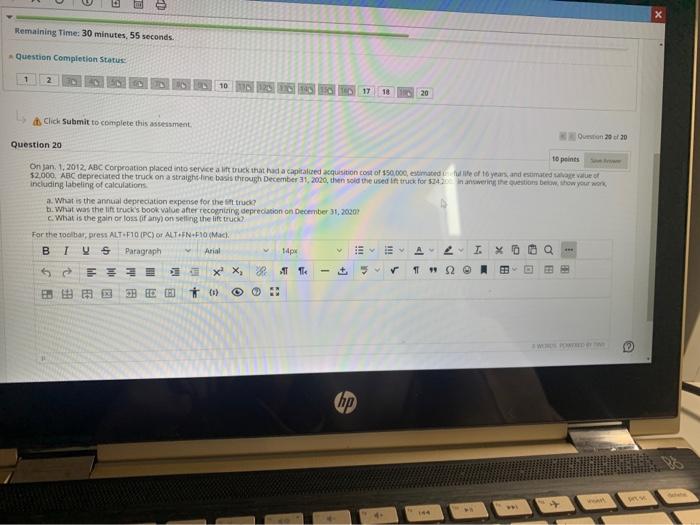

Question: X Remaining Time: 30 minutes, 55 seconds. Question Completion Status 2 10 17 1 20 d. Click Submit to complete this assessment On 20 /

X Remaining Time: 30 minutes, 55 seconds. Question Completion Status 2 10 17 1 20 d. Click Submit to complete this assessment On 20 / 20 Question 20 10 points On Jan 1, 2012, ABC Corproation placed into service at truck that had a capitalued acquisition cost of $50,000, estimate of 10 years, and estimated value of $2.000. ABC depreciated the truck on a straight line basis through December 31, 2020, en sold the used if truck for 57420 In an estim below how your work including labeling of calculations a. What is the annual depreciation expense for the truck? t. What was the lift trucks book value after recogniring depreciation on December 31, 2007 What is the gain or loss of any on selling the lift truc For the toolbar, presa ALT F10/PC) or ALT FNF10 Mack. BIS Paragraph Arial B ALTY 6ESE XX, 14 11" 22 A f fly 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts