Question: X Tell me Share 510 Document1 - Word deniskaryn1167@gmail.com D Home Insert Draw Design Layout References Mailings Review View Help Acrobat K Times New

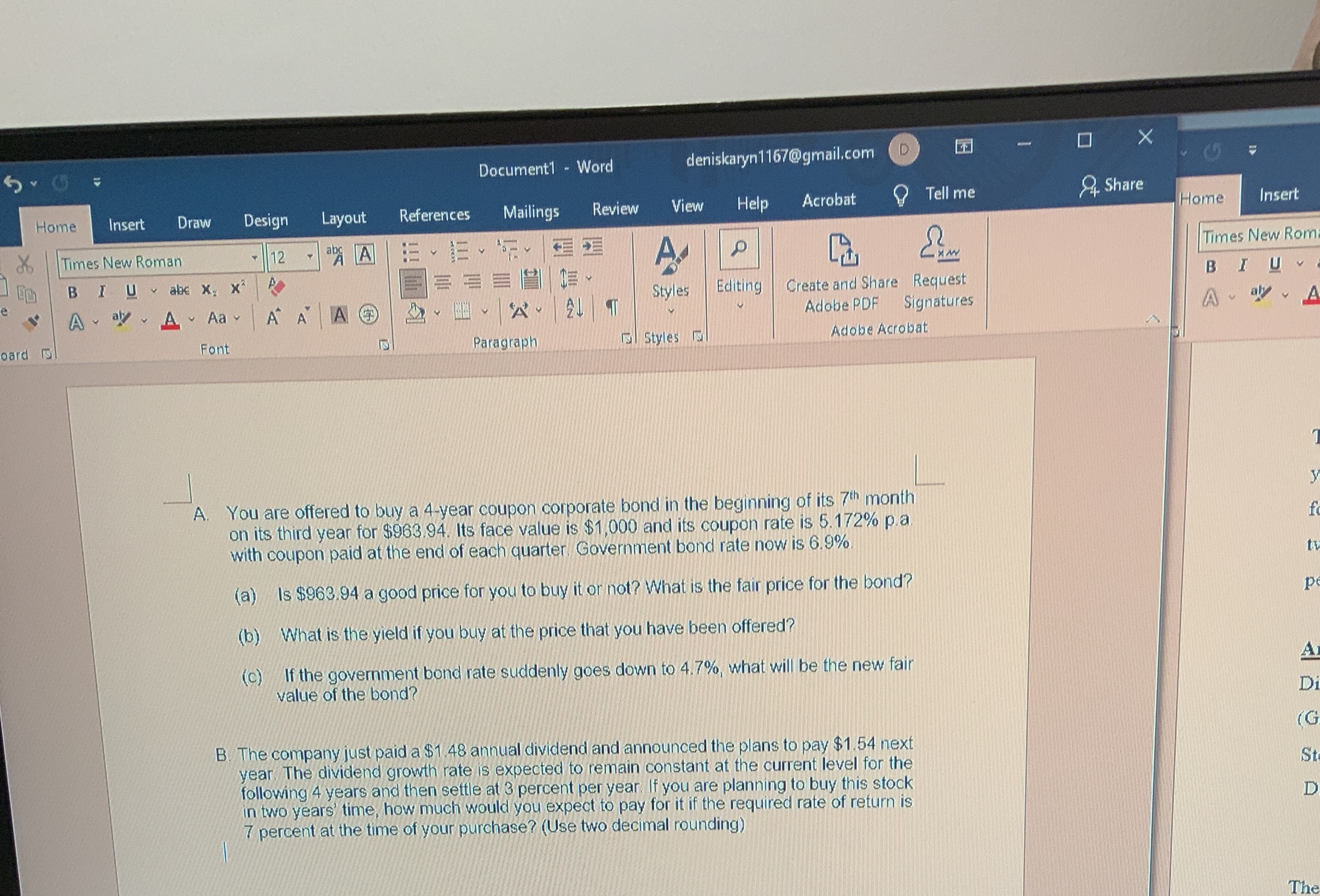

X Tell me Share 510 Document1 - Word deniskaryn1167@gmail.com D Home Insert Draw Design Layout References Mailings Review View Help Acrobat K Times New Roman T 12 abe A A P BIU 2 abc X, X Styles e A A Aa A A A A oard Font A Paragraph 3 T Styles Editing Create and Share Request Adobe PDF Signatures Adobe Acrobat Home Insert Times New Rom BIU A aly A A. You are offered to buy a 4-year coupon corporate bond in the beginning of its 7th month on its third year for $963.94. Its face value is $1,000 and its coupon rate is 5.172% p.a with coupon paid at the end of each quarter. Government bond rate now is 6.9%. (a) Is $963.94 a good price for you to buy it or not? What is the fair price for the bond? (b) What is the yield if you buy at the price that you have been offered? (c) If the government bond rate suddenly goes down to 4.7%, what will be the new fair value of the bond? B. The company just paid a $1.48 annual dividend and announced the plans to pay $1.54 next year. The dividend growth rate is expected to remain constant at the current level for the following 4 years and then settle at 3 percent per year. If you are planning to buy this stock in two years' time, how much would you expect to pay for it if the required rate of return is 7 percent at the time of your purchase? (Use two decimal rounding) y f tv p A Di (G St D The

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts