Question: XYZ Co is evaluating to replace the existing two year old computers that cost $35 million with an original life of 5 years. The cost

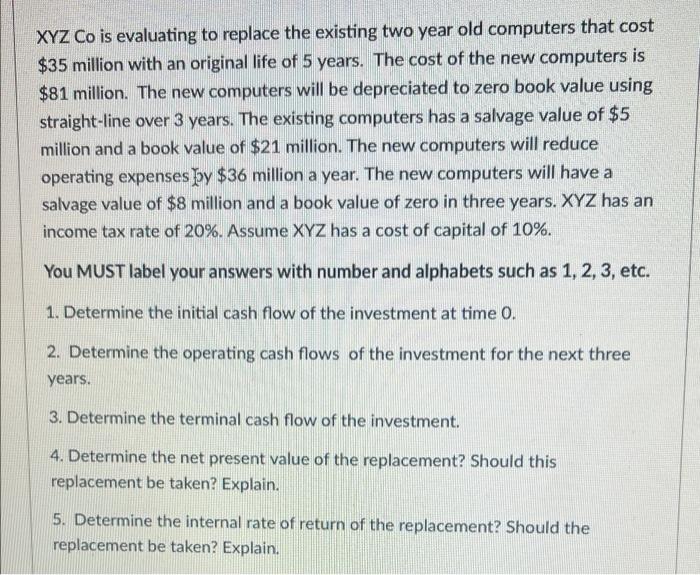

XYZ Co is evaluating to replace the existing two year old computers that cost $35 million with an original life of 5 years. The cost of the new computers is $81 million. The new computers will be depreciated to zero book value using straight-line over 3 years. The existing computers has a salvage value of $5 million and a book value of $21 million. The new computers will reduce operating expenses by $36 million a year. The new computers will have a salvage value of $8 million and a book value of zero in three years. XYZ has an income tax rate of 20%. Assume XYZ has a cost of capital of 10%. a You MUST label your answers with number and alphabets such as 1, 2, 3, etc. 1. Determine the initial cash flow of the investment at time 0. 2. Determine the operating cash flows of the investment for the next three years. 3. Determine the terminal cash flow of the investment. 4. Determine the net present value of the replacement? Should this replacement be taken? Explain. 5. Determine the internal rate of return of the replacement? Should the replacement be taken? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts