XYZ Inc. a calendar year, accrual basis corporation, had the following items during 2021: Gross...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

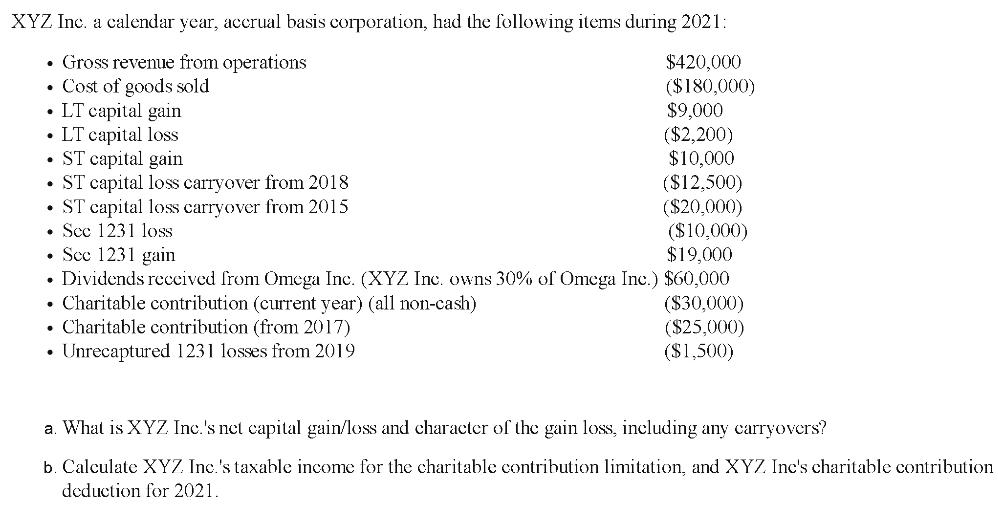

XYZ Inc. a calendar year, accrual basis corporation, had the following items during 2021: • Gross revenue from operations • Cost of goods sold $420,000 ($180,000) $9,000 • LT capital gain .LT capital loss ($2,200) ST capital gain $10,000 • ST capital loss carryover from 2018 ($12,500) ($20,000) ($10,000) • Scc 1231 gain $19,000 • Dividends received from Omega Inc. (XYZ Inc. owns 30% of Omega Inc.) $60,000 Charitable contribution (current year) (all non-cash) • Charitable contribution (from 2017) ($30,000) ($25,000) ($1,500) Unrecaptured 1231 losses from 2019 . • ST capital loss carryover from 2015 . Sec 1231 loss . . a. What is XYZ Inc.'s net capital gain/loss and character of the gain loss, including any carryovers? b. Calculate XYZ Inc.'s taxable income for the charitable contribution limitation, and XYZ Inc's charitable contribution deduction for 2021. XYZ Inc. a calendar year, accrual basis corporation, had the following items during 2021: • Gross revenue from operations • Cost of goods sold $420,000 ($180,000) $9,000 • LT capital gain .LT capital loss ($2,200) ST capital gain $10,000 • ST capital loss carryover from 2018 ($12,500) ($20,000) ($10,000) • Scc 1231 gain $19,000 • Dividends received from Omega Inc. (XYZ Inc. owns 30% of Omega Inc.) $60,000 Charitable contribution (current year) (all non-cash) • Charitable contribution (from 2017) ($30,000) ($25,000) ($1,500) Unrecaptured 1231 losses from 2019 . • ST capital loss carryover from 2015 . Sec 1231 loss . . a. What is XYZ Inc.'s net capital gain/loss and character of the gain loss, including any carryovers? b. Calculate XYZ Inc.'s taxable income for the charitable contribution limitation, and XYZ Inc's charitable contribution deduction for 2021.

Expert Answer:

Answer rating: 100% (QA)

Gross capital gain 60000 Less capital losses 30000 Net capital gain 30000 Ch... View the full answer

Related Book For

Taxation Of Individuals And Business Entities 2016

ISBN: 9781259334870

7th Edition

Authors: Brian Spilker, Benjamin Ayers, John Robinson, Edmund Outslay, Ronald Worsham, John Barrick, Connie Weaver

Posted Date:

Students also viewed these business communication questions

-

Bottle-Up, Inc. was organized on January 8, 2010. and made its Selection on January 24, 2010. The necessary consents to the election were filed in a timely manner. Its address is 1234 Hill Street,...

-

The following additional information is available for the Dr. Ivan and Irene Incisor family from Chapters 1-6. On December 12, Irene purchased the building where her store is located. She paid...

-

Emily Jackson (Social Security number 765-12-4326) and James Stewart (Social Security number 466-74-9932) are partners in a partnership that owns and operates a barber shop. The partnership's first...

-

Display the TERM_DESC, COURSE_NAME, BLDG_CODE and ROOM for every course evertaught by faculty member John Blanchard. Question 2 Display the S_LAST, S_FIRST, COURSE_NAME, TERM_DESC and GRADE values...

-

A village has six residents, each of whom has $1000. Each resident may either invest his money in a government bond, which pays 11 percent/yr, or use it to buy a year-old steer, which will graze on...

-

Barry and Carl are next-door neighbors. Barrys dog digs under Carls fence and does $500 worth of damage to Carls garden. Barry refuses to pay for the damage, claiming that Carls cats have been...

-

Choose a product and sell it using the FAB methodology.

-

A fisherman notices that wave crests pass the bow of his anchored boat every 3.0s. He measures the distance between two crests to be 6.5 m. How fast are the waves traveling?

-

You write one New York Inc. June 120 call option contract for a premium of $5.68. You hold the position until the expiration date when New York Inc. stock sells for $126.56 per share. Calculate...

-

The City of Smithville created a Street Improvement Bond Debt Service Fund to be used to retire the bonds issued for the purposes described in Chapter 5 of this cumulative problem, and to pay the...

-

An electric elevator with a motor at the top has a multistrand cable weighing 4 lb/ft. When the car is at the first floor, 160 ft of cable are paid out, and effectively 0 ft are out when the car is...

-

In which type of leadership, leaders take in opinions from the group members before coming to the final decision? Autocratic style Participative style Free-rein style None of the above

-

What are the six kinds of responsibilities that objects may have? What kind of method is used to perform each responsibility?

-

Develop a real-world model that needs an invariant to be correct?

-

Why should an attribute not be typed with a class name? Why should an attribute not be used to reference another class?

-

Elaborate three real-world examples of map, partition, and relation?

-

A clinic compared healthy dogs it owned with healthy pets brought to clinic to be neutered. The summary statistics for blood cholesterol levels (milligrams deciliter of blood) appear in the following...

-

Selected condensed data taken from a recent statement of financial position of Morino Ltd. are as follows. MORINO LTD. Statement of Financial Position (partial) Other current assets...

-

Alex is 31 years old and has lived in Los Alamos, New Mexico, for the last four years where he works at the Los Alamos National Laboratory (LANL). LANL provides employees with a 401(k) plan and for...

-

Reggie is a self-employed taxpayer who turns 59 years old at the end of the year (2015). In 2015, his net Schedule C income was $300,000. This was his only source of income. This year, Reggie is...

-

Mel and Cindy Gibson's 12-year-old daughter Rachel was abducted on her way home from school on March 15, 2015. Police reports indicated that a stranger had physically dragged Rachel into a waiting...

-

In 2022, Mark purchased two separate activities. Information regarding these activities for 2022 and 2023 is as follows: The 2022 losses were suspended losses for that year. During 2023, Mark also...

-

Jerry sprayed all of the landscaping around his business with a pesticide in June 2023. Shortly thereafter, all of the trees and shrubs unaccountably died. The FMV and the adjusted basis of the...

-

In 2023, Julie, a single individual, reported the following items of income and deduction: Julie owns 100% and is an active participant in the rental real estate activity. What is her taxable income...

Study smarter with the SolutionInn App