Question: X Your answer is incorrect Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is

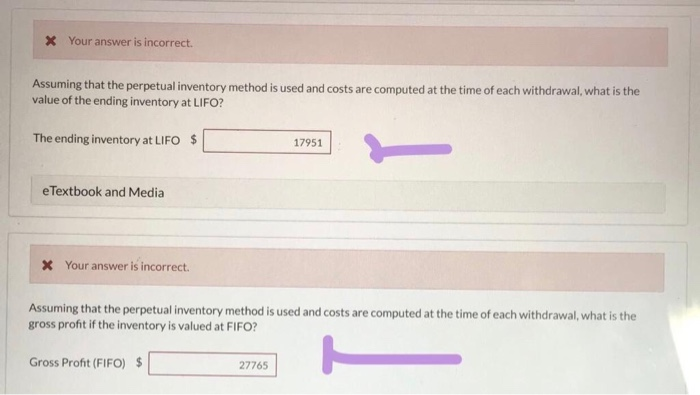

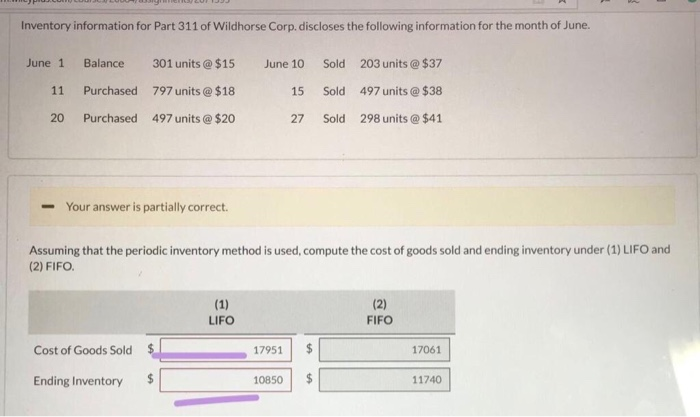

X Your answer is incorrect Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the value of the ending inventory at LIFO? The ending inventory at LIFO 17951 e Textbook and Media x Your answer is incorrect Assuming that the perpetual inventory method is used and costs are computed at the time of each withdrawal, what is the gross profit if the inventory is valued at FIFO? Gross Profit (FIFO) $ 27765 Inventory information for Part 311 of Wildhorse Corp. discloses the following information for the month of June. June 1 301 units @ $15 June 10 203 units@ $37 Balance Sold 797 units@$18 497 units@$38 11 Purchased 15 Sold 497 units @ $20 20 Purchased 298 units@$41 27 Sold Your answer is partially correct Assuming that the periodic inventory method is used, compute the cost of goods sold and ending inventory under (1) LIFO and (2) FIFO. (2) FIFO (1) LIFO $ Cost of Goods Sold 17951 17061 $ $ 11740 Ending Inventory 10850

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts