Question: x1= 110, x2= 10% I need full written steps, please DO NOT USE EXCEL OR TABLES, thank you. Question(4): A power plant is being considered

x1= 110, x2= 10%

I need full written steps, please DO NOT USE EXCEL OR TABLES, thank you.

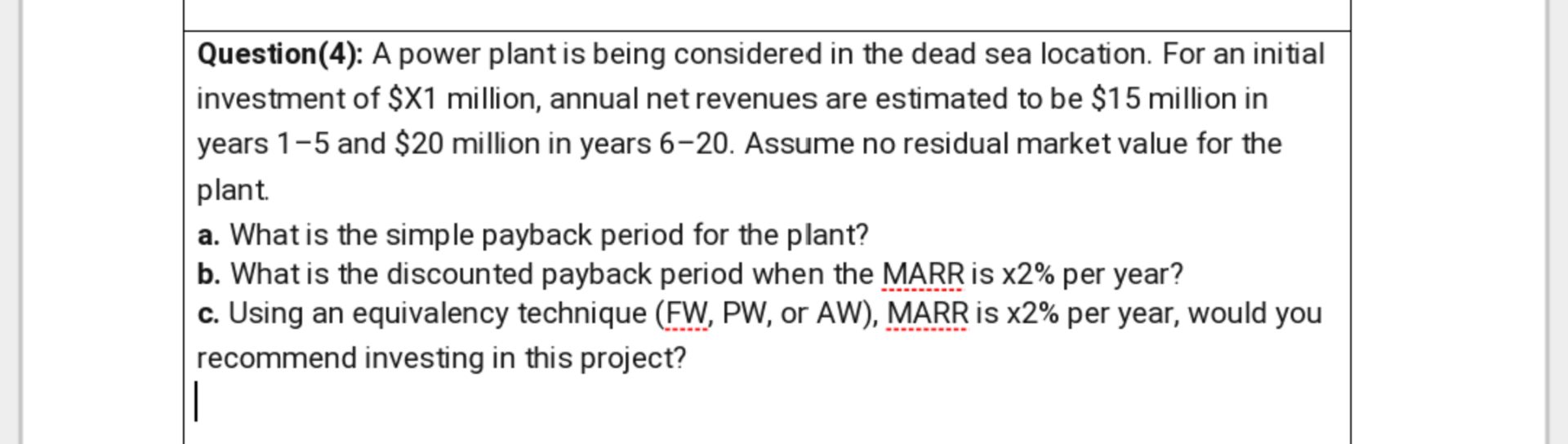

Question(4): A power plant is being considered in the dead sea location. For an initial investment of $X1 million, annual net revenues are estimated to be $15 million in years 1-5 and $20 million in years 6-20. Assume no residual market value for the plant a. What is the simple payback period for the plant? b. What is the discounted payback period when the MARR is x2% per year? c. Using an equivalency technique (FW, PW, or AW), MARR is x2% per year, would you recommend investing in this project

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock