Question: xyC Chapter 7 Homework Top Hat Secure | https://clemson.instructure.com/courses/29200/modules/items/542352 Files HP2009 | Home C Davis, Managerial Accounting, 3e CALCULATOR PRINTE VERSION BACK NEXT T RESOURCES

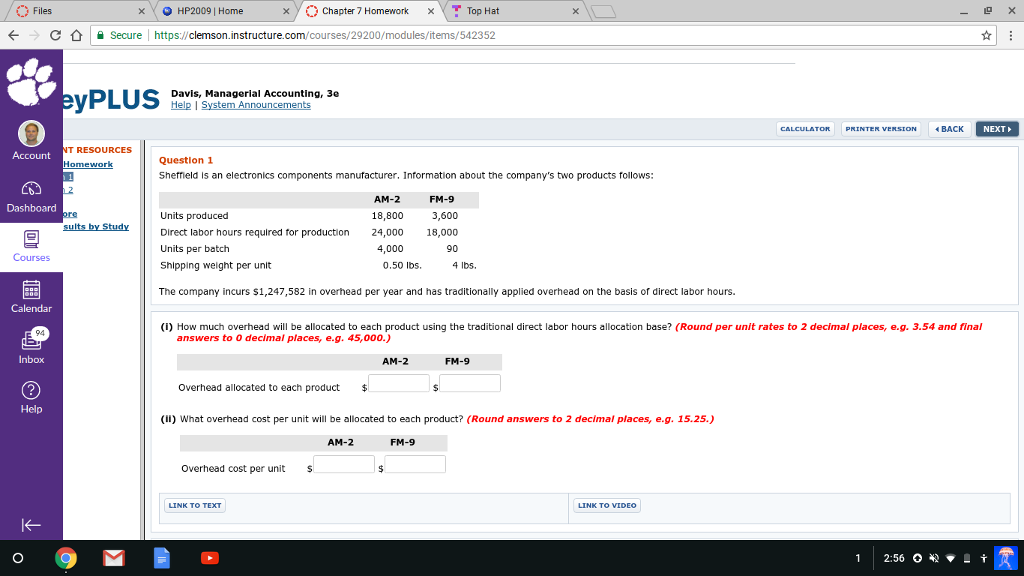

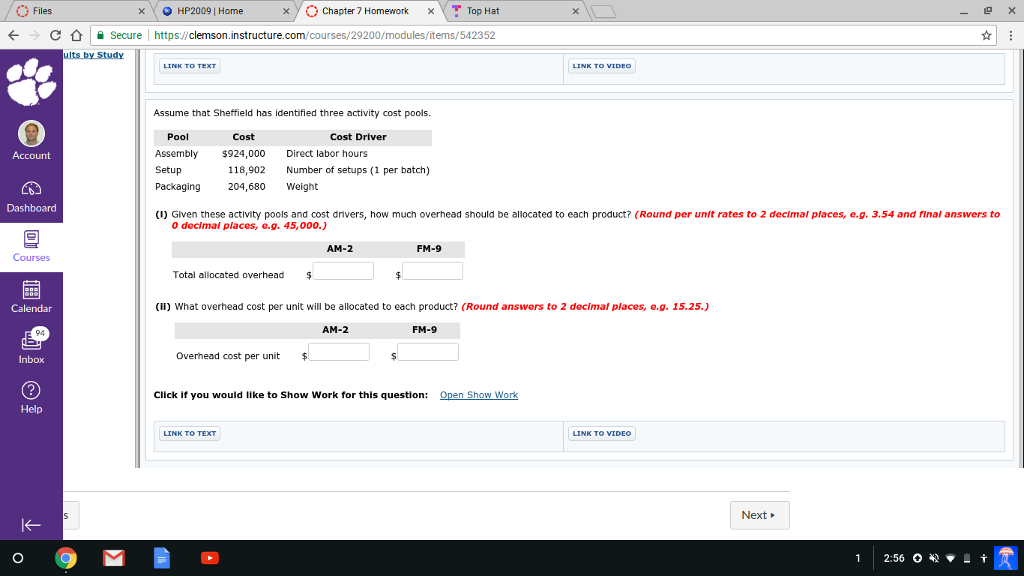

xyC Chapter 7 Homework Top Hat Secure | https://clemson.instructure.com/courses/29200/modules/items/542352 Files HP2009 | Home C Davis, Managerial Accounting, 3e CALCULATOR PRINTE VERSION BACK NEXT T RESOURCES Question 1 Shernield is an electronics components manufacturer. Inrormation about the company's two products follows: AM-2 18,800 24,000 4,000 FM-9 3,600 18,000 re Units produced Direct labor hours required for production Units per batch Shipping weight per unit 90 Courses 0.50 lbs. 4 lbs. The company incurs $1,247,582 in overhead per year and has traditionally applied overhead on the basis of direct labor hours. (i) How much overhead will be allocated to each product using the traditional direct labor hours allocation base? (Round per unit rates to 2 decimal places, e.g. 3.54 and final 94 answers to 0 decimal places, e.g. 45,000.) Inbox AM-2 FM-9 Overhead allocated to each poduct $ Help (Il) What overhead cost per unit will be allocated to each product? (Round answers to 2 decimal places, e.g. 15.25.,) AM-2 FM-9 Overhead cost per unit $ LINK TO TEXT xyC Chapter 7 Homework Top Hat Secure | https://clemson.instructure.com/courses/29200/modules/items/542352 Files HP2009 | Home C Davis, Managerial Accounting, 3e CALCULATOR PRINTE VERSION BACK NEXT T RESOURCES Question 1 Shernield is an electronics components manufacturer. Inrormation about the company's two products follows: AM-2 18,800 24,000 4,000 FM-9 3,600 18,000 re Units produced Direct labor hours required for production Units per batch Shipping weight per unit 90 Courses 0.50 lbs. 4 lbs. The company incurs $1,247,582 in overhead per year and has traditionally applied overhead on the basis of direct labor hours. (i) How much overhead will be allocated to each product using the traditional direct labor hours allocation base? (Round per unit rates to 2 decimal places, e.g. 3.54 and final 94 answers to 0 decimal places, e.g. 45,000.) Inbox AM-2 FM-9 Overhead allocated to each poduct $ Help (Il) What overhead cost per unit will be allocated to each product? (Round answers to 2 decimal places, e.g. 15.25.,) AM-2 FM-9 Overhead cost per unit $ LINK TO TEXT

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts