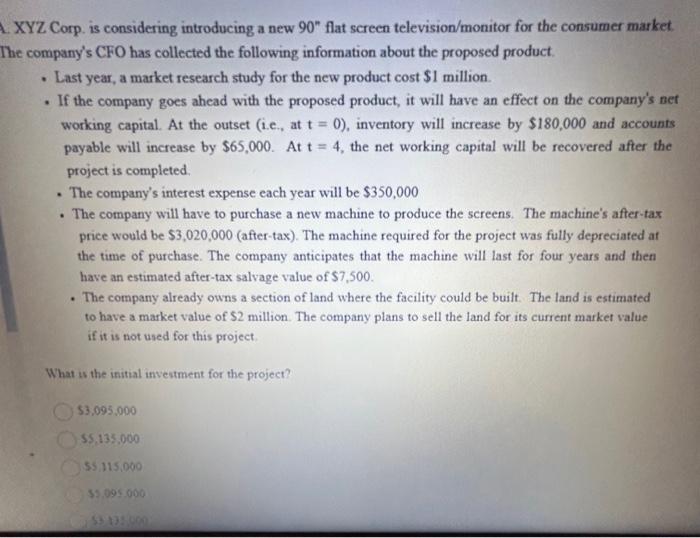

Question: XYZ Corp. is considering introducing a new 90 flat screen television/monitor for the consumer market ecompany's CFO has collected the following information about the proposed

XYZ Corp. is considering introducing a new 90 flat screen television/monitor for the consumer market ecompany's CFO has collected the following information about the proposed product. - Last year, a market research study for the new product cost $1 million. - If the company goes ahead with the proposed product, it will have an effect on the company's net working capital. At the outset (i.e., at t=0 ), inventory will increase by $180,000 and accounts payable will increase by $65,000. At t=4, the net working capital will be recovered after the project is completed. - The company's interest expense each year will be $350,000 - The company will have to purchase a new machine to produce the screens. The machine's after-tax price would be $3,020,000 (after-tax). The machine required for the project was fully depreciated at the time of purchase. The company anticipates that the machine will last for four years and then have an estimated after-tax salvage value of $7,500. - The company already owns a section of land where the facility could be built. The land is estimated to have a market value of $2 million. The company plans to sell the land for its current market value if it is not used for this project. What is the initial investment for the project? $3,095,000 55,135,000 53115,000 - The company already owns a section of land where the tacility could to have a market value of $2 million. The company plans to sell the lar if it is not used for this project. What is the initial investment for the project? $3,095,000 $5,135,000 $5,115,000 $5,095,000 $3,135,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts