Question: x Relevant Costs with NPV Sales always decrease in the summer at The Coffee House, and Beatrice, the owner, wants to increase sales in the

x

x

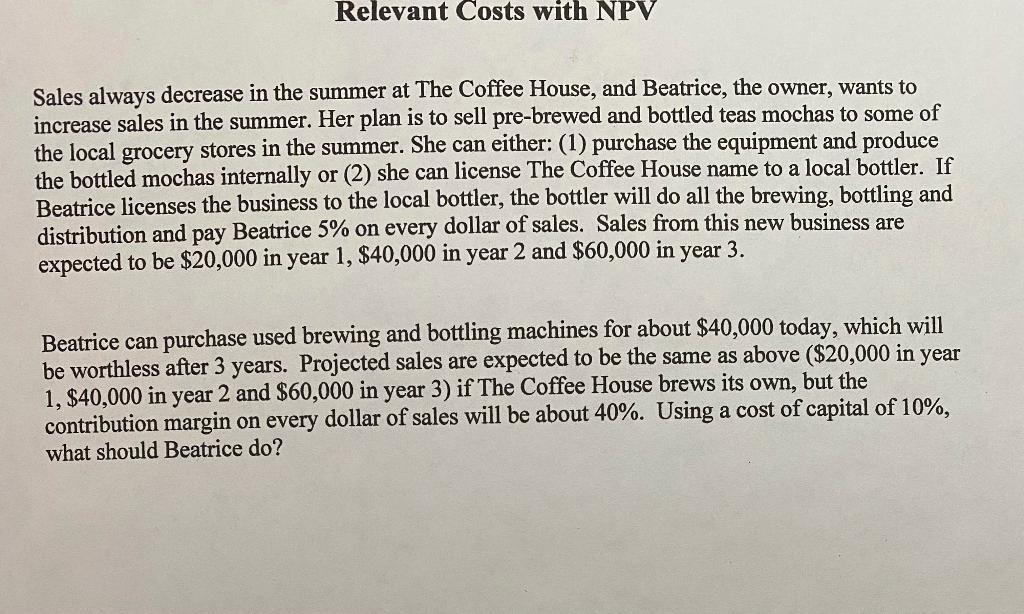

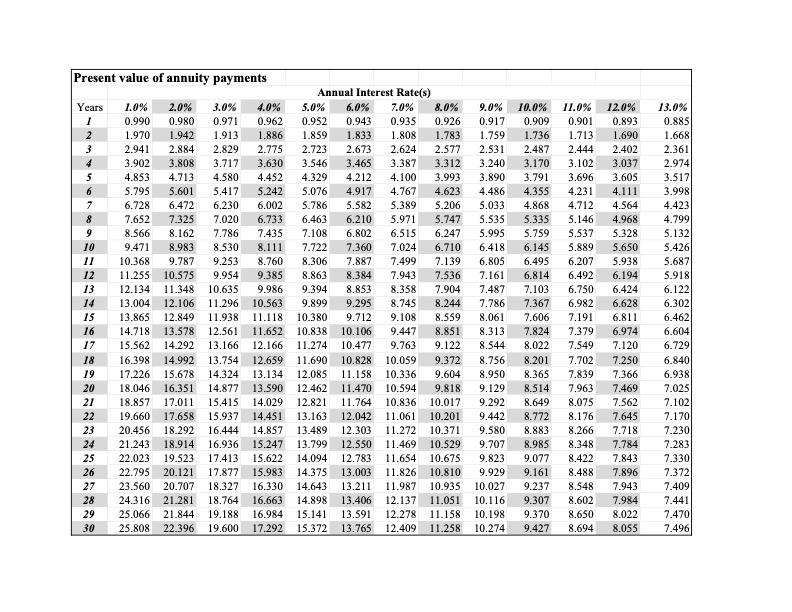

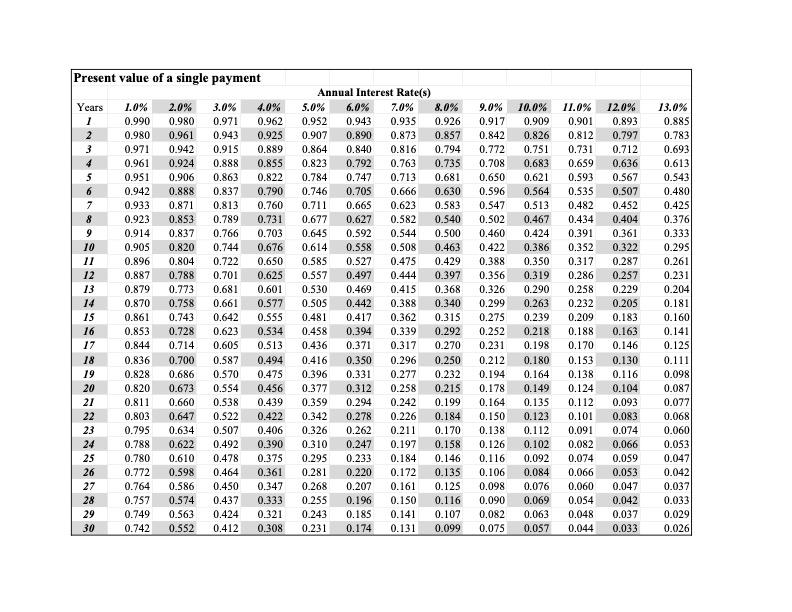

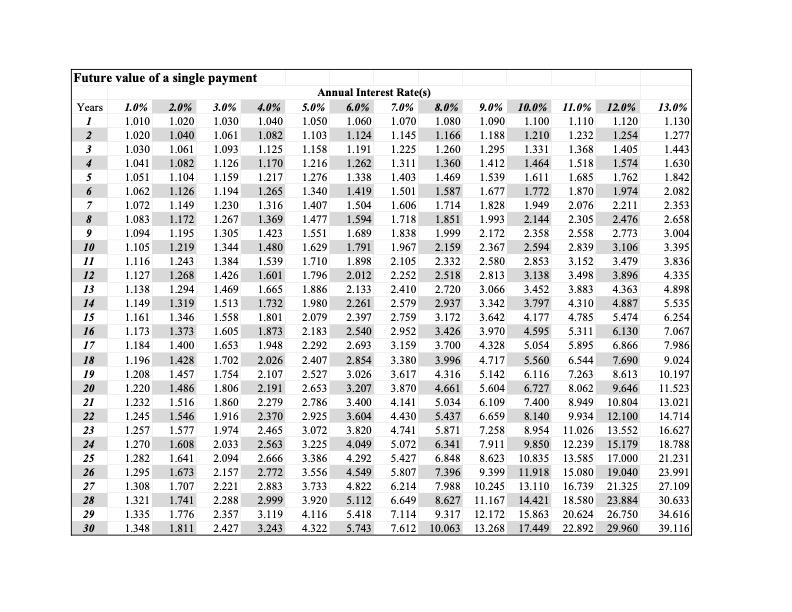

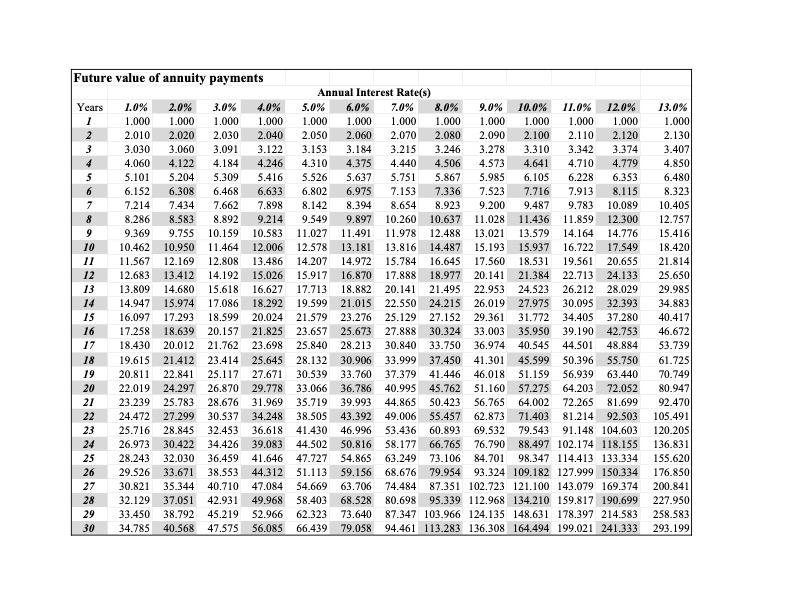

Relevant Costs with NPV Sales always decrease in the summer at The Coffee House, and Beatrice, the owner, wants to increase sales in the summer. Her plan is to sell pre-brewed and bottled teas mochas to some of the local grocery stores in the summer. She can either: (1) purchase the equipment and produce the bottled mochas internally or (2) she can license The Coffee House name to a local bottler. If Beatrice licenses the business to the local bottler, the bottler will do all the brewing, bottling and distribution and pay Beatrice 5% on every dollar of sales. Sales from this new business are expected to be $20,000 in year 1, $40,000 in year 2 and $60,000 in year 3. Beatrice can purchase used brewing and bottling machines for about $40,000 today, which will be worthless after 3 years. Projected sales are expected to be the same as above ($20,000 in year 1, $40,000 in year 2 and $60,000 in year 3) if The Coffee House brews its own, but the contribution margin on every dollar of sales will be about 40%. Using a cost of capital of 10%, what should Beatrice do? Present value of annuity payments Annual Interest Rate(s) 1 11.0% 12.0% 13.0% 0.901 0.893 0.885 1.668 2.361 2 1.713 1.690 3 2.974 3.517 5 6 3.998 7 4.423 8 4.799 9 10 11 5.132 5.426 5.687 5.918 6.122 6.302 12 13 14 Years 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 1.970 1.942 1.913 1.886 1.859 1.833 1.808 1.783 1.759 1.736 2.941 2.884 2.829 2.775 2.723 2.673 2.624 2.577 2.531 2.487 2.444 2.402 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 3.240 3.170 3.102 3.037 4.853 4.713 4.580 4.452 4.329 4.212 4.100 3.993 3.890 3.791 3.696 3.605 5.795 5.601 5.417 5.242 5.076 4.917 4.767 4.623 4.486 4.355 4.231 4.111 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5.033 4.868 4.712 4.564 7.652 7.325 7.020 6.733 6.463 6.210 5.971 5.747 5.535 5.335 5.146 4.968 8.566 8.162 7.786 7.435 7.108 6.802 6.515 6.247 5.995 5.759 5.537 5.328 9.471 8.983 8.530 8.111 7.722 7.360 7.024 6.710 6.418 6.145 5.889 5.650 10.368 9.787 9.253 8.760 8.306 7.887 7.499 7.139 6.805 6.495 6.207 5.938 11.255 10.575 9.954 9.385 8.863 8.384 7.943 7.536 7.161 6.814 6.492 6.194 12.134 11.348 10.635 9.986 9.394 8.853 8.358 7.904 7.487 7.103 6.750 6.424 13.004 12.106 11.296 10.563 9.899 9.295 8.745 8.244 7.786 7.367 6.982 6.628 13.865 12.849 11.938 11.118 10.380 9.712 9.108 8.559 8.061 7.606 7.191 6.811 12.561 11.652 10.838 10.106 9.447 8.851 8.313 7.824 7.379 6.974 13.166 12.166 11.274 10.477 9.763 9.122 8.544 8.022 13.754 12.659 11.690 10.828 10.059 9.372 8.756 8.201 14.324 13.134 12.085 11.158 10.336 9.604 8.950 8.365 18.046 16.351 14.877 13.590 12.462 11.470 10.594 9.818 9.129 8.514 7.963 7.469 18.857 17.011 15.415 14.029 12.821 11.764 10.836 10.017 9.292 8.649 8.075 7.562 19.660 17.658 15.937 14.451 13.163 12.042 11.061 10.201 9.442 8.772 8.176 7.645 14.857 13.489 12.303 11.272 10.371 9.580 8.883 8.266 7.718 21.243 18.914 16.936 15.247 13.799 12.550 11.469 10.529 9.707 8.985 8.348 7.784 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 8.422 7.843 22.795 20.121 17.877 15.983 14.375 13.003 11.826 10.810 9.929 9.161 8.488 7.896 27 23.560 20.707 18.327 16.330 14.643 13.211 11.987 10.935 10.027 9.237 8.548 7.943 28 24.316 21.281 18.764 16.663 14.898 13.406 12.137 11.051 10.116 8.602 29 25.066 21.844 19.188 16.984 15.141 13.591 12.278 11.158 10.198 30 25.808 22.396 19.600 17.292 15.372 13.765 12.409 11.258 10.274 6.462 16 14.718 13.578 6.604 17 15.562 7.549 7.120 6.729 18 14.292 16.398 14.992 17,226 15.678 7.702 7.250 6.840 19 7.839 7.366 6.938 20 7.025 21 7.102 7.170 22 23 20.456 18.292 16.444 24 25 7.230 7.283 7.330 26 7.372 7.409 7.984 7.441 9.307 9.370 9.427 8.650 8.022 7.470 8.694 8.055 7.496 4567 Present value of a single payment Annual Interest Rate(s) 12.0% 13.0% 1 0.885 2 3 0.783 0.693 0.613 5 0.543 6 0.480 7 0.933 0.871 0.813 0.452 0.425 8 0.923 0.853 0.789 0.731 0.677 0.376 9 0.914 0.837 0.703 0.645 10 Years 1.0% 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 0.990 0.980 0.971 0.962 0.952 0.943 0.935 0.926 0.917 0.909 0.901 0.893 0.980 0.961 0.943 0.925 0.907 0.890 0.873 0.857 0.842 0.826 0.812 0.797 0.971 0.942 0.915 0.889 0.864 0.840 0.816 0.794 0.772 0.751 0.731 0.712 0.961 0.924 0.888 0.855 0.823 0.792 0.763 0.735 0.708 0.683 0.659 0.636 0.951 0.906 0.863 0.822 0.784 0.747 0.713 0.681 0.650 0.621 0.593 0.567 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.535 0.507 0.760 0.711 0.665 0.623 0.583 0.547 0.513 0.482 0.627 0.582 0.540 0.502 0.467 0.434 0.404 0.766 0.592 0.544 0.500 0.460 0.424 0.391 0.361 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0.352 0.322 0.896 0.804 0.722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.317 0.287 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0.286 0.257 0.879 0.773 0.681 0.601 0.530 0.469 0.415 0.368 0.326 0.290 0.258 0.229 0.870 0.758 0.661 0.577 0.505 0.442 0.388 0.340 0.299 0.263 0.232 0.205 0.861 0.743 0.481 0.417 0.362 0.315 0.275 0.239 0.209 0.183 0.853 0.728 0.458 0.394 0.339 0.292 0.252 0.218 0.188 0.163 0.371 0.317 0.270 0.231 0.198 0.170 0.146 0.250 0.212 0.180 0.153 0.130 0.232 0.194 0.164 0.138 0.116 0.258 0.215 0.294 0.242 0.199 0.278 0.226 0.184 0.333 0.295 0.261 11 12 0.231 13 14 0.204 0.181 0.160 0.141 0.642 0.555 0.623 0.534 0.844 0.714 0.605 0.513 0.436 0.125 0.836 0.700 0.587 0.494 0.416 0.350 0.296 0.111 0.828 0.686 0.570 0.475 0.396 0.331 0.277 0.098 0.820 0.673 0.554 0.456 0.377 0.312 0.178 0.149 0.124 0.104 0.087 0.811 0.660 0.538 0.439 0.359 0.077 0.803 0.647 0.522 0.422 0.342 0.068 0.795 0.634 0.507 0.406 0.060 0.788 0.622 0.492 0.053 0.780 0.610 0.478 0.047 0.375 0.295 0.464 0.361 0.281 0.164 0.135 0.112 0.093 0.150 0.123 0.101 0.083 0.326 0.262 0.211 0.170 0.138 0.112 0.091 0.074 0.390 0.310 0.247 0.197 0.158 0.126 0.102 0.082 0.066 0.233 0.184 0.146 0.116. 0.092 0.074 0.059 0.220 0.172 0.135 0.106 0.084 0.066 0.053 0.207 0.161 0.125 0.098 0.076 0.060 0.047 0.196 0.150 0.116 0.090 0.069 0.054 0.042 0.185 0.141 0.107 0.082 0.063 0.048 0.037 0.174 0.131 0.772 0.598 0.042 0.764 0.586 0.450 0.347 0.268 0.037 0.757 0.574 0.033 0.437 0.333 0.255 0.424 0.321 0.243 0.749 0.563 0.029 0.742 0.552 0.412 0.308 0.231 0.099 0.075 0.057 0.044 0.033 0.026 567 17 18 287233382233 19 20 21 24 25 26 29 30 Future value of a single payment Years 1.0% 1.010 1 2 3 1.041 5 6 7 1.072 1.149 1.230 8 9 3.004 10 3.395 11 3.836 12 4.335 13 Annual Interest Rate(s) 2.0% 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 1.020 1.030 1.040 1.050 1.060 1.070 1.080 1.090 1.100 1.110 1.120 1.130 1.020 1.040 1.061 1.082 1.103 1.124 1.145 1.166 1.188 1.210 1.232 1.254 1.277 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.260 1.295 1.331 1.368 1.405 1.443 1.082 1.126 1.170 1.216 1.262 1.311 1.360 1.412 1.464 1.518 1.574 1.630 1.051 1.104 1.159 1.217 1.276 1.338 1.403 1.469 1.539 1.611 1.685 1.762 1.842 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.587 1.677 1.772 1.870 1.974 2.082 1.316 1.407 1.504 1.606 1.714 1.828 1.949 2.076 2.211 2.353 1.083 1.172 1.267 1.369 1.477 1.594 1.718 1.851 1.993 2.144 2.305 2.476 2.658 1.094 1.195 1.305 1.423 1.551 1.689 1.838 1.999 2.172 2.358 2.558 2.773 1.105 1.219 1.344 1.480 1.629 1.791 1.967 2.159 2.367 2.594 2.839 3.106 1.116 1.243 1.384 1.539 1.710 1.898 2.105 2.332 2.580 2.853 3.152 3.479 1.127 1.268 1.426 1.601 1.796 2.012 2.252 2.518 2.813 3.138 3.498 3.896 1.138 1.294 1.469 1.665 1.886 2.133 2.410 2.720 3.066 3.452 3.883 4.363 1.149 1.319 1.513 1.732 1.980 2.261 2.579 2.937 3.342 3.797 4.310 4.887 1.161 1.346 1.558 1.801 2.079 2.397 2.759 3.172 3.642 4.177 4.785 5.474 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 3.970 4.595 5.311 1.184 1.400 1.653 1.948 2.693 3.159 3.700 4.328 5.054 5.895 6.866 2.854 3.380 3.996 4.717 5.560 6.544 7.690 3.026 3.617 4.316 5.142 6.116 7.263 8.613 4.661 5.604 6.727 8.062 9.646 5.034 6.109 7.400 8.949 10.804 5.437 6.659 3.820 4.741 5.871 7.258 4.049 5.072 6.341 7.911 4.292 5.427 6.848 4.549 5.807 7.396 4.822 4.898 14 5.535 15 6.254 16 6.130 7.067 17 2.292 7.986 18 1.196 1.428 1.702 2.026 9.024 19 2.107 10.197 1.208 1.220 1.486 2.407 2.527 2.653 2.786 1.457 1.754 1.806 1.860 2.279 20 2.191 3.207 3.870 11.523 21 1.232 1.516 3.400 4.141 13.021 22 1.546 1.916 2.925 3.604 4.430 14.714 1.245 1.257 1.577 1.974 23 2.370 2.465 2.033 2.563 16.627 24 1.270 1.608 18.788 25 1.282 1.641 2,094 2.666 21.231 23.991 26 8.140 9.934 12.100 8.954 11.026 13.552 9.850 12.239 15.179 8.623 10.835 13.585 17.000 9.399 11.918 15.080 19.040 7.988 10.245 13.110 16.739 21.325 8.627 11.167 14.421 18.580 23.884 9.317 12.172 15.863 20.624 26.750 7.612 10.063 13.268 17.449 22.892 29.960 3.072 3.225 3.386 1.295 1.673 2.157 2.772 3.556 1.308 1.707 2.221 2.883 3.733 6.214 1.321 1.741 2.288 2.999 3.920 5.112 6.649 1.335 1.776 2.357 3.119 4.116 5.418 7.114 1.348 1.811 2.427 3.243 4.322 5.743 27 28 27.109 30.633 34.616 39.116 29 30 Future value of annuity payments Annual Interest Rate(s) Years 6.0% 7.0% 1 2 3 5 6 8.323 10.405 7 8 12.757 9 15.416 10 18.420 11 21.814 12 13 12.683 13.412 13.809 14.947 14 1.0% 2.0% 3.0% 4.0% 5.0% 8.0% 9.0% 10.0% 11.0% 12.0% 13.0% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2.010 2.020 2.030 2.040 2.050 2.060 2.070 2.080 2.090 2.100 2.110 2.120 2.130 3.030 3.060 3.091 3.122 3.153 3.184 3.215 3.246 3.278 3.310 3.342 3.374 3.407 4.060 4.122 4.184 4.246 4.310 4.375 4.440 4.506 4.573 4.641 4.710 4.779 4.850 5.101 5.204 5.309 5.416 5.526 5.637 5.751 5.867 5.985 6.105 6.228 6.353 6.480 6.152 6.308 6.468 6.633 6.802 6.975 7.153 7.336 7.523 7.716 7.913 8.115 7.214 7.434 7.662 7.898 8.142 8.394 8.654 8.923 9.200 9.487 9.783 10.089 8.286 8.583 8.892 9.214 9.549 9.897 10.260 10.637 11.028 11.436 11.859 12.300 9.369 9.755 10.159 10.583 11.027 11.491 11.978 12.488 13.021 13.579 14.164 14.776 10.462 10.950 11.464 12.006 12.578 13.181 13.816 14.487 15.193 15.937 16.722 17.549 11.567 12.169 12.808 13.486 14.207 14.972 15.784 16.645 17.560 18.531 19.561 20.655 14.192 15.026 15.917 16.870 17.888 18.977 20.141 21.384 22.713 24.133 14.680 15.618 16.627 17.713 18.882 20.141 21.495 22.953 24.523 26.212 28.029 15.974 17.086 18.292 19.599 21.015 22.550 24.215 26.019 27.975 30.095 32.393 17.293 18.599 20.024 21.579 23.276 25.129 27.152 29.361 31.772 34.405 37,280 18.639 20.157 21.825 23.657 25.673 27.888 30.324 33.003 35.950 39.190 42.753 20.012 21.762 23.698 25.840 28.213 30.840 33.750 36.974 40.545 44.501 48.884 21.412 23.414 25.645 28.132 30.906 33.999 37.450 41.301 45.599 50.396 55.750 19 20.811 22.841 25.117 27.671 30.539 33.760 37.379 41.446 46.018 51.159 56.939 63.440 20 22.019 24.297 26.870 29.778 33.066 36.786 40.995 45.762 51.160 57.275 64.203 72.052 21 23.239 25.783 28.676 31.969 35.719 39.993 44.865 50.423 56.765 64.002 72.265 81.699 24.472 27.299 30.537 34.248 38.505 43.392 49.006 55.457 62.873 71.403 81.214 92.503 25.716 28.845 32.453 36.618 41.430 46.996 53.436 60.893 69.532 79.543 91.148 104.603 120.205 24 26.973 30.422 34.426 39.083 44.502 50.816 58.177 66.765 76.790 88.497 102.174 118.155 136.831 25 28.243 32.030 36.459 41.646 47.727 54.865 63.249 73.106 84.701 98.347 114.413 133.334 155.620 26 29.526 33.671 38.553 44.312 51.113 59.156 68.676 79.954 93.324 109.182 127.999 150.334 176.850 30.821 35.344 40.710 47,084 54.669 63.706 74.484 87.351 102.723 121.100 143.079 169.374 200.841 32.129 37.051 42.931 49.968 58.403 68.528 80.698 95.339 112.968 134.210 159.817 190.699 227.950 29 33.450 38.792 45.219 52.966 62.323 73.640 87.347 103.966 124.135 148.631 178.397 214.583 258.583 30 34.785 40.568 47.575 56.085 66.439 79.058 94.461 113.283 136.308 164.494 199.021 241.333 293.199 25.650 29.985 34.883 40.417 46.672 53.739 16.097 16 17.258 17 18.430 18 19.615 61.725 70.749 80.947 92.470 105.491 567 287233382223

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts