Question: XYZ is a calendar-year corporation that began business on January 1, 2021. For the year, it reported the following information in its current-year audited income

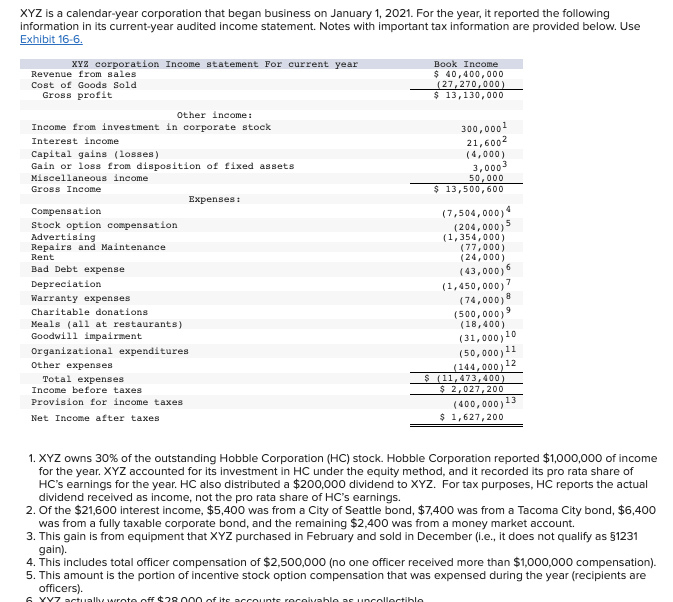

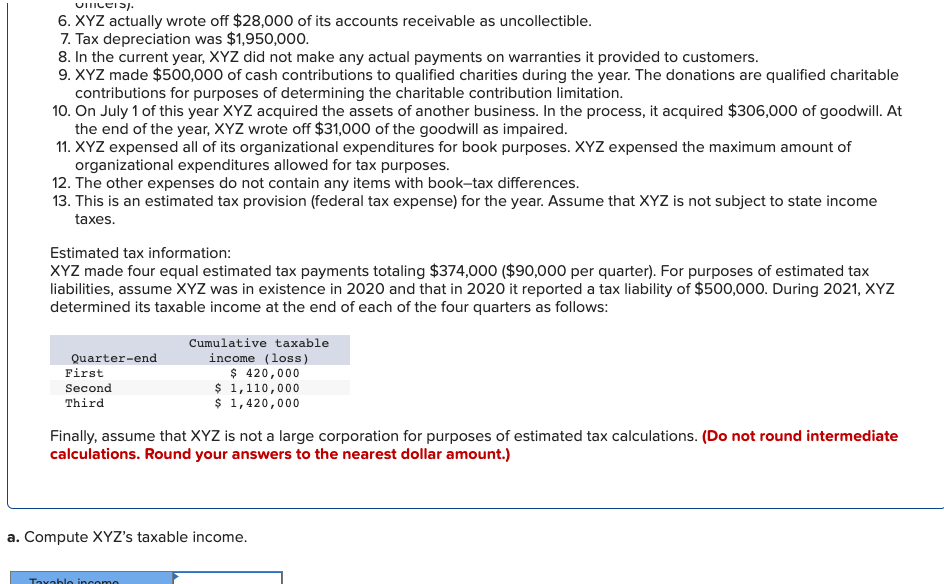

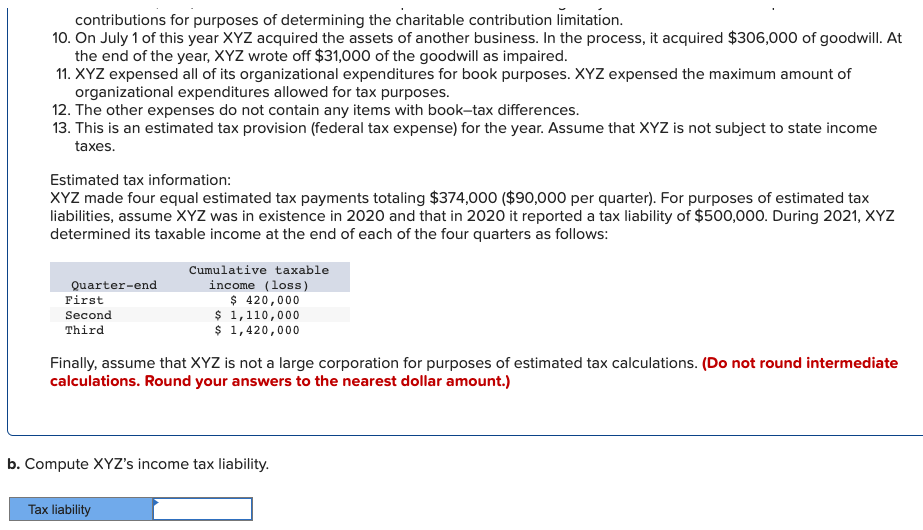

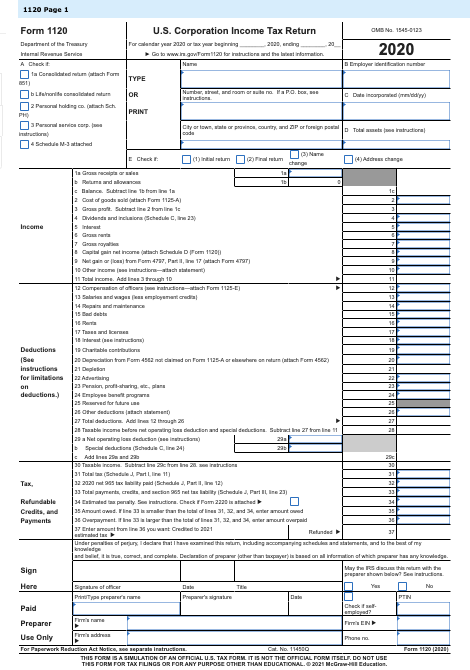

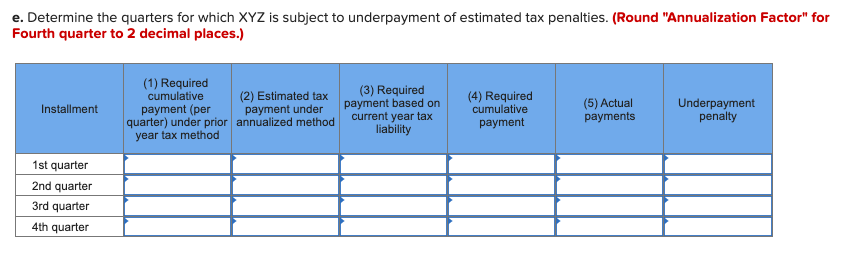

XYZ is a calendar-year corporation that began business on January 1, 2021. For the year, it reported the following information in its current-year audited income statement. Notes with important tax information are provided below. Use Exhibit 16-6. XYZ corporation Income statement for current year Book Income Revenue from sales $ 40,400,000 Cost of Goods Sold (27,270,000) Gross profit $ 13,130,000 Other income: Income from investment in corporate stock 300,0001 Interest income 21,6002 Capital gains (losses) (4,000) Gain or loss from disposition of fixed assets 3,000 Miscellaneous income 50,000 Gross Income $ 13,500, 600 Expenses Compensation (7,504,000) Stock option compensation (204,000) Advertising (1,354,000) Repairs and Maintenance (77,000) Rent Bad Debt expense (24,000) (43,000) 6 Depreciation (1,450,000) Warranty expenses (74,000) Charitable donations (500,000) Meals (all at restaurants) (18,400) Goodwill impairment Organizational expenditures 11 (50,000) Other expenses Total expenses $ (11,473,400) Income before taxes $ 2,027,200 Provision for income taxes 13 (400,000) Net Income after taxes $ 1,627,200 (31,000,10 (144,000, 12 1. XYZ owns 30% of the outstanding Hobble Corporation (HC) stock. Hobble Corporation reported $1,000,000 of income for the year. XYZ accounted for its investment in HC under the equity method, and it recorded its pro rata share of HC's earnings for the year. HC also distributed a $200,000 dividend to XYZ. For tax purposes, HC reports the actual dividend received as income, not the pro rata share of HC's earnings. 2. Of the $21,600 interest income, $5,400 was from a City of Seattle bond, $7,400 was from a Tacoma City bond, $6,400 was from a fully taxable corporate bond, and the remaining $2,400 was from a money market account. 3. This gain is from equipment that XYZ purchased in February and sold in December (i.e., it does not qualify as 51231 gain). 4. This includes total officer compensation of $2,500,000 (no one officer received more than $1,000,000 compensation). 5. This amount is the portion of incentive stock option compensation that was expensed during the year (recipients are officers). 6 Yyz actualbe wroteff 29000 of its accounts receivable as uncollectible UITLES). 6.XYZ actually wrote off $28,000 of its accounts receivable as uncollectible. 7. Tax depreciation was $1,950,000. 8. In the current year, XYZ did not make any actual payments on warranties it provided to customers. 9. XYZ made $500,000 of cash contributions to qualified charities during the year. The donations are qualified charitable contributions for purposes of determining the charitable contribution limitation. 10. On July 1 of this year XYZ acquired the assets of another business. In the process, it acquired $306,000 of goodwill. At the end of the year, XYZ wrote off $31,000 of the goodwill as impaired. 11. XYZ expensed all of its organizational expenditures for book purposes. XYZ expensed the maximum amount of organizational expenditures allowed for tax purposes. 12. The other expenses do not contain any items with book-tax differences. 13. This is an estimated tax provision (federal tax expense) for the year. Assume that XYZ is not subject to state income taxes. Estimated tax information: XYZ made four equal estimated tax payments totaling $374,000 ($90,000 per quarter). For purposes of estimated tax liabilities, assume XYZ was in existence in 2020 and that in 2020 it reported a tax liability of $500,000. During 2021, XYZ determined its taxable income at the end of each of the four quarters as follows: Quarter-end First Second Third Cumulative taxable income (loss) $ 420,000 $ 1,110,000 $ 1,420,000 Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations. (Do not round intermediate calculations. Round your answers to the nearest dollar amount.) a. Compute XYZ's taxable income. Table income contributions for purposes of determining the charitable contribution limitation. 10. On July 1 of this year XYZ acquired the assets of another business. In the process, it acquired $306,000 of goodwill. At the end of the year, XYZ wrote off $31,000 of the goodwill as impaired. 11. XYZ expensed all of its organizational expenditures for book purposes. XYZ expensed the maximum amount of organizational expenditures allowed for tax purposes. 12. The other expenses do not contain any items with book-tax differences. 13. This is an estimated tax provision (federal tax expense) for the year. Assume that XYZ is not subject to state income taxes. Estimated tax information: XYZ made four equal estimated tax payments totaling $374,000 ($90,000 per quarter). For purposes of estimated tax liabilities, assume XYZ was in existence in 2020 and that in 2020 it reported a tax liability of $500,000. During 2021, XYZ determined its taxable income at the end of each of the four quarters as follows: Cumulative taxable Quarter-end income (loss) First $ 420,000 Second $ 1,110,000 Third $ 1,420,000 Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations. (Do not round intermediate calculations. Round your answers to the nearest dollar amount.) b. Compute XYZ's income tax liability. Tax liability c. Complete XYZ's Schedule M-1. (Enter all amounts as positive numbers.) Schedule M1 Schedule M1 Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Note: The corporation may be required to file Schedule M-3. See instructions. 1 Net income (loss) per books 7 Income recorded on books this year not 2 Federal income tax per books included on this return (itemize): 3 Excess of capital losses over capital gains Tax-exempt interest 4 Income subject to tax not recorded on books this year (itemize): 5 Expenses recorded on books this year not deducted on this return (itemize): a Depreciation b Charitable contributions c Travel and entertainment Other (itemize): 08 Deductions on this return not charged against book income this year (itemize): a Depreciation b Charitable contributions c Other (itemize): M 09 Add lines 7 and 8 Stock option compensation (incentive stock options) Bad debt expense Warranty expense Goodwill impairment Organizational expenditures 6 Add lines 1 through 5 $ 0 10 Income (page 1, line 28)line 6 less line 9 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2021 McGraw-Hill Education. 1120 Page 1 2020 Form 1120 U.S. Corporation Income Tax Return OMSN 1545-0123 Department of the Trem Por calendar year 2020 or layer beginning 2020, ending 20 Internal Senio Go to www.ingavior 120 Barratiera and the west insation A Check Nam Emplayer cercaron number ta Corolla ruchom TYPE Limonia colicited return OR Number, art, and roamor subano Ha Poboa, racons Dule inapowy 2 Persarul holding co. (nach sich PH PRINT Persorul corpo City or lows, was or procuPor foreign po Torredor Inaimaata pade 4 Schedule 1-3 Name Check Initial rum album 4) change charge 1 Grassroor la Perando Tb Balance Subtract line 1b hominem Cost of goods walutachom 1125A) Gran prat. Subtract line 2 tramline is 4 Dividends and inclusion (Schedule C, 23) Income Interest 17 Gran rayal Capital gain rat Income tuch Schedule D 12001 Nel gain controlom 47, Part , 17 with For 10 Other income intrudioretische rest) 11 Total income. Add instruct 12 Coperation of our rationech Form 1125-E) 13 Sandnement credial 13 14 and 14 1 Bad debts 15 10 17 Those and cares 17 Interest (en) 10 Deductions Charitable contribution 10 See 20 Depreciation from Tom 4582 na dinad on Form 1125A er here on return (nachom 4562) 20 instructions 21Do 21 for limitations 22 Adreng 22 on 23 Perator, prostries 23 deduction) 24 Employee bwrw 24 25 served for future as he deductions atachment 127 Total deductions. And through 26 as Thuable income before operating lociedadion and special decision. Subtractine ZT from line 11 12a Niet operating los deduction (truction) Specialidadtion Schedule C, line 24 23 Addinas 22 25 30 Tablecom Subtractic from 21. sratructions 31 Total (Schedule J. Partine) 31 22 2021 rt 95 taxability paid schedule, Pati, 12) 32 Total payments, credits and sections retta Schedule, Part I, 23 33 Refundable 34 Elated to paralyserardira. Check Tram 2220 is attached 34 Credits, and 35 Amount and lines are the total of lines, and the amounted 35 Payments payment. It is larger than the total de 31, 32 and an amount overald 36 17 Ender armount from lies you want Credited to 2021 ad Red Under press of perung dederat have said this was, including accompanying schedules and students, and to the best of my navledge and ballet tilstrecord, and complete. Declaration of preparate tantaqayer) is based on all rution of which proper has any kredige Sign May the res do this with the preparer hower Here Egnare D TI No Pin you prepare rare Prepare Paid Checker rad? more Preparer PEN Use Only Press Phone For Paperwork Reduction Act Notico, se separata instruction Cat No. 114500 Form 1.20 2020 THIS FORMA SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 20:21 McGraw-Education PN e. Determine the quarters for which XYZ is subject to underpayment of estimated tax penalties. (Round "Annualization Factor" for Fourth quarter to 2 decimal places.) Installment (1) Required cumulative (2) Estimated tax (3) Required payment (per payment under payment based on quarter) under prior annualized method current year tax year tax method liability (4) Required cumulative payment (5) Actual payments Underpayment penalty 1st quarter 2nd quarter 3rd quarter 4th quarter XYZ is a calendar-year corporation that began business on January 1, 2021. For the year, it reported the following information in its current-year audited income statement. Notes with important tax information are provided below. Use Exhibit 16-6. XYZ corporation Income statement for current year Book Income Revenue from sales $ 40,400,000 Cost of Goods Sold (27,270,000) Gross profit $ 13,130,000 Other income: Income from investment in corporate stock 300,0001 Interest income 21,6002 Capital gains (losses) (4,000) Gain or loss from disposition of fixed assets 3,000 Miscellaneous income 50,000 Gross Income $ 13,500, 600 Expenses Compensation (7,504,000) Stock option compensation (204,000) Advertising (1,354,000) Repairs and Maintenance (77,000) Rent Bad Debt expense (24,000) (43,000) 6 Depreciation (1,450,000) Warranty expenses (74,000) Charitable donations (500,000) Meals (all at restaurants) (18,400) Goodwill impairment Organizational expenditures 11 (50,000) Other expenses Total expenses $ (11,473,400) Income before taxes $ 2,027,200 Provision for income taxes 13 (400,000) Net Income after taxes $ 1,627,200 (31,000,10 (144,000, 12 1. XYZ owns 30% of the outstanding Hobble Corporation (HC) stock. Hobble Corporation reported $1,000,000 of income for the year. XYZ accounted for its investment in HC under the equity method, and it recorded its pro rata share of HC's earnings for the year. HC also distributed a $200,000 dividend to XYZ. For tax purposes, HC reports the actual dividend received as income, not the pro rata share of HC's earnings. 2. Of the $21,600 interest income, $5,400 was from a City of Seattle bond, $7,400 was from a Tacoma City bond, $6,400 was from a fully taxable corporate bond, and the remaining $2,400 was from a money market account. 3. This gain is from equipment that XYZ purchased in February and sold in December (i.e., it does not qualify as 51231 gain). 4. This includes total officer compensation of $2,500,000 (no one officer received more than $1,000,000 compensation). 5. This amount is the portion of incentive stock option compensation that was expensed during the year (recipients are officers). 6 Yyz actualbe wroteff 29000 of its accounts receivable as uncollectible UITLES). 6.XYZ actually wrote off $28,000 of its accounts receivable as uncollectible. 7. Tax depreciation was $1,950,000. 8. In the current year, XYZ did not make any actual payments on warranties it provided to customers. 9. XYZ made $500,000 of cash contributions to qualified charities during the year. The donations are qualified charitable contributions for purposes of determining the charitable contribution limitation. 10. On July 1 of this year XYZ acquired the assets of another business. In the process, it acquired $306,000 of goodwill. At the end of the year, XYZ wrote off $31,000 of the goodwill as impaired. 11. XYZ expensed all of its organizational expenditures for book purposes. XYZ expensed the maximum amount of organizational expenditures allowed for tax purposes. 12. The other expenses do not contain any items with book-tax differences. 13. This is an estimated tax provision (federal tax expense) for the year. Assume that XYZ is not subject to state income taxes. Estimated tax information: XYZ made four equal estimated tax payments totaling $374,000 ($90,000 per quarter). For purposes of estimated tax liabilities, assume XYZ was in existence in 2020 and that in 2020 it reported a tax liability of $500,000. During 2021, XYZ determined its taxable income at the end of each of the four quarters as follows: Quarter-end First Second Third Cumulative taxable income (loss) $ 420,000 $ 1,110,000 $ 1,420,000 Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations. (Do not round intermediate calculations. Round your answers to the nearest dollar amount.) a. Compute XYZ's taxable income. Table income contributions for purposes of determining the charitable contribution limitation. 10. On July 1 of this year XYZ acquired the assets of another business. In the process, it acquired $306,000 of goodwill. At the end of the year, XYZ wrote off $31,000 of the goodwill as impaired. 11. XYZ expensed all of its organizational expenditures for book purposes. XYZ expensed the maximum amount of organizational expenditures allowed for tax purposes. 12. The other expenses do not contain any items with book-tax differences. 13. This is an estimated tax provision (federal tax expense) for the year. Assume that XYZ is not subject to state income taxes. Estimated tax information: XYZ made four equal estimated tax payments totaling $374,000 ($90,000 per quarter). For purposes of estimated tax liabilities, assume XYZ was in existence in 2020 and that in 2020 it reported a tax liability of $500,000. During 2021, XYZ determined its taxable income at the end of each of the four quarters as follows: Cumulative taxable Quarter-end income (loss) First $ 420,000 Second $ 1,110,000 Third $ 1,420,000 Finally, assume that XYZ is not a large corporation for purposes of estimated tax calculations. (Do not round intermediate calculations. Round your answers to the nearest dollar amount.) b. Compute XYZ's income tax liability. Tax liability c. Complete XYZ's Schedule M-1. (Enter all amounts as positive numbers.) Schedule M1 Schedule M1 Schedule M-1 Reconciliation of Income (Loss) per Books With Income per Return Note: The corporation may be required to file Schedule M-3. See instructions. 1 Net income (loss) per books 7 Income recorded on books this year not 2 Federal income tax per books included on this return (itemize): 3 Excess of capital losses over capital gains Tax-exempt interest 4 Income subject to tax not recorded on books this year (itemize): 5 Expenses recorded on books this year not deducted on this return (itemize): a Depreciation b Charitable contributions c Travel and entertainment Other (itemize): 08 Deductions on this return not charged against book income this year (itemize): a Depreciation b Charitable contributions c Other (itemize): M 09 Add lines 7 and 8 Stock option compensation (incentive stock options) Bad debt expense Warranty expense Goodwill impairment Organizational expenditures 6 Add lines 1 through 5 $ 0 10 Income (page 1, line 28)line 6 less line 9 THIS FORM IS A SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 2021 McGraw-Hill Education. 1120 Page 1 2020 Form 1120 U.S. Corporation Income Tax Return OMSN 1545-0123 Department of the Trem Por calendar year 2020 or layer beginning 2020, ending 20 Internal Senio Go to www.ingavior 120 Barratiera and the west insation A Check Nam Emplayer cercaron number ta Corolla ruchom TYPE Limonia colicited return OR Number, art, and roamor subano Ha Poboa, racons Dule inapowy 2 Persarul holding co. (nach sich PH PRINT Persorul corpo City or lows, was or procuPor foreign po Torredor Inaimaata pade 4 Schedule 1-3 Name Check Initial rum album 4) change charge 1 Grassroor la Perando Tb Balance Subtract line 1b hominem Cost of goods walutachom 1125A) Gran prat. Subtract line 2 tramline is 4 Dividends and inclusion (Schedule C, 23) Income Interest 17 Gran rayal Capital gain rat Income tuch Schedule D 12001 Nel gain controlom 47, Part , 17 with For 10 Other income intrudioretische rest) 11 Total income. Add instruct 12 Coperation of our rationech Form 1125-E) 13 Sandnement credial 13 14 and 14 1 Bad debts 15 10 17 Those and cares 17 Interest (en) 10 Deductions Charitable contribution 10 See 20 Depreciation from Tom 4582 na dinad on Form 1125A er here on return (nachom 4562) 20 instructions 21Do 21 for limitations 22 Adreng 22 on 23 Perator, prostries 23 deduction) 24 Employee bwrw 24 25 served for future as he deductions atachment 127 Total deductions. And through 26 as Thuable income before operating lociedadion and special decision. Subtractine ZT from line 11 12a Niet operating los deduction (truction) Specialidadtion Schedule C, line 24 23 Addinas 22 25 30 Tablecom Subtractic from 21. sratructions 31 Total (Schedule J. Partine) 31 22 2021 rt 95 taxability paid schedule, Pati, 12) 32 Total payments, credits and sections retta Schedule, Part I, 23 33 Refundable 34 Elated to paralyserardira. Check Tram 2220 is attached 34 Credits, and 35 Amount and lines are the total of lines, and the amounted 35 Payments payment. It is larger than the total de 31, 32 and an amount overald 36 17 Ender armount from lies you want Credited to 2021 ad Red Under press of perung dederat have said this was, including accompanying schedules and students, and to the best of my navledge and ballet tilstrecord, and complete. Declaration of preparate tantaqayer) is based on all rution of which proper has any kredige Sign May the res do this with the preparer hower Here Egnare D TI No Pin you prepare rare Prepare Paid Checker rad? more Preparer PEN Use Only Press Phone For Paperwork Reduction Act Notico, se separata instruction Cat No. 114500 Form 1.20 2020 THIS FORMA SIMULATION OF AN OFFICIAL U.S. TAX FORM. IT IS NOT THE OFFICIAL FORM ITSELF. DO NOT USE THIS FORM FOR TAX FILINGS OR FOR ANY PURPOSE OTHER THAN EDUCATIONAL. 20:21 McGraw-Education PN e. Determine the quarters for which XYZ is subject to underpayment of estimated tax penalties. (Round "Annualization Factor" for Fourth quarter to 2 decimal places.) Installment (1) Required cumulative (2) Estimated tax (3) Required payment (per payment under payment based on quarter) under prior annualized method current year tax year tax method liability (4) Required cumulative payment (5) Actual payments Underpayment penalty 1st quarter 2nd quarter 3rd quarter 4th quarter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts