Question: XYZ is evaluating the ene project. The project would require an 3132,000 would be deprecated 115.000 wars in The project is eget have operating flow

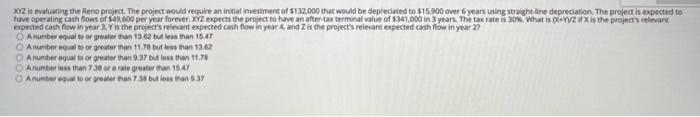

XYZ is evaluating the ene project. The project would require an 3132,000 would be deprecated 115.000 wars in The project is eget have operating flow of 19.00 year forever.XYZpect the project to have an external value of 5341.000 mars. The What is the projects meant expected cash flow in variant techo year and is the presentepechowiny2? Auror granten 15.4 Aurora 11.30 Abonn .. Aube than wat Angan 733 XYZ evaluating the Reno project. The project would require an initial investment of $132.000 that would be depreciated to $15.900 over 6 years using straight line depreciation. The projects expected to have operating cash flows of $49.600 per year forever, XYZ expects the project to have an after tas terminal value of $345.000 in 3 years. The tax rate 8 306. What is azt is the project's relevant expected cash flow in year 2. Yis the projects relevant expected cash flow in year and the projects relevant expected cash flow in year 27 O A number equals or greater than 15.62 less than 16:47 Anumber equal to or greater than 11.78 but less than 1362 A number equal to or greater than 9:37 but less than 11.78 O A numberless than 738 or arwe greater than 1547 A number oor groter an 738 but an 9.37

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts