Question: XYZ Company purchases computer software that is not systems software during the current year. The acquisition cost is $5,000, and the assets are Class 12

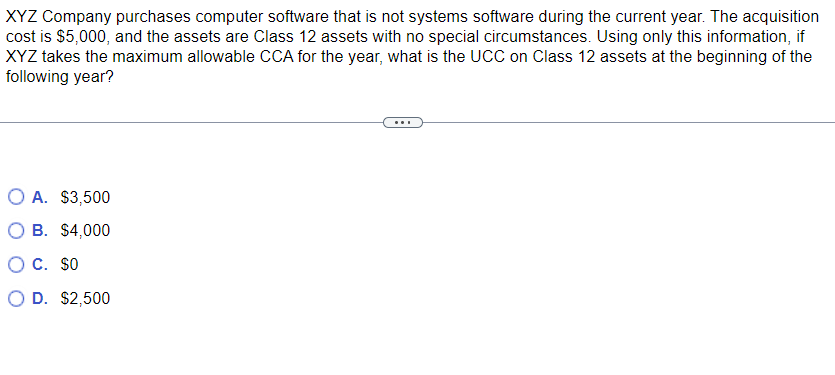

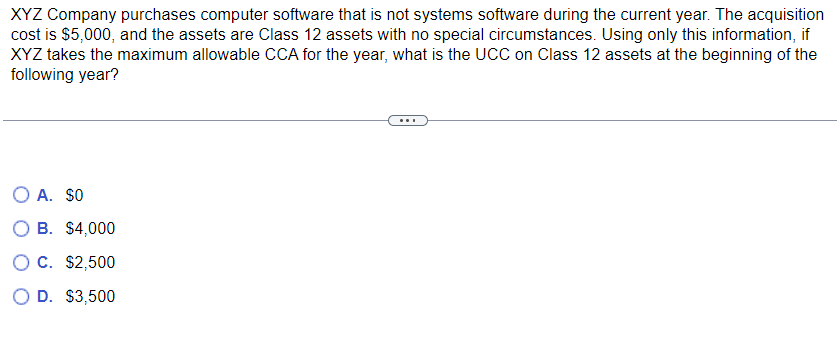

XYZ Company purchases computer software that is not systems software during the current year. The acquisition cost is $5,000, and the assets are Class 12 assets with no special circumstances. Using only this information, if XYZ takes the maximum allowable CCA for the year, what is the UCC on Class 12 assets at the beginning of the following year? A. $3,500 B. $4,000 C. $0 D. $2,500 XYZ Company purchases computer software that is not systems software during the current year. The acquisition cost is $5,000, and the assets are Class 12 assets with no special circumstances. Using only this information, if XYZ takes the maximum allowable CCA for the year, what is the UCC on Class 12 assets at the beginning of the following year? A. $0 B. $4,000 C. $2,500 D. $3,500

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts