Question: xam 5 Help Sove 8 Eait Submit 2 2 Sharon purchased a new photocopier for her business. According to her accountant, she can deduct 1

xam

Help

Sove Eait

Submit

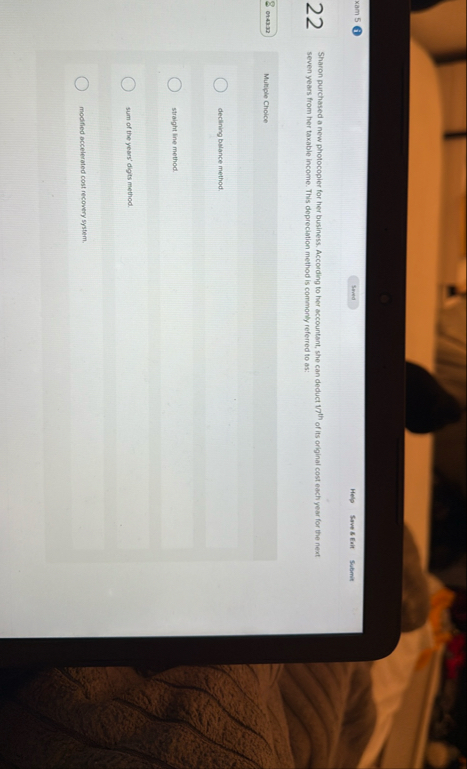

Sharon purchased a new photocopier for her business. According to her accountant, she can deduct of its original cost each year for the next seven years from her taxable income. This depreciation method is commonly referred to as:

Multiple Choice

declining balance method.

straight line method.

sum of the years' digts method.

modified accelerated cost recovery system.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock