Question: > XCO 2 ME DATA VIEW Insert Column * Cut Font Name - Font Size TabStop Wrap Text Bio US Overline 3 Merge Cell 3.

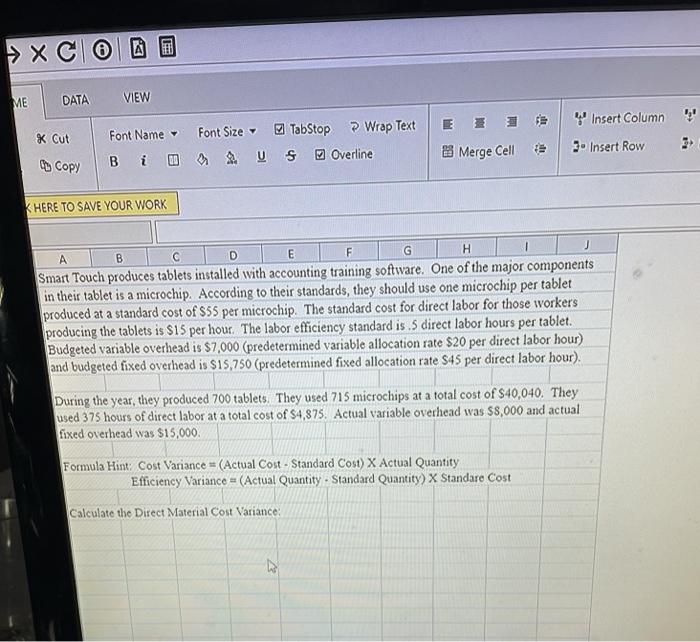

> XCO 2 ME DATA VIEW Insert Column * Cut Font Name - Font Size TabStop Wrap Text Bio US Overline 3 Merge Cell 3. Insert Row Copy K HERE TO SAVE YOUR WORK H F G A D B C E Smart Touch produces tablets installed with accounting training software. One of the major components in their tablet is a microchip. According to their standards, they should use one microchip per tablet produced at a standard cost of $55 per microchip. The standard cost for direct labor for those workers producing the tablets is $15 per hour. The labor efficiency standard is 5 direct labor hours per tablet. Budgeted variable overhead is $7.000 (predetermined variable allocation rate $20 per direct labor hour) and budgeted fixed overhead is $15,750 (predetermined fixed allocation rate $45 per direct labor hour). During the year, they produced 700 tablets. They used 715 microchips at a total cost of $40,040. They used 375 hours of direct labor at a total cost of $4,875. Actual variable overhead was $8,000 and actual fixed overhead was $15,000, Formula Hint: Cost Variance (Actual Cost - Standard Cost) X Actual Quantity Efficiency Variance = (Actual Quantity - Standard Quantity) X Standare Cost Calculate the Direct Material Cost Variance

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts