Question: xam I (Ch 4,5, 6 & 7) Time Remaining: 162 minutes Back to Assignment Deadline Today at 03:55 AM Attempts: Score: 1 15. Chapter b

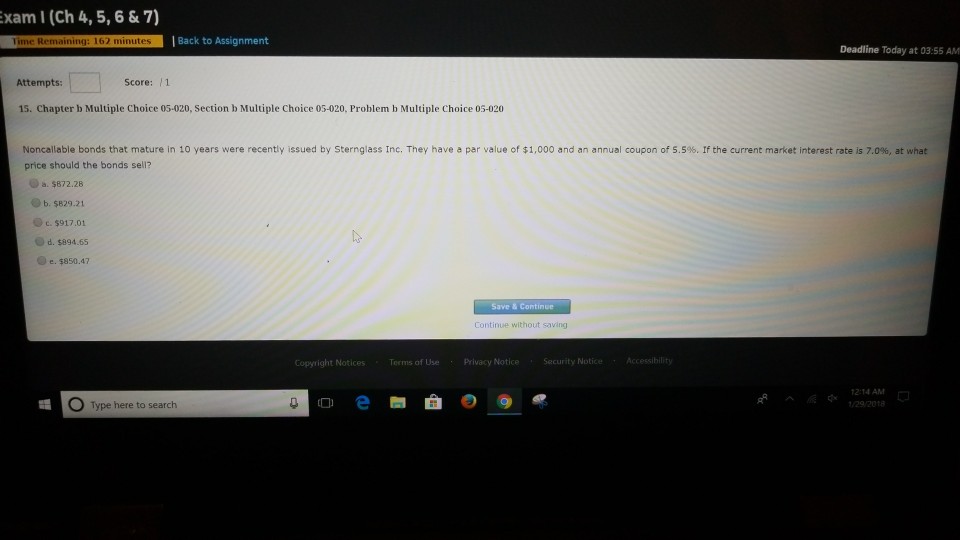

xam I (Ch 4,5, 6 & 7) Time Remaining: 162 minutes Back to Assignment Deadline Today at 03:55 AM Attempts: Score: 1 15. Chapter b Multiple Choice 05-020, Section b Multiple Choice 05-020, Problem b Multiple Choice 05-020 Noncallable bonds that mature in 10 years were recently issued by Sternglass Inc. They have a par value of $1,000 and an annual coupon of 5.5%. If the current market interest rate is 7.0%, at what price should the bonds sell? a. $872.28 b. $829.21 c, $917.01 Od. $894.65 e. $850.47 Save & Continue Continue without saving Copyright Notices Terms of Use Privacy Notice Security Notice Accessibility 12:14 AM Type here to searc

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts