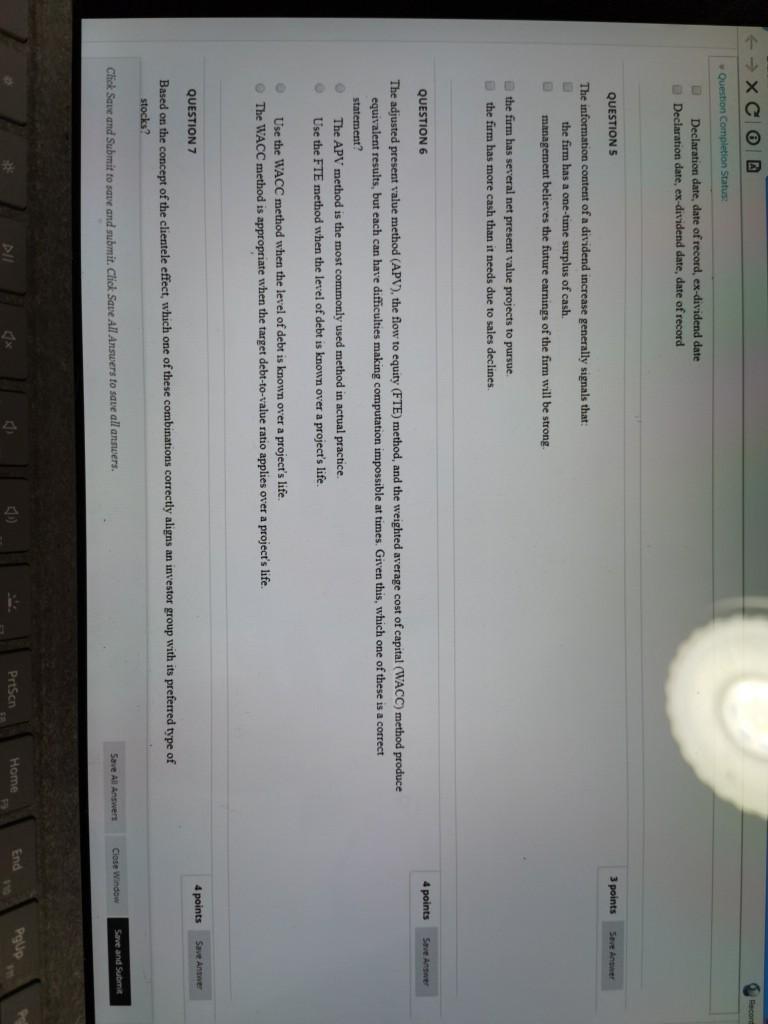

Question: XC a Recon Question Completion Status: Declaration date, date of record, ex-dividend date Declaration date, ex-dividend date, date of record QUESTIONS 3 points Seven The

XC a Recon Question Completion Status: Declaration date, date of record, ex-dividend date Declaration date, ex-dividend date, date of record QUESTIONS 3 points Seven The information content of a dividend increase generally signals that: the firm has a one-time surplus of cash. management believes the future earnings of the firm will be strong the firm has several net present value projects to pursue the firm has more cash than it needs due sales declines QUESTION 6 4 points Steve Arte The adjusted present value method (APV), the flow to equity (FTE) method, and the weighted average cost of capital (WACC) method produce equivalent results, but each can have difficulties making computation impossible at times. Given this, which one of these is a correct statement? The APV method is the most commonly used method in actual practice. Use the FTE method when the level of debt is known over a project's life. Use the WACC method when the level of debt is known over a project's life The WACC method is appropriate when the target debt-to-value ratio applies over a project's life. 4 points Save Anne QUESTION 7 Based on the concept of the clientele effect, which one of these combinations correctly aligns an investor group with its preferred type of stocks? Close Window Save Al Answer Save and Submit Click Save and Submit to save and submit. Click Save All Answers to save all answers. dx Prtson Home Polo End

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts