Question: xploring Finance Visualizations - Short - Term versus Long - Term Cash Flows hort - lerm versus Long - Ierm Cash flows Sonceptual Overview: Explore

xploring Finance Visualizations ShortTerm versus LongTerm Cash Flows

hortlerm versus LongIerm Cash flows

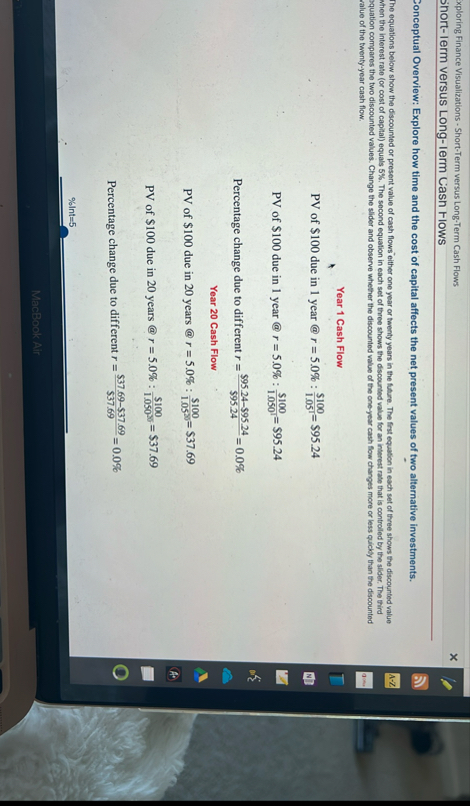

Sonceptual Overview: Explore how time and the cost of capital affects the net present values of two alternative investments.

The equations below show the discounted or present value of casth flows either one year or twenty years in the fiare. The frst equabion in each set of three shows the discounted value when the interest rate or cost of capital equals The second equation in each set of three shows the discounted value for an interest rate that is controlled by the slider. The third pquation compares the two discounted values. Change the slider and observe whether the discounted value of the one year cash flow changes more or less quicky than the discounted value of the twentyyear cash flow.

Year Cash Flow

PV of $ due in year @ :$

PV of $ due in year @ :$

Percentage change due to different

Year Cash Flow

PV of $ due in years @ :$

PV of $ due in years @ :$

Percentage change due to different

Int

MacBook Air

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock