Question: XYZ is evaluating a project that would require the purchase of a piece of equipment for $480,000 today. During year 1, the project is

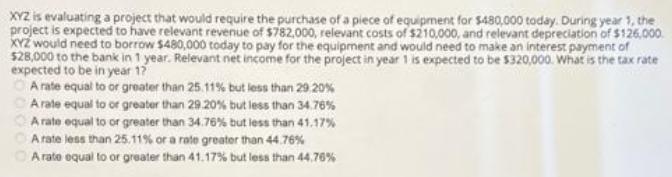

XYZ is evaluating a project that would require the purchase of a piece of equipment for $480,000 today. During year 1, the project is expected to have relevant revenue of $782,000, relevant costs of $210,000, and relevant depreciation of $126,000. XYZ would need to borrow $480,000 today to pay for the equipment and would need to make an interest payment of $28,000 to the bank in 1 year. Relevant net income for the project in year 1 is expected to be $320,000. What is the tax rate expected to be in year 17 A rate equal to or greater than 25.11% but less than 29 20% Arate equal to or greater than 29.20% but less than 34.76% A rate equal to or greater than 34.76% but less than 41.17% A rate less than 25.11% or a rate greater than 44.76% A rate equal to or greater than 41.17% but less than 44.76%

Step by Step Solution

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Relevant Revenue Less Relevant Costs Depreciation Interest ... View full answer

Get step-by-step solutions from verified subject matter experts