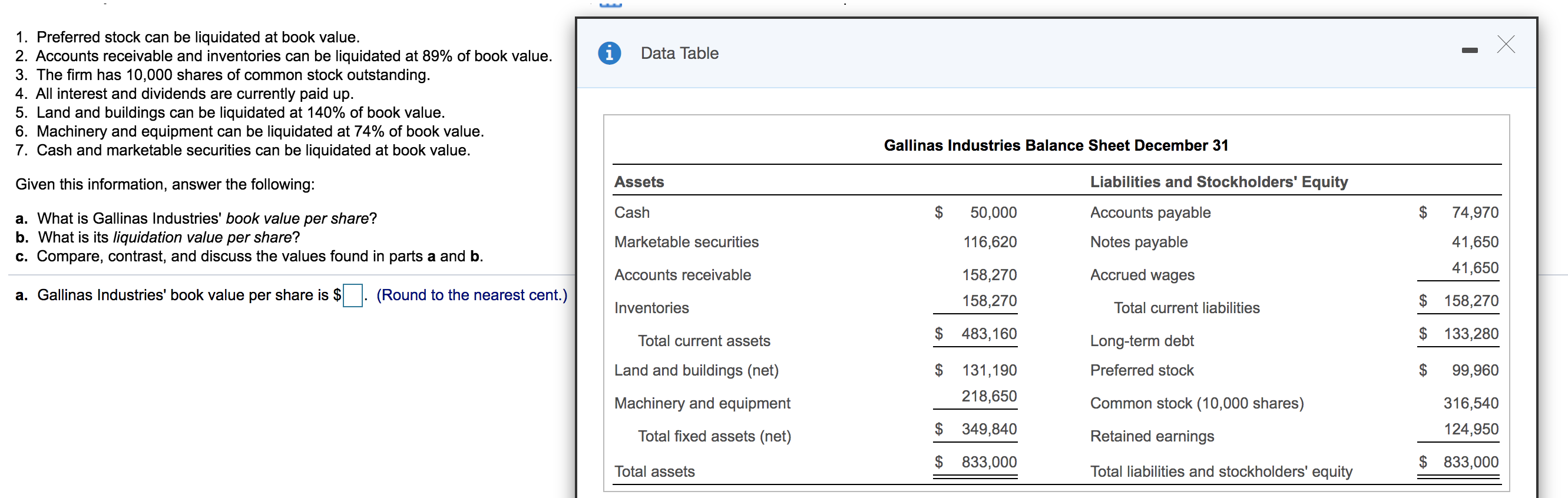

Question: X i - Data Table 1. Preferred stock can be liquidated at book value. 2. Accounts receivable and inventories can be liquidated at 89% of

X i - Data Table 1. Preferred stock can be liquidated at book value. 2. Accounts receivable and inventories can be liquidated at 89% of book value. 3. The firm has 10,000 shares of common stock outstanding. 4. All interest and dividends are currently paid up. 5. Land and buildings can be liquidated at 140% of book value. 6. Machinery and equipment can be liquidated at 74% of book value. 7. Cash and marketable securities can be liquidated at book value. Gallinas Industries Balance Sheet December 31 Given this information, answer the following: Assets Liabilities and Stockholders' Equity Cash $ 50,000 Accounts payable $ 74,970 a. What is Gallinas Industries' book value per share? b. What is its liquidation value per share? c. Compare, contrast, and discuss the values found in parts a and b. Marketable securities 116,620 Notes payable 41,650 41,650 Accounts receivable Accrued wages a. Gallinas Industries' book value per share is $. (Round to the nearest cent.) 158,270 158,270 Inventories Total current liabilities $ 158,270 $ 483,160 $ 133,280 Total current assets Long-term debt Land and buildings (net) Preferred stock $ 99,960 $ 131,190 218,650 Machinery and equipment Common stock (10,000 shares) 316,540 124,950 Total fixed assets (net) $ 349,840 Retained earnings $ 833,000 Total assets Total liabilities and stockholders' equity $ 833,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts