Question: X Your answer is incorrect. Presented below are two independent situations. (a) Buffalo Co. sold $2,030,000 of 10%, 10-year bonds at 105 on January 1,

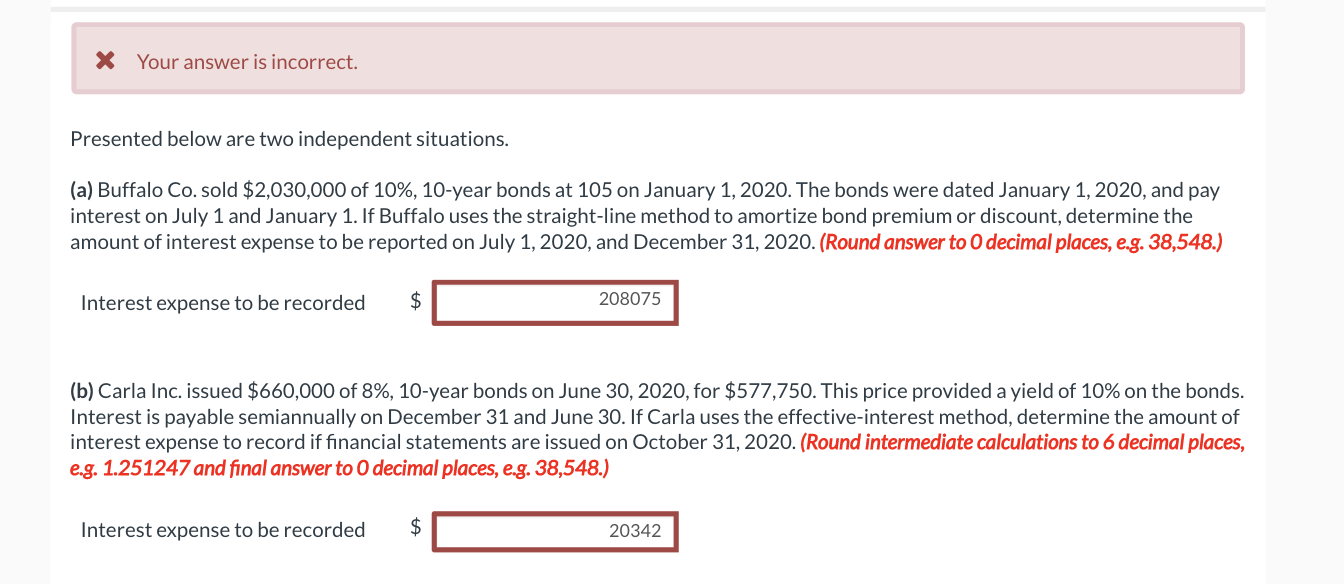

X Your answer is incorrect. Presented below are two independent situations. (a) Buffalo Co. sold $2,030,000 of 10%, 10-year bonds at 105 on January 1, 2020. The bonds were dated January 1, 2020, and pay interest on July 1 and January 1. If Buffalo uses the straight-line method to amortize bond premium or discount, determine the amount of interest expense to be reported on July 1, 2020, and December 31, 2020. (Round answer to 0 decimal places, e.g. 38,548.) Interest expense to be recorded $ 208075 (b) Carla Inc. issued $660,000 of 8%, 10-year bonds on June 30, 2020, for $577,750. This price provided a yield of 10% on the bonds. Interest is payable semiannually on December 31 and June 30. If Carla uses the effective-interest method, determine the amount of interest expense to record if financial statements are issued on October 31, 2020. (Round intermediate calculations to 6 decimal places, e.g. 1.251247 and final answer to 0 decimal places, e.g. 38,548.) Interest expense to be recorded $ 20342

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts