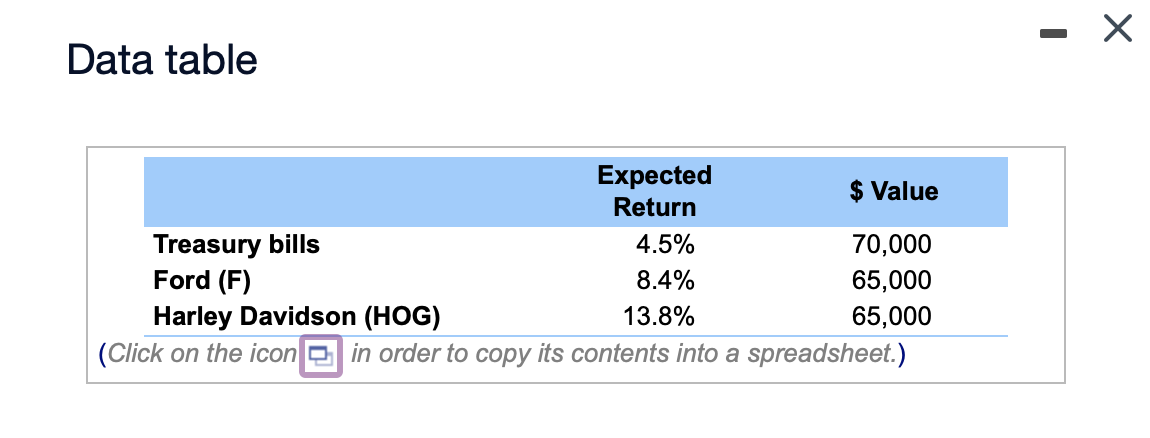

Question: - - X Data table Expected $ Value Return Treasury bills 4.5% 70,000 Ford (F) 8.4% 65,000 Harley Davidson (HOG) 13.8% 65,000 (Click on the

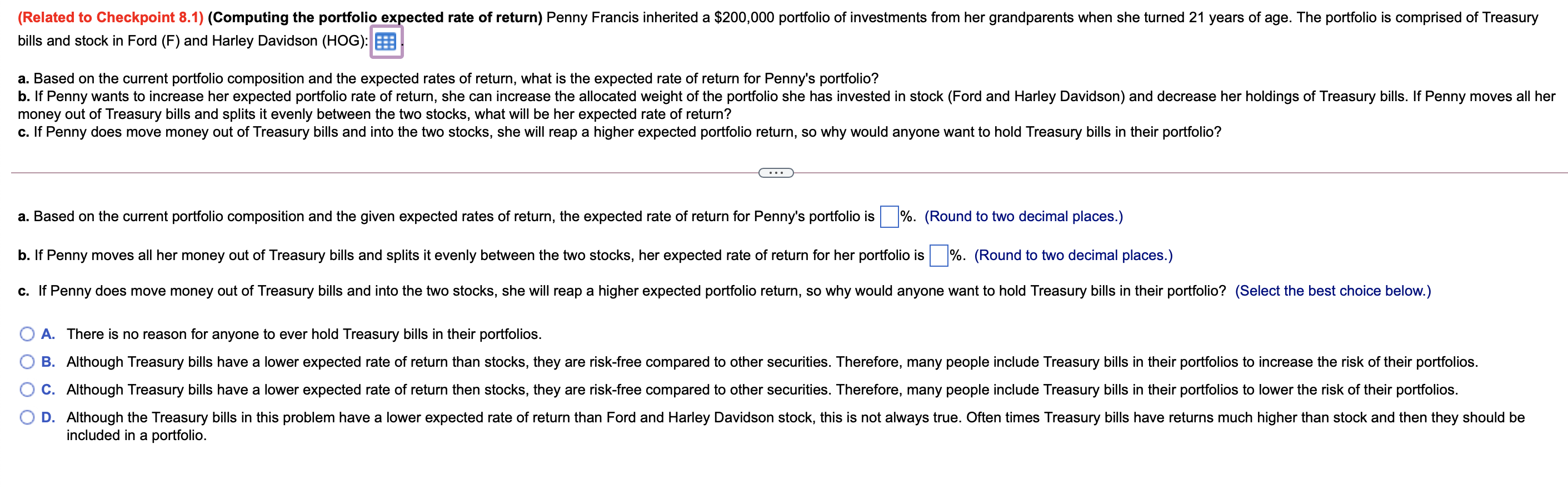

- - X Data table Expected $ Value Return Treasury bills 4.5% 70,000 Ford (F) 8.4% 65,000 Harley Davidson (HOG) 13.8% 65,000 (Click on the icon in order to copy its contents into a spreadsheet.) (Related to Checkpoint 8.1) (Computing the portfolio expected rate of return) Penny Francis inherited a $200,000 portfolio of investments from her grandparents when she turned 21 years of age. The portfolio is comprised of Treasury bills and stock in Ford (F) and Harley Davidson (HOG): a. Based on the current portfolio composition and the expected rates of return, what is the expected rate of return for Penny's portfolio? b. If Penny wants to increase her expected portfolio rate of return, she can increase the allocated weight of the portfolio she has invested in stock (Ford and Harley Davidson) and decrease her holdings of Treasury bills. If Penny moves all her money out of Treasury bills and splits it evenly between the two stocks, what will be her expected rate of return? c. If Penny does move money out of Treasury bills and into the two stocks, she will reap a higher expected portfolio return, so why would anyone want to hold Treasury bills in their portfolio? a. Based on the current portfolio composition and the given expected rates of return, the expected rate of return for Penny's portfolio is %. (Round to two decimal places.) b. If Penny moves all her money out of Treasury bills and splits it evenly between the two stocks, her expected rate of return for her portfolio is %. (Round to two decimal places.) c. If Penny does move money out of Treasury bills and into the two stocks, she will reap a higher expected portfolio return, so why would anyone want to hold Treasury bills in their portfolio? (Select the best choice below.) A. There is no reason for anyone to ever hold Treasury bills in their portfolios. B. Although Treasury bills have a lower expected rate of return than stocks, they are risk-free compared to other securities. Therefore, many people include Treasury bills in their portfolios to increase the risk of their portfolios. C. Although Treasury bills have a lower expected rate of return then stocks, they are risk-free compared to other securities. Therefore, many people include Treasury bills in their portfolios to lower the risk of their portfolios. O D. Although the Treasury bills in this problem have a lower expected rate of return than Ford and Harley Davidson stock, this is not always true. Often times Treasury bills have returns much higher than stock and then they should be included in a portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts