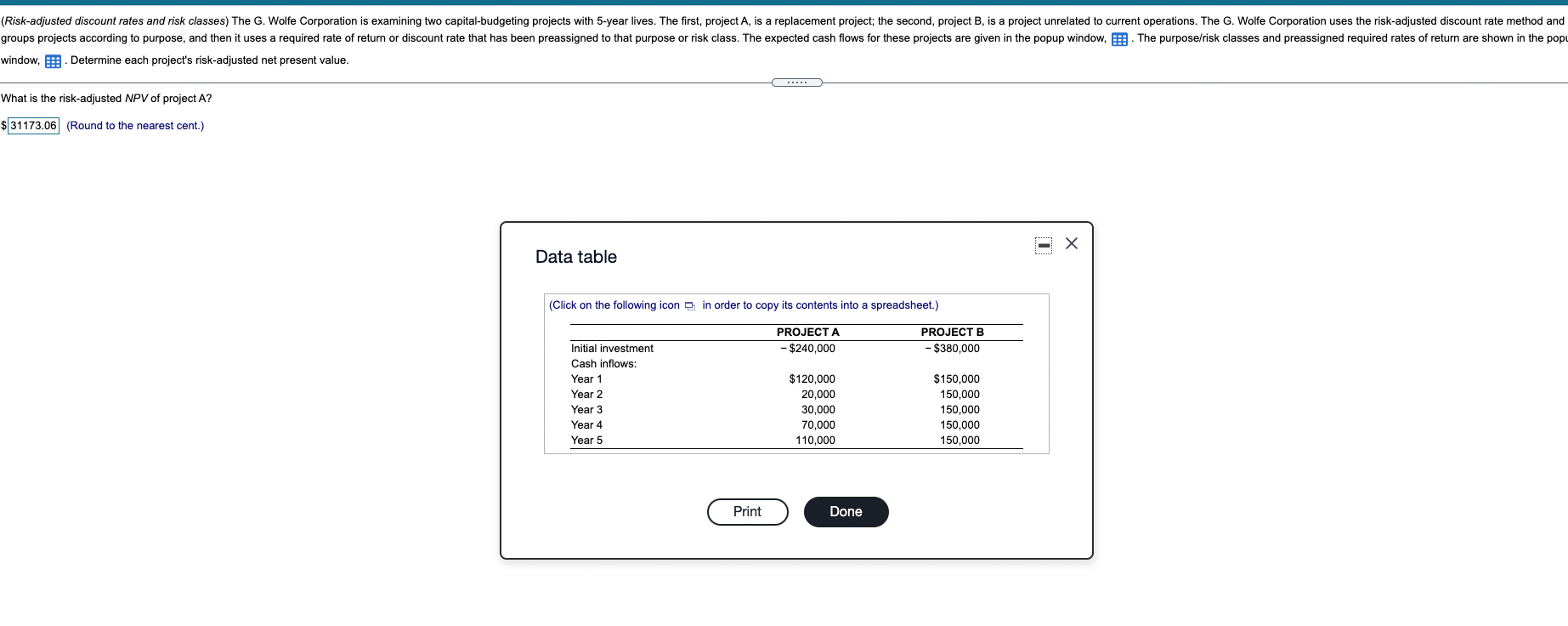

X Data table (Click on the following icon in order to copy its contents into a spreadsheet.) PURPOSE REQUIRED RATE OF RETURN Replacement decision 12% Modification or expansion of existing product line 15% Project unrelated to current operations 16% Research and development operations 20% Print Done (Risk-adjusted discount rates and risk classes) The G. Wolfe Corporation is examining two capital-budgeting projects with 5-year lives. The first, project A, is a replacement project; the second, project B, is a project unrelated to current operations. The G. Wolfe Corporation uses the risk-adjusted discount rate method and groups projects according to purpose, and then it uses a required rate of return or discount rate that has been preassigned to that purpose or risk class. The expected cash flows for these projects are given in the popup window, ! . The purpose/risk classes and preassigned required rates of return are shown in the popu window, Determine each project's risk-adjusted net present value. ..... What is the risk-adjusted NPV of project A? $31173.06 (Round to the nearest cent.) Data table (Click on the following icon in order to copy its contents into a spreadsheet.) PROJECT A - $240,000 PROJECT B - $380,000 Initial investment Cash inflows: Year 1 2 Year 3 Year 4 Year 5 $120,000 20,000 30,000 70,000 110,000 $150,000 150,000 150,000 150,000 150,000 Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts