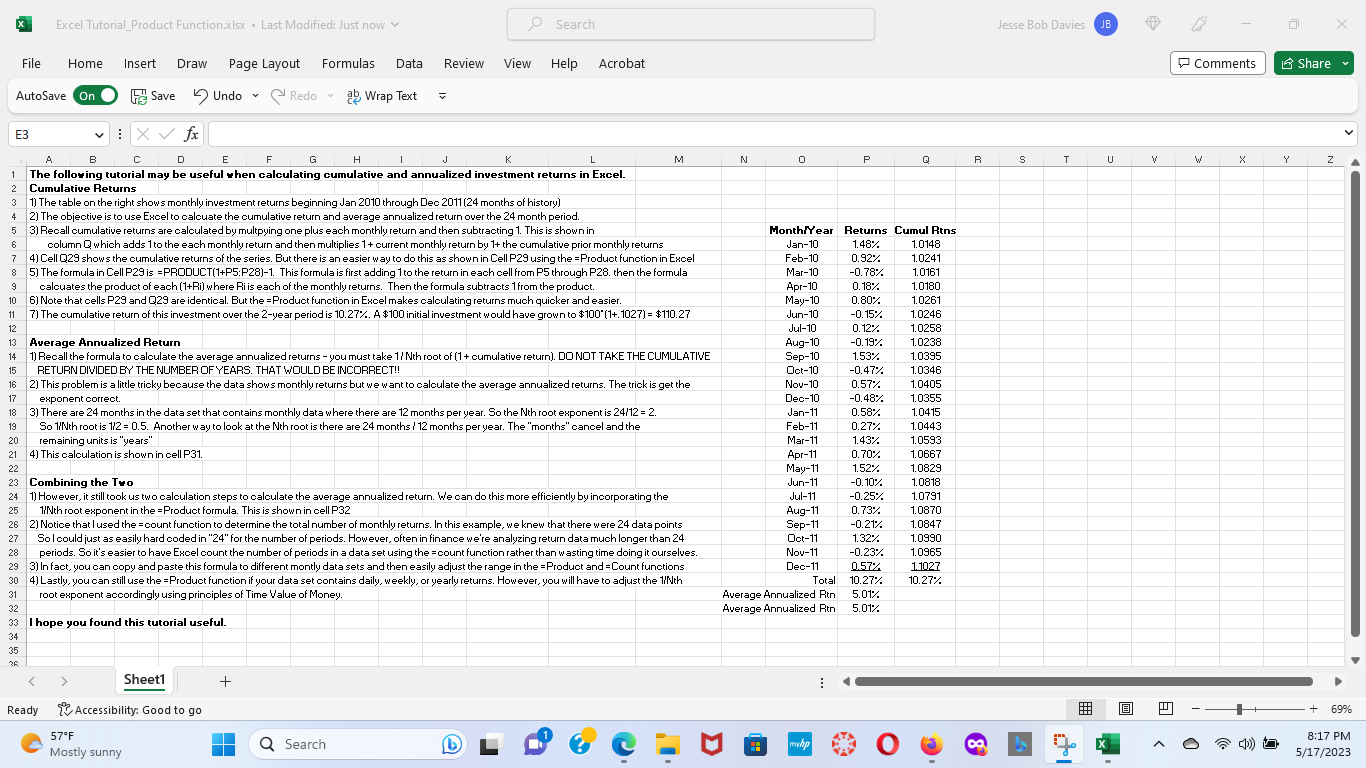

Question: X Excel Tutorial_Product Function,xIsx . Last Modified: Just now v Search Jesse Bob Davies JB X File Home Insert Draw Page Layout Formulas Data Review

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock