Question: XCOM Remaining Time: 2 hours, 05 minutes, 43 seconds. * Question Completion Status: 24 pd QUESTION 11 SECTION F: FOREIGN CURRENCY AND FINANCIAL INSTRUMENTS (TOTAL

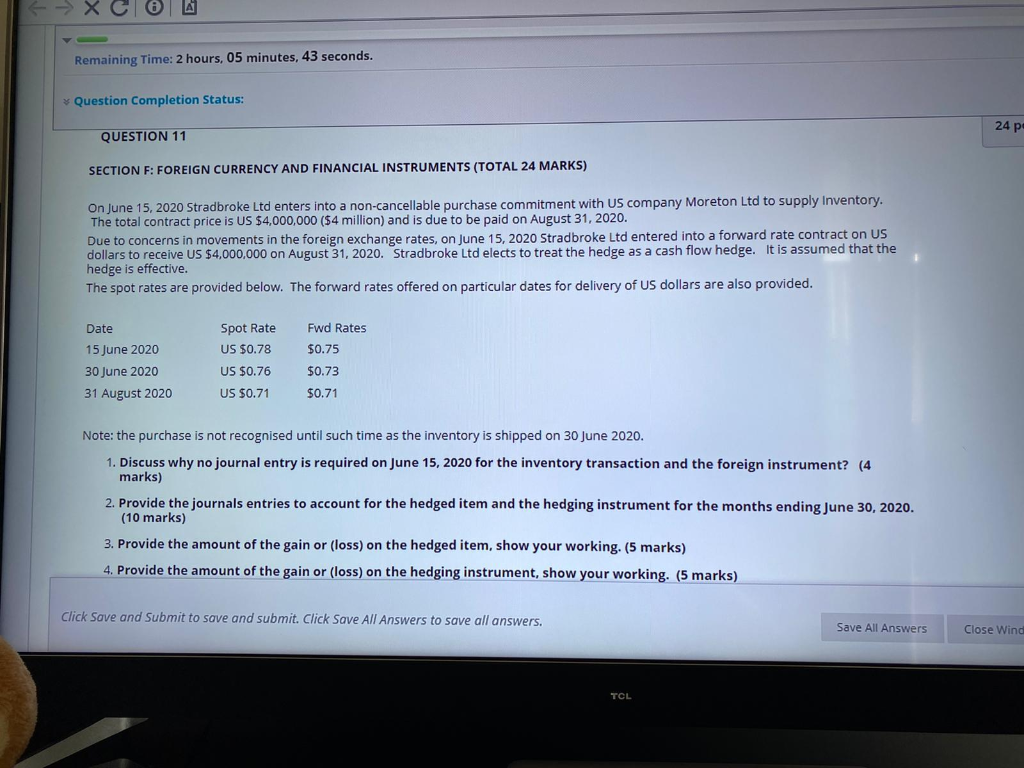

XCOM Remaining Time: 2 hours, 05 minutes, 43 seconds. * Question Completion Status: 24 pd QUESTION 11 SECTION F: FOREIGN CURRENCY AND FINANCIAL INSTRUMENTS (TOTAL 24 MARKS) On June 15, 2020 Stradbroke Ltd enters into a non-cancellable purchase commitment with US company Moreton Ltd to supply Inventory. The total contract price is US $4,000,000 ($4 million) and is due to be paid on August 31, 2020. Due to concerns in movements in the foreign exchange rates, on June 15, 2020 Stradbroke Ltd entered into a forward rate contract on US dollars to receive US $4,000,000 on August 31, 2020. Stradbroke Ltd elects to treat the hedge as a cash flow hedge. It is assumed that the hedge is effective. The spot rates are provided below. The forward rates offered on particular dates for delivery of US dollars are also provided. Date 15 June 2020 30 June 2020 31 August 2020 Spot Rate US $0.78 US $0.76 US $0.71 Fwd Rates $0.75 $0.73 $0.71 Note: the purchase is not recognised until such time as the inventory is shipped on 30 June 2020. 1. Discuss why no journal entry is required on June 15, 2020 for the inventory transaction and the foreign instrument? (4 marks) 2. Provide the journals entries to account for the hedged item and the hedging instrument for the months ending June 30, 2020. (10 marks) 3. Provide the amount of the gain or (loss) on the hedged item, show your working. (5 marks) 4. Provide the amount of the gain or loss) on the hedging instrument, show your working. (5 marks) Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Seve al Answers Close Wind close wine TCL XCOM Remaining Time: 2 hours, 05 minutes, 43 seconds. * Question Completion Status: 24 pd QUESTION 11 SECTION F: FOREIGN CURRENCY AND FINANCIAL INSTRUMENTS (TOTAL 24 MARKS) On June 15, 2020 Stradbroke Ltd enters into a non-cancellable purchase commitment with US company Moreton Ltd to supply Inventory. The total contract price is US $4,000,000 ($4 million) and is due to be paid on August 31, 2020. Due to concerns in movements in the foreign exchange rates, on June 15, 2020 Stradbroke Ltd entered into a forward rate contract on US dollars to receive US $4,000,000 on August 31, 2020. Stradbroke Ltd elects to treat the hedge as a cash flow hedge. It is assumed that the hedge is effective. The spot rates are provided below. The forward rates offered on particular dates for delivery of US dollars are also provided. Date 15 June 2020 30 June 2020 31 August 2020 Spot Rate US $0.78 US $0.76 US $0.71 Fwd Rates $0.75 $0.73 $0.71 Note: the purchase is not recognised until such time as the inventory is shipped on 30 June 2020. 1. Discuss why no journal entry is required on June 15, 2020 for the inventory transaction and the foreign instrument? (4 marks) 2. Provide the journals entries to account for the hedged item and the hedging instrument for the months ending June 30, 2020. (10 marks) 3. Provide the amount of the gain or (loss) on the hedged item, show your working. (5 marks) 4. Provide the amount of the gain or loss) on the hedging instrument, show your working. (5 marks) Click Save and Submit to save and submit. Click Save All Answers to save all answers. Save All Answers Seve al Answers Close Wind close wine TCL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts