Question: X WP AC WP N WP X PE |M Ki | * * 01 1 AC | V PE | M Vi | F SC

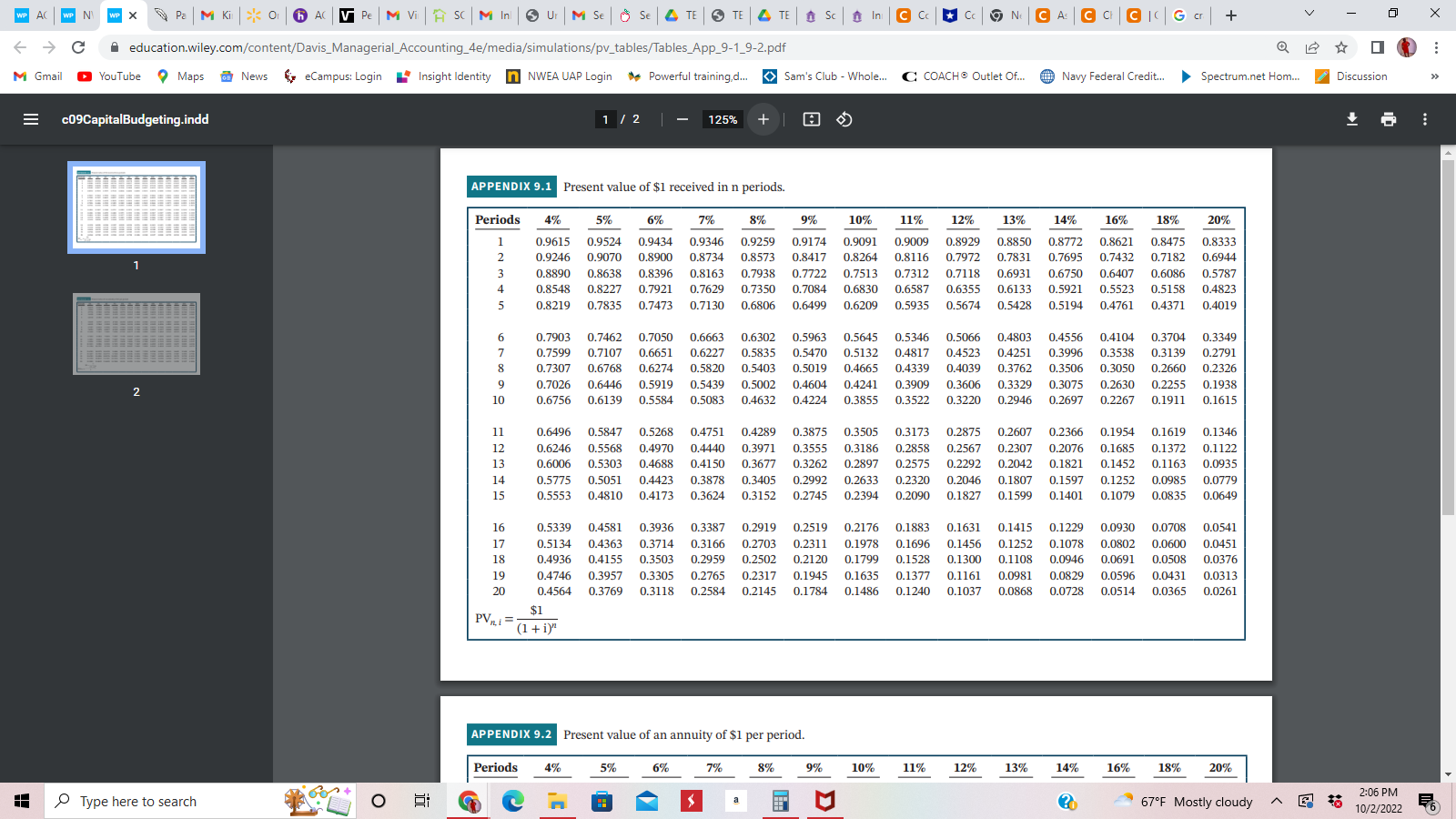

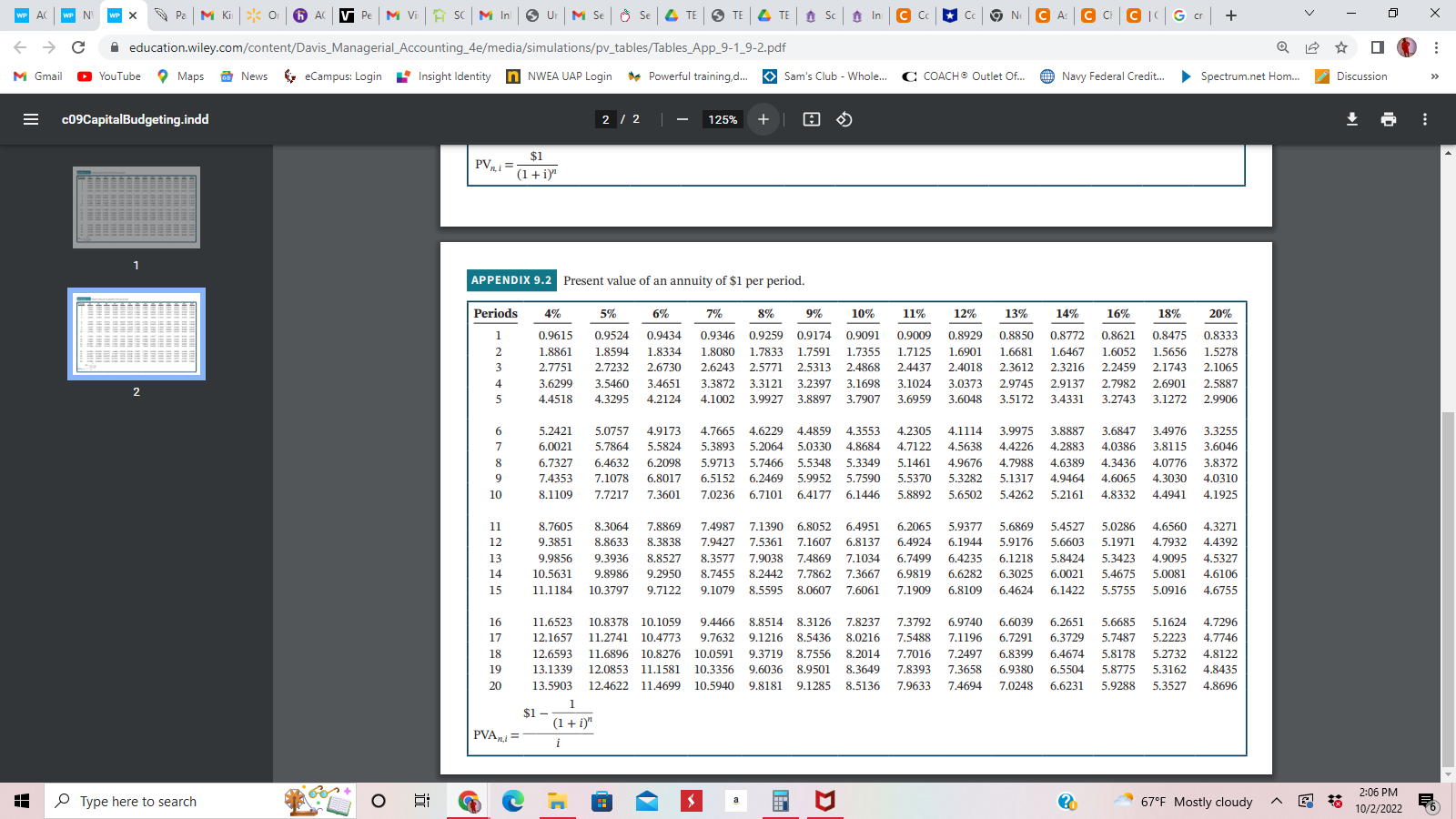

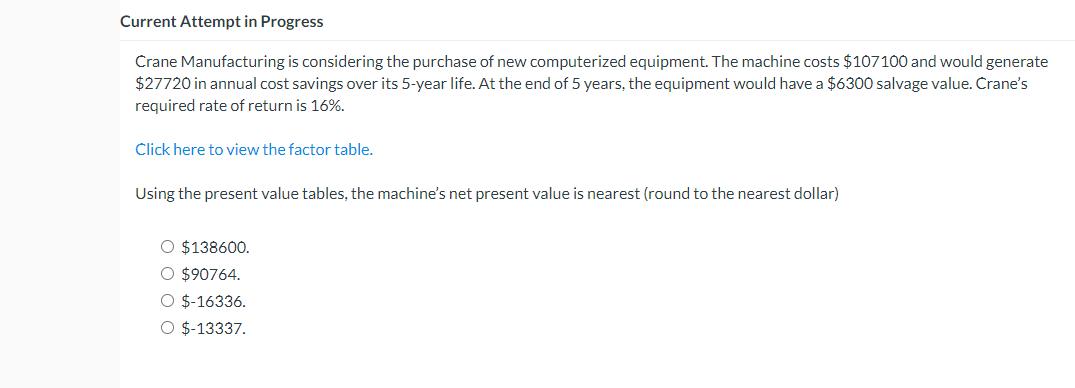

X WP AC WP N WP X PE |M Ki | * * 01 1 AC | V PE | M Vi | F SC | M In | 3 Ur / M SE | @ SE | 4 TE | & TE | A TE | A Sc | 1 In | C CC | # Cc | 6 N. | C A | G C| GIG a | + Q 2 0 ... C A education.wiley.com/content/Davis_Managerial_Accounting_4e/media/simulations/pv_tables/Tables_App_9-1_9-2.pdf Discussion > > M Gmail YouTube ) Maps on News Sam's Club - Whole... C: COACH Outlet Of.. @ Navy Federal Credit.. Spectrum.net Hom.. E c09CapitalBudgeting.indd 1 / 2 125% + APPENDIX 9.1 Present value of $1 received in n periods. Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 16% 18% 20% 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8772 0.8621 0.8475 0.8333 0.9246 0.9070 0.8900 0.8734 0.8573 0.8417 0.8264 0.8116 0.7972 0.7831 0.7695 0.7432 0.7182 0.6944 0.8890 0.8638 0.8396 0.8163 0.7938 0.7722 0.7513 0.7312 0.7118 0.6931 0.6750 0.6407 0.6086 0.5787 AWN 0.8548 0.8227 0.7921 0.7629 0.7350 0.7084 0.6830 0.6587 0.6355 0.6133 0.5921 0.5523 0.5158 0.4823 0.8219 0.7835 0.7473 0.7130 0.6806 0.6499 0.6209 0.5935 0.5674 0.5428 0.5194 0.4761 0.4371 0.4019 0.7903 0.7462 0.7050 0.6663 0.6302 0.5963 0.5645 0.5346 0.5066 0.4803 0.4556 0.4104 0.3704 0.3349 0.2791 0.7599 0.7107 0.6651 0.6227 0.5835 0.5470 0.5132 0.4817 0.4523 0.4251 0.3996 0.3538 0.3139 0.7307 0.6768 0.6274 0.5820 0.5403 0.5019 0.4665 0.4339 0.4039 0.3762 0.3506 0.3050 0.2660 0.2326 0.7026 0.6446 0.5919 0.5439 0.5002 0.4604 0.4241 0.3909 0.3606 0.3329 0.3075 0.2630 0.2255 0.1938 2 0.6139 0.5584 0.5083 0.4632 0.4224 0.3855 0.3522 0.3220 0.2946 0.2697 0.2267 0.1911 0.1615 0.6756 11 0.6496 0.5847 0.5268 0.4751 0.4289 0.3875 0.3505 0.3173 0.2875 0.2607 0.2366 0.1954 0.1619 0.1346 0.2076 0.1372 12 0.6246 0.5568 0.4970 0.4440 0.3971 0.3555 0.3186 0.2858 0.2567 0.2307 0.1685 0.1122 13 0.6006 0.5303 0.4688 0.4150 0.3677 0.3262 0.2897 0.2575 0.2292 0.2042 0.1821 0.1452 0.1163 0.0935 14 0.5775 0.5051 0.4423 0.3878 0.3405 0.2992 0.2633 0.2320 0.2046 0.1807 0.1597 0.1252 0.0985 0.0779 15 0.3624 0.3152 0.0649 0.5553 0.4810 0.4173 0.2745 0.2394 0.2090 0.1827 0.1599 0.1401 0.1079 0.0835 16 0.5339 0.4581 0.3936 0.3387 0.2919 0.2519 0.2176 0.1883 0.1631 0.1415 0.1229 0.0930 0.0708 0.0541 17 0.5134 0.4363 0.3714 0.3166 0.2703 0.2311 0.1978 0.1696 0.1456 0.1252 0.1078 0.0802 0.0600 0.0451 18 0.4936 0.4155 0.3503 0.2959 0.2502 0.2120 0.1799 0.1528 0.1300 0.1108 0.0946 0.0691 0.0508 0.0376 19 0.4746 0.3957 0.3305 0.2765 0.2317 0.1945 0.1635 0.1377 0.1161 0.0981 0.0829 0.0596 0.0431 0.0313 0.4564 0.3769 0.3118 0.2584 0.2145 0.1784 0.1486 0.1240 0.1037 0.0868 0.0728 0.0514 0.0365 0.0261 $1 PVn1= (1 + i)n APPENDIX 9.2 Present value of an annuity of $1 per period. Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 16% 18% 20% 2:06 PM Type here to search O E m 67'F Mostly cloudy 10/2/2022 56WP AC WP N WP X PE |M Ki | * * 01 1 AC | V PE | M Vi | F SC | M In | 3 Ur | M SE | 0 SE | 4 TE | & TE | 4 TE | A Sc | 1 In | C CC | Cc | 6 N. | C A | G C| GIGG | + X C A education.wiley.com/content/Davis_Managerial_Accounting_4e/media/simulations/pv_tables/Tables_App_9-1_9-2.pdf Q 2 0 ... M Gmail YouTube . Maps on News ( eCampus: Login Insight Identity In NWEA UAP Login Powerful training,d.. Sam's Club - Whole... C COACH Outlet Of.. @ Navy Federal Credit... Spectrum.net Hom.. Discussion > > E c09CapitalBudgeting.indd 2/2 - 125% + $1 (1 + i)" APPENDIX 9.2 Present value of an annuity of $1 per period. Periods 4% 5% 6% 7% 8% 9% 10% 11% 12% 13% 14% 16% 18% 20% 0.9615 0.9524 0.9434 0.9346 0.9259 0.9174 0.9091 0.9009 0.8929 0.8850 0.8772 0.8621 0.8475 0.8333 1.8861 1.8594 1.8334 1.8080 1.7833 1.7591 1.7355 1.7125 1.6901 1.6681 1.6467 1.6052 1.5656 1.5278 2.7751 2.7232 2.6730 2.6243 2.5771 2.5313 2.4868 2.4437 2.4018 2.3612 2.3216 2.2459 2.1743 2.1065 DAWN 3.6299 3.5460 3.4651 3.3872 3.3121 3.2397 3.1698 3.1024 3.0373 2.9745 2.9137 2.7982 2.6901 2.5887 2 4.4518 4.3295 4.2124 4.1002 3.9927 3.8897 3.7907 3.6959 3.6048 3.5172 3.4331 3.2743 3.1272 2.9906 5.2421 5.0757 4.9173 4.7665 4.6229 4.4859 4.3553 4.2305 4.1114 3.9975 3.8887 3.6847 3.4976 3.3255 6.0021 5.7864 5.5824 5.3893 5.2064 5.0330 4.8684 4.7122 4.5638 4.4226 4.2883 4.0386 3.8115 3.6046 6.7327 6.4632 6.2098 5.9713 5.7466 5.5348 5.3349 5.1461 4.9676 4.7988 4.6389 4.3436 4.0776 3.8372 7.4353 7.1078 6.8017 5.5152 6.2469 5.9952 5.7590 5.5370 5.3282 5.1317 4.9464 4.6065 4.3030 4.0310 10 8.1109 7.7217 7.3601 7.0236 6.7101 6.4177 6.1446 5.8892 5.6502 5.4262 5.2161 4.8332 4.4941 4.1925 11 8.7605 8.3064 7.8869 7.4987 7.1390 6.8052 6.4951 6.2065 5.9377 5.6869 5.4527 5.0286 4.6560 4.3271 12 9.3851 8.8633 8.3838 7.9427 7.5361 7.1607 6.8137 6.4924 6.1944 5.9176 5.6603 5.1971 4.7932 4.4392 13 9.9856 9.3936 8.8527 8.3577 7.9038 7.4869 7.1034 6.7499 6.4235 6.1218 5.8424 5.3423 4.9095 4.5327 14 10.5631 9.8986 9.2950 8.7455 8.2442 7.7862 7.3667 6.9819 6.6282 6.3025 6.0021 5.4675 5.0081 4.6106 15 11.1184 10.3797 9.7122 9.1079 8.5595 8.0607 7.6061 7.1909 6.8109 6.4624 6.1422 5.5755 5.0916 4.6755 16 11.6523 10.8378 10.1059 9.4466 8.8514 8.3126 7.8237 7.3792 6.9740 6.6039 6.2651 5.6685 5.1624 4.7296 17 12.1657 11.2741 10.4773 9.7632 9.1216 8.5436 8.0216 7.5488 7.1196 6.7291 6.3729 5.7487 5.2223 4.7746 18 12.6593 11.6896 10.8276 10.0591 9.3719 8.7556 8.2014 7.7016 7.2497 6.8399 6.4674 5.8178 5.2732 4.8122 19 13.1339 12.0853 11.1581 10.3356 9.6036 8.9501 8.3649 7.8393 7.3658 6.9380 6.5504 5.8775 5.3162 4.8435 20 13.5903 12.4622 11.4699 10.5940 9.8181 9.1285 8.5136 7.9633 7.4694 7.0248 6.6231 5.9288 5.3527 4.8696 $1 - (1 + i)" PVAn= 2:06 PM Type here to search 67'F Mostly cloudy ~ $6 10/2/2022 E6Current Attempt in Progress Crane Manufacturing is considering the purchase of new computerized equipment. The machine costs $10?lUO and would generate $27720 in annual cost savings over its 5year life. At the end of 5 years, the equipment would have a $6300 salvage value. Crane's required rate of return is 16%. Click here to view the factor table. Usingthe present value tables, the machine's net present value is nearest [round to the nearest dollar) 0 $138600. 0 $990764. 0 $46336. O $43337

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts