Question: xam 2 i Help Save & Exit Su Nichols Enterprises has an investment in 2 5 , 0 0 0 bonds of Elliott Electronics that

xam i

Help

Save & Exit

Su

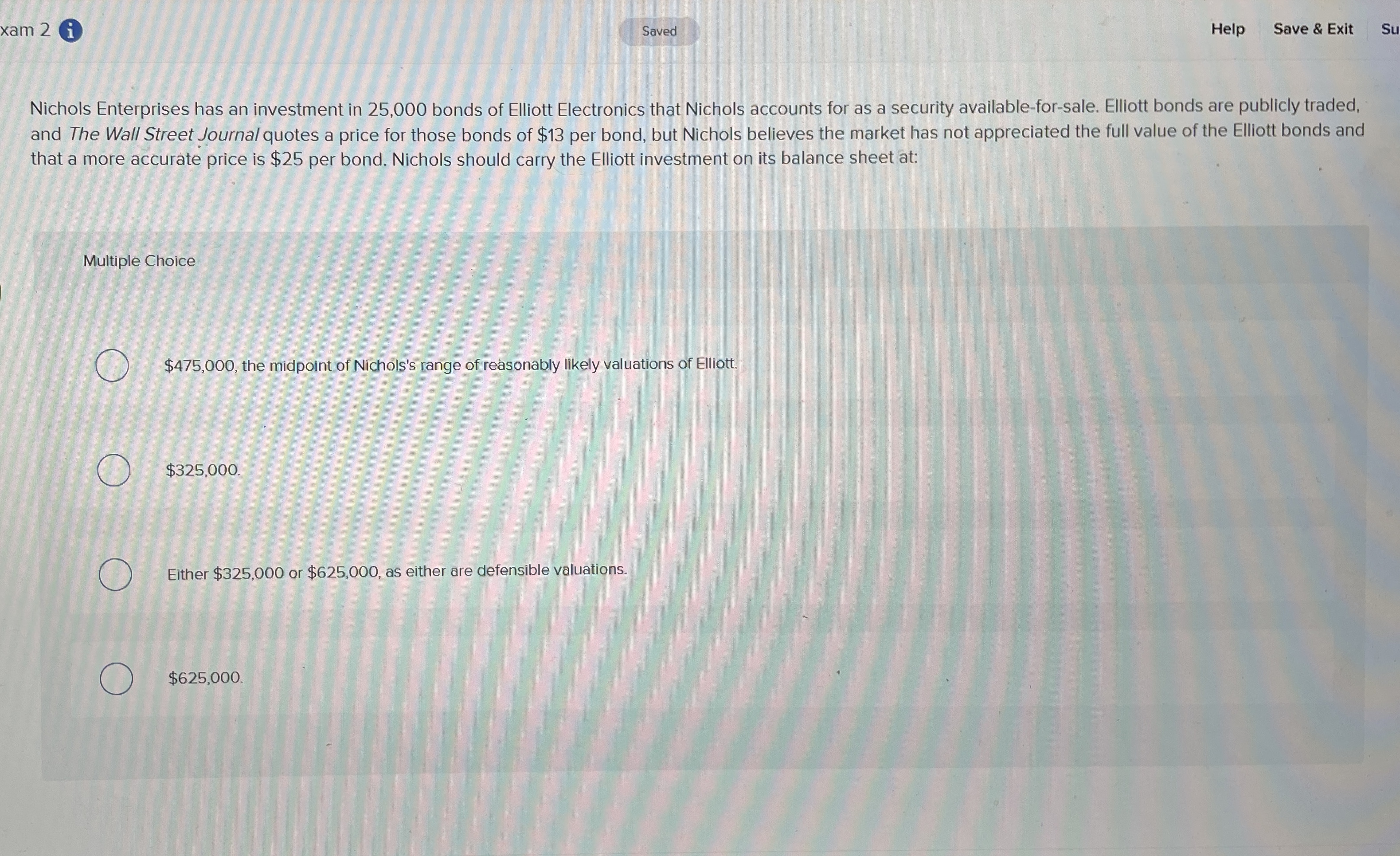

Nichols Enterprises has an investment in bonds of Elliott Electronics that Nichols accounts for as a security availableforsale. Elliott bonds are publicly traded, and The Wall Street Journal quotes a price for those bonds of $ per bond, but Nichols believes the market has not appreciated the full value of the Elliott bonds and that a more accurate price is $ per bond. Nichols should carry the Elliott investment on its balance sheet at:

Multiple Choice

$ the midpoint of Nichols's range of reasonably likely valuations of Elliott.

$

Either $ or $ as either are defensible valuations.

$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock