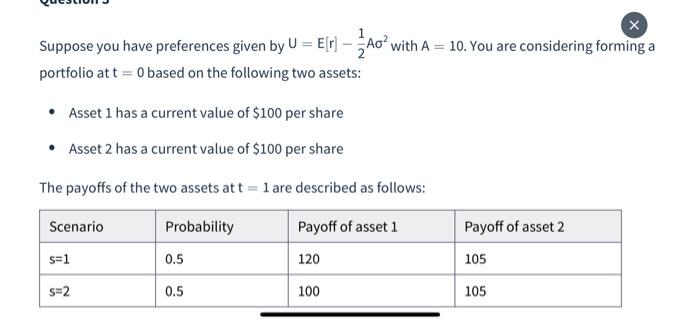

Question: x Suppose you have preferences given by U = E[r - Ao?with A = 10. You are considering forming a portfolio at t = 0

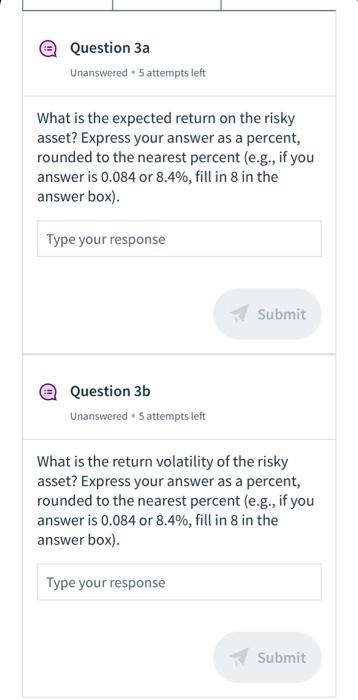

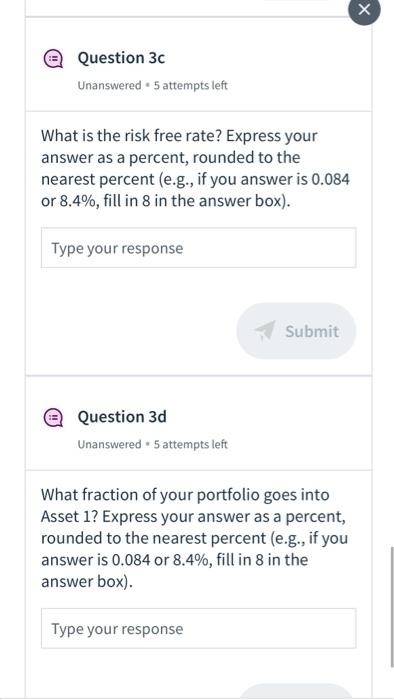

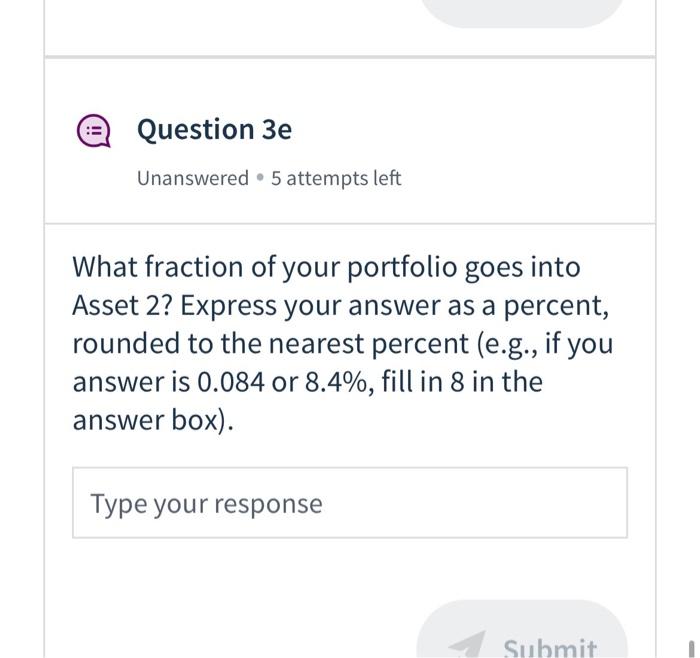

x Suppose you have preferences given by U = E[r - Ao?with A = 10. You are considering forming a portfolio at t = 0 based on the following two assets: Asset 1 has a current value of $100 per share Asset 2 has a current value of $100 per share The payoffs of the two assets at t = 1 are described as follows: Scenario Probability Payoff of asset 1 Payoff of asset 2 s=1 0.5 120 105 s=2 0.5 100 105 Question 3a Unanswered 5 attempts left What is the expected return on the risky asset? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your response Submit e Question 3b Unanswered 5 attempts left What is the return volatility of the risky asset? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your response Submit Question 3c Unanswered 5 attempts left What is the risk free rate? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your response Submit Question 3d Unanswered 5 attempts left What fraction of your portfolio goes into Asset 1? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your response Question 3e Unanswered 5 attempts left What fraction of your portfolio goes into Asset 2? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your response - Submit x Suppose you have preferences given by U = E[r - Ao?with A = 10. You are considering forming a portfolio at t = 0 based on the following two assets: Asset 1 has a current value of $100 per share Asset 2 has a current value of $100 per share The payoffs of the two assets at t = 1 are described as follows: Scenario Probability Payoff of asset 1 Payoff of asset 2 s=1 0.5 120 105 s=2 0.5 100 105 Question 3a Unanswered 5 attempts left What is the expected return on the risky asset? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your response Submit e Question 3b Unanswered 5 attempts left What is the return volatility of the risky asset? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your response Submit Question 3c Unanswered 5 attempts left What is the risk free rate? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your response Submit Question 3d Unanswered 5 attempts left What fraction of your portfolio goes into Asset 1? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your response Question 3e Unanswered 5 attempts left What fraction of your portfolio goes into Asset 2? Express your answer as a percent, rounded to the nearest percent (e.g., if you answer is 0.084 or 8.4%, fill in 8 in the answer box). Type your response - Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts