Question: x Your answer is incorrect. Try again. On January 1, 2016, Tony and Jon formed T&J Personal Financial Planning with capital investments of $476,600 and

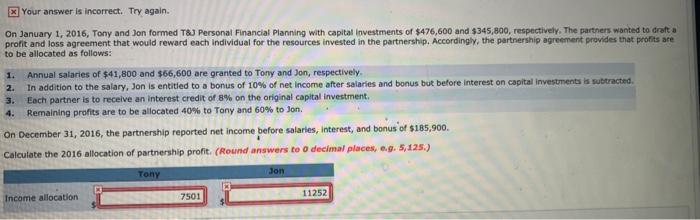

x Your answer is incorrect. Try again. On January 1, 2016, Tony and Jon formed T&J Personal Financial Planning with capital investments of $476,600 and $345,800, respectively. The partners wanted to draft a profit and loss agreement that would reward each individual for the resources invested in the partnership. Accordingly, the partnership agreement provides that profits are to be allocated as follows: 1. 4. Annual salaries of $41,800 and $66,600 are granted to Tony and Jon, respectively. 2. In addition to the salary, Jon is entitled to a bonus of 10% of net income after salaries and bonus but before interest on capital investments is subtracted Each partner is to receive an interest credit of 8% on the original capital investment. Remaining profits are to be allocated 40% to Tony and 60% to Jon. On December 31, 2016, the partnership reported net income before salaries, Interest, and bonus of $185,900. Calculate the 2016 allocation of partnership profit. (Round answers to o decimal places, e... 5,125.) Tony Jon 7501 11252 Income allocation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts