Question: XPO-1 (similar to) Question Help Integrative-Expected return, standard deviation, and coefficient of variation An asset is currently being considered by Perth Industries. Th probability distribution

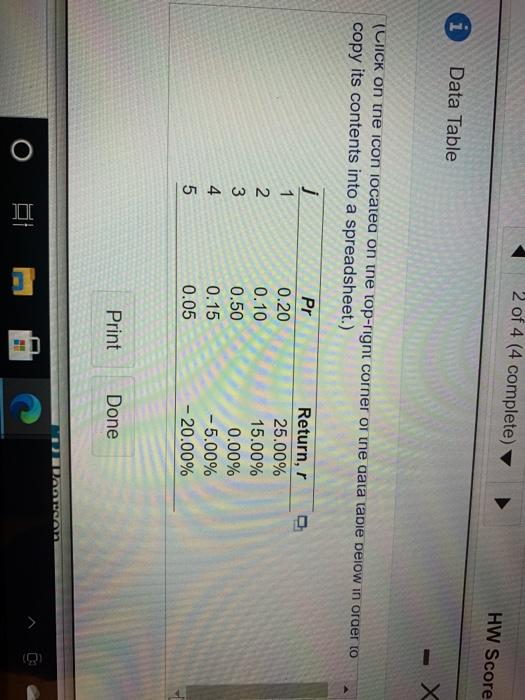

XPO-1 (similar to) Question Help Integrative-Expected return, standard deviation, and coefficient of variation An asset is currently being considered by Perth Industries. Th probability distribution of expected returns for this asset is shown in the following table, a. Calculate the expected val of return, r, for the asset. a. The expected value of return, r, for the asset is 4.75 %. (Round to two decimal places.) b. The standard deviation, or for the asset's returns is %. (Round to two decimal places.) Enter your answer in the answer box and then click Check Answer. 1 part Clear All Check Answer remaining O Type here to search 12:11 AM 4/17/2021 RI Inse 2 of 4 (4 complete) HW Score i Data Table (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) 0 1 2 3 4 5 Pr 0.20 0.10 0.50 0.15 0.05 Return, 25.00% 15.00% 0.00% - 5.00% - 20.00% Print Done

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts